Chairman Chey Taewon Promotes Glass Substrates at 'CES 2025'

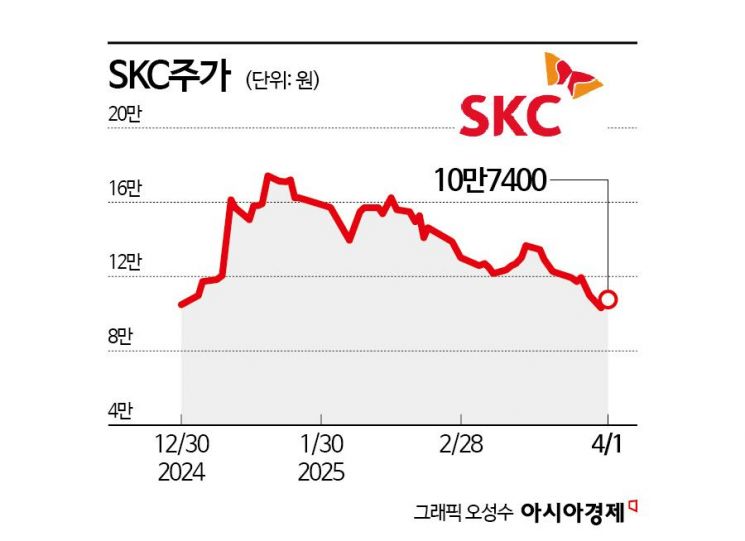

Stock Price, Once Soaring to 181,000 Won, Falls Back to Around 107,000 Won

Timing of Mass Production to Determine Stock Rebound

The stock price of SKC, the intermediate holding company of SK Group, has retreated back to the level seen at the end of last year. Although the stock price surged sharply at the beginning of the year due to expectations of mass production of glass substrates by its subsidiary, it has given up all the gains as market interest waned. Securities firms expect the stock price to rebound as the timing of glass substrate mass production becomes more concrete.

According to the financial investment industry on the 2nd, SKC's stock price recorded 107,400 won, down 40.7% from the year's high of 181,000 won recorded on January 20. The market capitalization, which had grown to 6.5 trillion won, shrank to 4.07 trillion won.

SKC's stock price closed at 105,100 won at the end of last year and surged to 181,000 won at the beginning of this year. From January 6 to 9, at CES 2025, the world's largest electronics and IT exhibition held in Las Vegas, USA, glass substrates became a hot topic, boosting the company's value.

SKC participated in CES and exhibited a physical glass substrate developed by Absolix. SKC holds a 70% stake in Absolix. Absolix has completed a mass production plant for glass substrates in Georgia, USA, and is accelerating commercialization. Glass substrates are expected to be a solution to increase the speed of artificial intelligence (AI) servers that process large-scale data. They allow ultra-fine circuit implementation and have the advantage of embedding various components such as multilayer ceramic capacitors (MLCC) inside, enabling the placement of high-capacity central processing units (CPU) and graphics processing units (GPU) on the surface. After meeting Jensen Huang, CEO of NVIDIA, at CES, SK Group Chairman Chey Tae-won said while holding a sample of SKC's glass substrate, "I just sold it."

However, after CES ended, interest in glass substrates faded in the domestic stock market, leading to a flood of profit-taking sales. Poor performance in the fourth quarter also partially affected the stock price trend. Lee Jin-ho, a researcher at Mirae Asset Securities, explained, "The market expectation for the fourth quarter last year was an operating loss of 60.7 billion won, but the actual deficit reached 82.6 billion won."

Since hitting the year's high, domestic institutional investors have recorded a cumulative net sale of 11.7 billion won. Foreigners and individuals, who showed net buying advantages of 10.3 billion won and 8 billion won respectively, are currently experiencing valuation losses. The average purchase price per share for foreigners is 140,170 won, about 23% higher than the current stock price. The individual investors' valuation loss rate is -26%.

On the 31st of last month, when short selling resumed, the short sale volume of SKC reached 187,000 shares, accounting for 35.7% of the total trading volume. The Korea Exchange designated SKC as a short-selling overheated stock. Short selling was prohibited for one day on the 1st. The average selling price of investors who shorted on the 31st was 104,300 won. Although the stock price has fallen back to the level seen at the end of last year, short sellers are betting on further declines.

Market experts foresee that the pace of business development in glass substrates will influence the stock price. Roh Woo-ho, a researcher at Meritz Securities, said, "The glass substrate business will become more active," adding, "The decision to expand the second production line in the US in the second half of this year will be a significant momentum."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)