Aston University Report Analyzes Trade Data from 132 Countries

South Korea Among Most Affected Due to High Trade Ranking in Sectors Like Automobiles

A study has revealed that if U.S. President Donald Trump imposes a 25% tariff on all imports, it could cause economic damage to the global economy amounting to up to $1.4 trillion (2,060 trillion won). In particular, South Korea, one of the major trading partners of the U.S., including in the automobile sector, is expected to be more affected compared to other countries.

On the 1st (local time), the British daily Financial Times (FT) reported this citing a new report from a research team at Aston University in the UK. The research team modeled ripple effects by setting six scenarios based on bilateral trade data among 132 countries in 2023. The six scenarios progressively intensify assumptions reflecting the expansion of tariff-targeted countries and the possibility of retaliation.

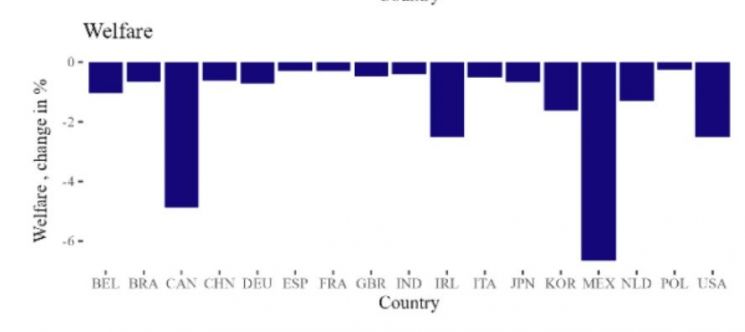

The 6th scenario mentioned in the new report by the research team at Aston University, UK. Economic welfare impact by country under the scenario assuming a 25% US tariff imposition and full retaliation. Unit: %, Source: Aston University research team report

The 6th scenario mentioned in the new report by the research team at Aston University, UK. Economic welfare impact by country under the scenario assuming a 25% US tariff imposition and full retaliation. Unit: %, Source: Aston University research team report

The most extreme case, the sixth scenario, assumes the U.S. imposes a 25% tariff and that all countries worldwide retaliate fully. Measures such as a 10% tariff on Canadian energy and an additional 20% on China were also included. Under this scenario, global economic losses amounting to $1.4 trillion were observed. Mexico’s economic welfare is expected to decrease by 6.6%, making it the most affected country globally. Canada (-4.9%) followed, then the U.S. (-2.5%), Ireland (-2.5%), South Korea (-1.6%), the Netherlands (-1.3%), and Belgium (-1.0%). The higher the trade ranking with the U.S., the greater the impact.

The decline in economic welfare is closely related to reductions in exports and imports. The U.S., which initiated the tariffs, is also expected to see exports drop by 66% and imports by 46%. South Korea is expected to experience a 7.5% decrease in exports and a 9.2% decrease in imports due to its high trade concentration and supply chain dependence. Japan is also expected to show a similar trend to South Korea. FT noted, "South Korea, a major trading partner of the U.S., is also expected to be hit," adding, "Especially due to its high dependence on automobile exports, it may respond more sensitively."

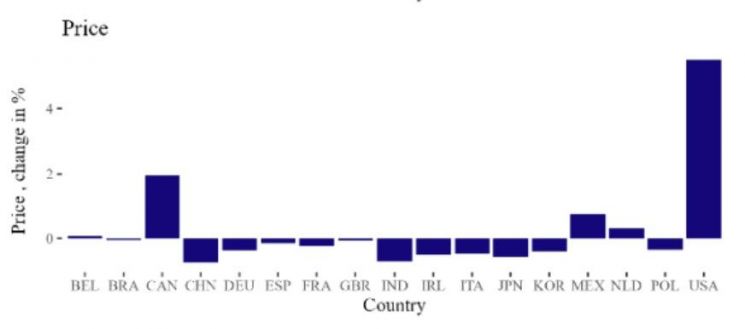

The 6th scenario mentioned in the new report by the research team at Aston University, UK. The impact on national inflation rates under the scenario assuming a 25% tariff imposition by the US and full-scale retaliation. Unit: %, Source = Aston University research team report

The 6th scenario mentioned in the new report by the research team at Aston University, UK. The impact on national inflation rates under the scenario assuming a 25% tariff imposition by the US and full-scale retaliation. Unit: %, Source = Aston University research team report

A bigger problem is inflation. The U.S. is expected to face the highest inflationary pressure due to tariffs. The anticipated inflation rate in the U.S. is 5.5%, significantly higher than Mexico’s 1.9%, which ranks second. Except for Canada (0.8%), the Netherlands (0.3%), and Belgium (0.1%), all other countries including South Korea are estimated to experience a decline in inflation.

Professor Jun Doo of Aston University, who led the study, pointed out, "If countries impose 25% tariffs on each other, it would have effects similar to the trade wars that deepened the Great Depression in the 1930s," adding, "Protectionism causes weakened competitiveness, supply chain collapse, and uneven cost burdens on consumers."

Some predict that a full-scale tariff war could lead to a loss of about 5.5 million jobs. Global credit rating agency Moody’s, through its own simulation, forecasted that this mutual tariff measure would increase unemployment by 7% and reduce U.S. GDP by 1.7%. Mark Zandi, Moody’s chief economist, warned, "In this case, we would experience a severe recession," and added, "The economy would be devastated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)