Increase in Insolvency of Savings Banks and Capital Companies Lending to Construction Industry Amid Industry Downturn

Financial Authorities Recommend Management Improvement to Sangsangin Savings Bank

Worsening Construction Industry Likely to Exacerbate Financial Institution Insolvency

As the real estate market deteriorates and the construction industry worsens, the risk of insolvency has also increased for savings banks and capital companies that lent money to these entities. Financial authorities recently issued timely corrective measures to Sangsangin Savings Bank, raising concerns that prolonged sluggishness in the construction industry could bring many savings banks' insolvencies to the surface.

Increase in Insolvency of Savings Banks and Capital Companies Lending to Construction Industry Amid Industry Downturn

According to the construction industry on the 21st, 12 general construction companies ranked within the top 300 in construction capability have filed for court receivership so far this year. This is a significantly faster pace compared to 16 companies last year and 7 in 2023. As the real estate market continues to slump, companies such as Shindong-A Construction (ranked 58th), Daejeo Construction (103rd), Sambu Construction (71st), Angang Construction (138th), and Daewoo Shipbuilding & Marine Engineering Construction (83rd) have filed for court receivership since the beginning of the year. Looking beyond the top 300, many small construction companies have already gone bankrupt or are at risk of bankruptcy, indicating a more severe situation in the construction industry.

As the financial health of construction companies deteriorates, the burden on financial institutions that lent money to them has also increased. Until last year, only the exposure to real estate project financing (PF) focused on developers was a concern, but this year, direct exposure to construction companies (construction industry exposure) has become problematic. The financial sector believes that problems may arise in financial companies such as savings banks and capital companies that mainly lent money to construction companies with lower construction capabilities.

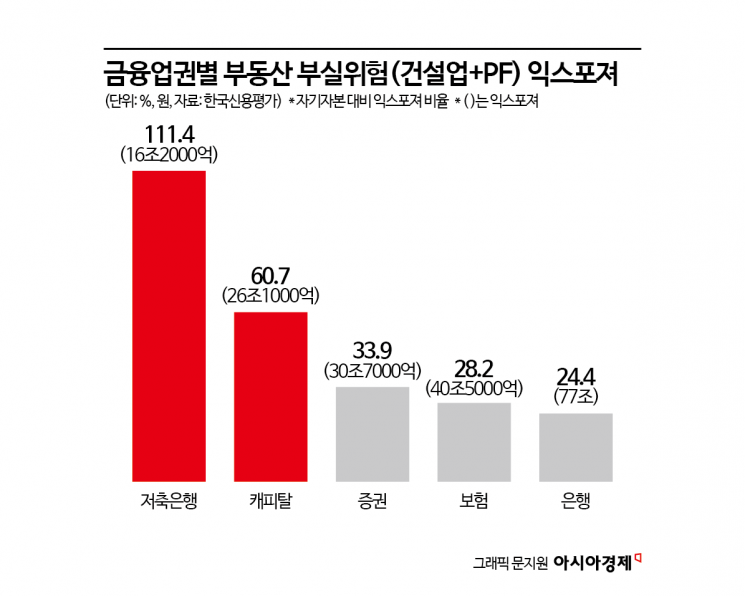

According to Korea Ratings' report on construction industry and PF exposure by financial sector, the total exposure of domestic savings banks related to construction (including PF) reached 16.2 trillion KRW, amounting to 111.4% of their equity capital. This means they have already lent more than 100% of their equity capital to the construction industry. Capital companies followed with 60.7%, securities at 33.9%, insurance at 28.2%, and banks at 24.4%.

Korea Ratings pointed out that savings banks have an exposure ratio of 39.9% to small and medium-sized construction companies ranked between 51st and 300th in construction capability, which is riskier compared to banks, insurance, and securities companies that mainly lend to large construction companies. The combined construction industry exposure (excluding PF) of savings banks was 717 billion KRW, accounting for 20.3% of their equity capital. When considering construction companies ranked outside the top 300, the exposure ratio of savings banks to small and medium-sized construction companies rises to 72%, increasing credit risk levels.

For capital companies, the combined construction industry exposure was 14.9 trillion KRW, with a burden ratio of 41.6% relative to equity capital. Although not as high as savings banks, capital companies also have a relatively high proportion (18.1%) of small and medium-sized construction companies within the top 300, making it a risk factor.

Kim Kyung-geun, a senior researcher at Korea Ratings, explained, "Considering the recent trend of credit incidents among construction companies and the real estate market, the insolvency of financial sector exposure related to construction companies is expected to gradually expand." He added, "Especially for savings banks, the proportion of construction companies with lower construction capabilities is high compared to other sectors, so the risk of credit incidents related to construction companies is relatively high." Kim also noted, "Capital companies mainly provide loans to medium and large construction companies," but cautioned, "Since their combined construction industry exposure relative to equity capital is larger than other sectors, careful attention is required."

Financial Authorities Recommend Management Improvement to Sangsangin Savings Bank

Financial authorities have also taken proactive measures to prevent the deterioration of the construction industry from spreading to the secondary financial sector. On the 19th, the Financial Services Commission decided to issue a management improvement recommendation, corresponding to the first stage of timely corrective measures, to Sangsangin Savings Bank. Timely corrective measures are mandatory actions imposed by financial authorities on insolvent financial companies. Savings banks receiving management improvement recommendations must implement measures such as disposing of non-performing loans, increasing capital, and restricting dividends for six months.

As of the end of last year, Sangsangin's delinquency rate was 18.7%, and the ratio of non-performing loans classified as substandard or below was 26.9%, significantly exceeding the industry averages of 8.52% and 10.66%, respectively. This is due to the impact of the worsening real estate market. Financial authorities plan to order capital increases and non-performing loan cleanups for other savings banks with weak soundness and encourage rapid management normalization. Previously, at the end of last year, management improvement recommendations were also issued to Raon Savings Bank and Anguk Savings Bank. Pepper, Woori, and Solbrain Savings Banks received a management evaluation grade of 4 but were exempted from timely corrective measures this time.

However, authorities explained that the current situation differs from 2012 when many savings banks were consecutively expelled. A Financial Services Commission official said, "The past savings bank crisis involved large-scale losses that caused the Basel International Settlement Bank (BIS) ratio to plummet and made additional capital procurement impossible, leading to large-scale restructuring." He added, "Unlike past crises, the savings bank sector now maintains sufficient loss absorption capacity and crisis response ability, so the impact on the financial market will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)