Startups Achieve Profitability After Years of Losses

Lotte's Strategic Investments Fall Short Amid 'Crisis' Concerns

Junggonara and Wadiz: "No Issues from Lotte's Influence"

Startups such as Danggeun, Today’s House, and Class101, which had recorded losses for several years, have recently turned profitable one after another, boosting market sentiment. However, some companies backed by large corporate capital have struggled to catch this wave. Junggonara and Wadiz, in which Lotte participated as a strategic investor with expectations of synergy, fall into this category.

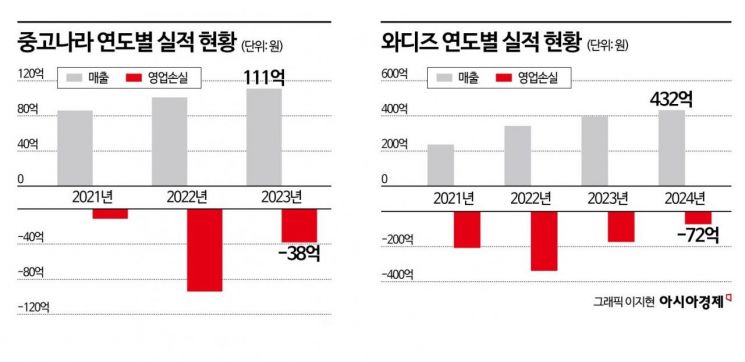

According to industry sources on the 4th, Junggonara, a secondhand trading platform invested in by Lotte Shopping, has recorded operating losses for four consecutive years. Although sales grew at an average annual rate of 13.6%, from 8.6 billion KRW in 2021 when it was acquired to 10.1 billion KRW in 2022 and 11.1 billion KRW in 2023, it has not translated into profits. Operating losses, which were 9.4 billion KRW in 2022, decreased to 3.8 billion KRW in 2023 but remained in the red, and it is reported that the company did not return to profitability last year either.

Lotte Shopping entered the rapidly growing secondhand trading market during the COVID-19 period in 2021, aiming to create synergies in the group’s distribution and logistics sectors. However, collaboration with Junggonara has effectively halted after the Seven Eleven parcel linkage service.

Currently, the largest shareholder of Junggonara is Eugene Unicorn Private Equity Fund (PEF). Lotte Shopping, as a strategic investor (SI), invested 30 billion KRW to hold a 47.06% stake. It also set a call option to acquire a 69.88% stake held by other financial investors (FIs), allowing it to become the largest shareholder at any time. However, the exercise of the call option for management rights acquisition was postponed once last year due to liquidity deterioration within the group and remains uncertain this year.

Lotte Holdings, which invested in the funding platform Wadiz, is effectively parting ways with the company. In 2021, Lotte Holdings highly valued Wadiz’s growth potential and invested 80 billion KRW, securing more than a 15% stake and becoming the second-largest shareholder. However, in December last year, it sold all its shares to Korea Investment & Securities, and Wadiz recently reflected this in its audit report, officially disclosing Korea Investment & Securities as the second-largest shareholder.

Wadiz recorded sales of 43.2 billion KRW and an operating loss of 7.2 billion KRW last year. While sales increased by 9% year-on-year and losses decreased by 58.3%, the company remains in a state of complete capital erosion, delaying its initial public offering (IPO). Continued losses have also lowered its corporate value. Along with the share sale, Lotte Holdings signed a price return swap (PRS) contract worth 18.6 billion KRW with Korea Investment & Securities, resulting in a 77% loss compared to the 80 billion KRW investment. Although a call option was set to repurchase shares, the industry views this as a de facto withdrawal.

The background to this trend is interpreted as Lotte Group’s liquidity management and reset of investment strategy. By boldly restructuring non-core businesses to improve financial structure and focusing on enhancing the competitiveness of core businesses, investment or reinvestment in startups, which are made with future value in mind, is shrinking.

A Wadiz representative emphasized, "The PRS contract between Lotte and Korea Investment & Securities was a transaction for asset liquidity of Lotte Holdings, not due to Wadiz’s poor performance or unresolved accumulated losses." They added, "The removal of a large corporation from the shareholder registry will not affect company operations," and stated, "Wadiz’s IPO will be pursued after achieving annual operating profit and considering overall market conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)