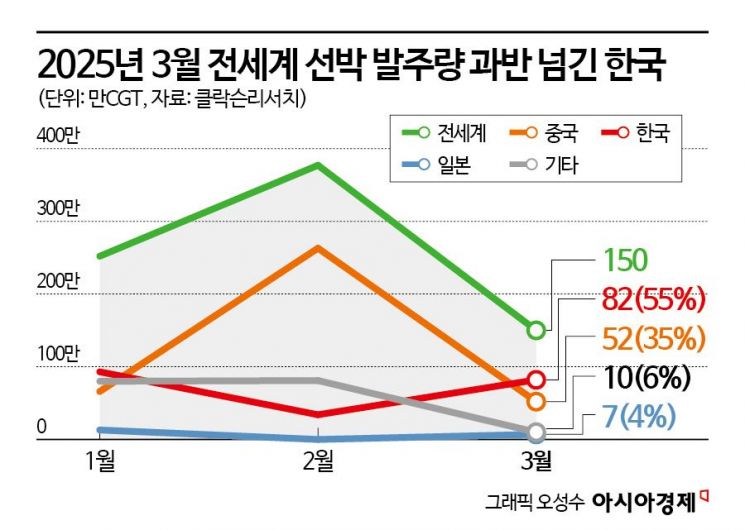

South Korea 55%, China 35%, Japan 4%

Cumulative Orders This Year Still Trail Behind China

Total Orders Down 52% Year-on-Year

Last month, South Korea accounted for more than half of the global ship orders, reclaiming the top spot in orders for March this year. However, when including orders from January and February, the cumulative orders for this year still lag behind China.

According to Clarkson Research, a UK-based shipbuilding and shipping market analysis firm, the global ship orders last month totaled 58 vessels, amounting to 1.5 million CGT (Compensated Gross Tonnage). South Korea secured 17 vessels corresponding to 820,000 CGT, capturing 55% of the order volume and ranking first. China followed with 31 vessels totaling 520,000 CGT, placing second. Although South Korea ordered fewer vessels than China, it secured more high value-added ships, resulting in a higher CGT share. The CGT per vessel was recorded at 48,000 CGT for South Korea and 17,000 CGT for China.

Comparing ship orders up to March this year with the same period last year, there was a 52% decrease. The global cumulative orders in the first quarter totaled 7.79 million CGT (234 vessels), down from 16.32 million CGT (710 vessels) in the same period last year. Among these, South Korea recorded 2.09 million CGT (40 vessels, 27%), while China recorded 3.80 million CGT (139 vessels, 49%). This shows that South Korea's cumulative orders this year have not reached China's level. These figures also represent a 55% and 58% decrease compared to the same period last year, respectively.

As of the end of last month, the global order backlog (remaining construction volume) increased by 1.52 million CGT from the previous month to 159.57 million CGT. By country, China held 93.97 million CGT (59%) and South Korea 36.12 million CGT (23%) of the backlog. Compared to the previous month, South Korea's backlog decreased by 570,000 CGT, while China's increased by 1.99 million CGT, and compared to the same period last year, South Korea's backlog decreased by 3.01 million CGT, whereas China's increased by 24.76 million CGT.

At the end of last month, the Clarkson Newbuilding Price Index fell by 0.93 points from February but rose 2.3% compared to March last year, standing at 187.43. It maintained a stable level.

The price per vessel by ship type was $255 million for liquefied natural gas (LNG) carriers over 174,000㎥, $125 million for very large crude carriers (VLCC), and $274 million for ultra-large container ships.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)