From Exporters to the U.S. to Small and Medium Material and Component Suppliers, All Hit

Concerns Raised Over Decreased Supply Volume and Profitability Deterioration

A survey revealed that the entire domestic manufacturing sector is directly or indirectly exposed to 'tariff risks' ahead of the U.S. administration's planned imposition of reciprocal tariffs on the 2nd. Six out of ten manufacturing companies, especially major exporters and small and medium-sized enterprises, are expected to be affected by the U.S. tariff policy.

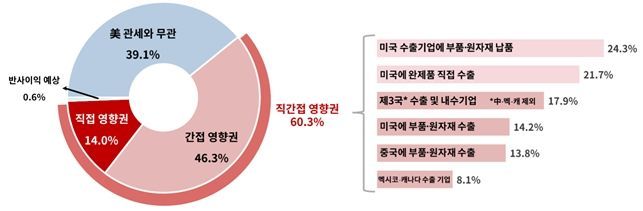

According to the 'U.S. Tariff Impact Survey' conducted by the Korea Chamber of Commerce and Industry (KCCI) on 2,107 manufacturing companies nationwide on the 1st, 60.3% of domestic manufacturing companies are within the influence of the Trump administration's tariff policy. Responses indicating 'directly affected' accounted for 14.0%, while those answering 'indirectly affected' made up 46.3%.

Proportion of companies under the influence of U.S. tariffs and composition by company type. Provided by the Korea Chamber of Commerce and Industry

Proportion of companies under the influence of U.S. tariffs and composition by company type. Provided by the Korea Chamber of Commerce and Industry

The companies hit by tariff imposition include ▲companies supplying parts and raw materials to U.S. exporters (24.3%) and ▲companies exporting finished products to the U.S. (21.7%), which accounted for the largest shares. They were followed by ▲companies exporting to third countries (excluding China, Mexico, and Canada) and domestic market companies (17.9%), ▲companies exporting parts and raw materials to the U.S. (14.2%), and ▲companies exporting parts and raw materials to China (13.8%). This means that not only companies directly exporting to the U.S. but also those exporting parts and raw materials to China fall within the tariff impact zone.

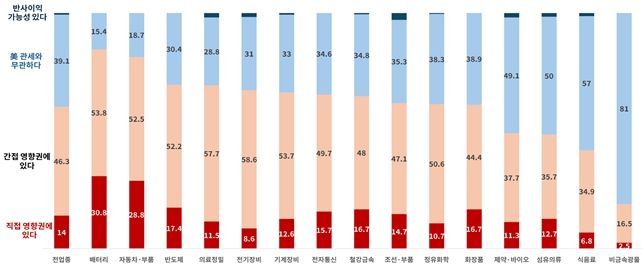

By industry, companies affected by the 'tariff bomb' include ▲battery (84.6%) and ▲automobile and parts (81.3%) sectors the most. This is interpreted as an effect of many partner companies supplying intermediate goods such as materials and parts to Korean large corporations operating in the U.S. In addition, ▲semiconductors (69.6%), ▲medical precision instruments (69.2%), ▲electrical equipment (67.2%), ▲machinery equipment (66.3%), and ▲electronics and telecommunications (65.4%) were also counted as industries within the tariff impact zone. By company size, large enterprises (76.7%), medium-sized enterprises (70.6%), and small enterprises (58.0%) were affected in that order.

The Trump administration imposed a 25% tariff on steel and aluminum products on the 12th of last month, followed by the announcement of the same level of tariffs on automobiles and parts on the 26th. Automobiles accounted for 46% of Korea's total exports to the U.S. last year, and when including volumes produced in countries such as Mexico and then exported, it is predicted that about 700,000 to 900,000 units could be affected.

Our companies are most concerned about a decrease in supply volume (47.2%) due to such tariff policies. This is likely because many companies fall within the indirect impact zone even if they do not export directly to the U.S. Next, the concerns include ▲profitability deterioration due to high tariffs (24.0%) and ▲decline in price competitiveness in the U.S. market (11.4%), as well as ▲adjustment of parts and raw material procurement networks (10.1%) for companies exporting to the U.S.

In the face of the realization of tariff impacts, the responses of our companies appear limited. Regarding the level of response, 74.5% of companies answered that they are either 'monitoring trends (45.5%)' or 'seeking internal countermeasures such as reducing production costs (29.0%)'. Only 3.9% of companies are exploring more fundamental countermeasures such as 'local production or market diversification,' and 20.8% answered that they have 'no response plan.'

In particular, small and medium-sized enterprises such as material, parts, and equipment suppliers showed a lack of response plans, with one in four (24.2%) of the affected SMEs answering that they have 'no response plan.'

The KCCI pointed out, using the automobile tariff announced on the 26th of last month as an example, that "the parts industry, mostly composed of small and medium-sized enterprises, may fall within the tariff impact zone due to 'reduced parts demand' caused by decreased exports to the U.S. and reduced finished car exports, as well as the possibility of 'volume dumping' into the domestic market by other countries trying to avoid tariffs."

Kim Hyun-soo, head of the Economic Policy Team at KCCI, said, "With U.S. tariffs becoming a reality, manufacturing companies will inevitably suffer operational damage not only from direct exports to the U.S. but also from indirect impacts such as China's low-price offensive. We will strive to minimize tariff impacts through private networks and diplomatic channels, establish support measures for affected industries, and, in the long term, improve the business environment to enhance competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)