FSS Uncovers 1,738 Staged Accidents

431 Suspects Who Embezzled 8.2 Billion KRW Referred for Investigation

Most Perpetrators Are Day Laborers, Delivery Workers, and Automotive Industry Employees

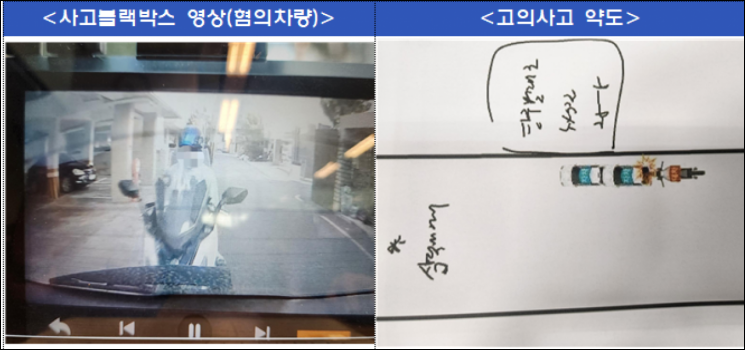

Inahyun Lee, a woman in her 30s who works in an office, was waiting in the first lane to make a left turn while driving her car home from work. After the signal turned green, she made the left turn but failed to properly recognize the white dividing line and encroached into the second lane. At that moment, she collided with a motorcycle ridden by Kim, a delivery worker in his 20s, and eventually proceeded with compensation procedures through the insurance company. However, there was a twist. According to the Financial Supervisory Service and the insurance company, Kim intentionally rammed into Lee’s vehicle without slowing down or avoiding it. It was also confirmed that Kim circled the same location multiple times to induce a staged accident. Ultimately, Kim was reported to the police for insurance fraud.

It was revealed that about 90% of the perpetrators in staged car accident insurance fraud cases last year were men in their 20s and 30s. The scale of car insurance fraud detected last year amounted to 570.4 billion KRW, accounting for half of all insurance fraud, raising calls for the government to establish special countermeasures.

On the 20th, the Financial Supervisory Service announced that it investigated car insurance fraud last year, identifying 1,738 staged accidents and 431 suspects who embezzled 8.2 billion KRW, and referred them for investigation. The FSS focused its investigative resources on staged car accident conspiracies, resulting in more than double the number of suspects compared to the previous year (155 people).

The suspects detected last year were mainly young men in their 20s and 30s with unstable incomes (88.6%). Those in their 20s accounted for 56.8% (245 people), and those in their 30s made up 31.7% (137 people). Among them, 93.5% were found to have conspired in advance with acquaintances such as friends and family to stage accidents.

By occupation, there were 23 day laborers, 21 delivery workers, 17 automotive-related workers, 16 students, 11 self-employed, 6 unemployed, and 10 others. These figures are based on 104 suspects whose employment status was identified during the FSS investigation.

Regarding accident types, 'lane change' accounted for the largest share at 62%. This involves intentionally colliding by not slowing down or even accelerating despite seeing the other vehicle changing lanes. 'Intersections' followed at 11.9%, where suspects do not slow down when entering or turning left or right at intersections, causing contact accidents. Other types included reversing (8%), rear-end collisions (7.7%), and traffic violations (4.1%).

The suspects mainly exploited situations where the victim vehicle encroached on the driving lane in high-traffic areas such as bus terminal intersections, roundabouts, and merging lanes, which are vulnerable road environments. They targeted nighttime hours, when quick accident response is difficult and visibility is poor, rather than daytime. They also avoided police reports or induced quick settlements and increased embezzlement amounts by riding with multiple conspirators.

Among 1,736 staged accidents with confirmed vehicle numbers, private cars accounted for the largest number at 994 cases (57.2%). Rental cars (338 cases, 19.4%) and two-wheelers (291 cases, 16.7%) followed. The suspects mainly staged accidents using vehicles to claim personal injury insurance money (settlement money, etc.). Of the 8.2 billion KRW embezzled, personal injury insurance money amounted to 5.5 billion KRW, exceeding property damage insurance money (2.7 billion KRW). The average insurance payout for private cars, rental cars, and commercial vehicles (5.01 million KRW) was higher than that for two-wheelers and pedestrian accidents (3.37 million KRW).

Suspects posted advertisements such as "Looking for attackers" on social networking services (SNS) like Telegram to recruit conspirators for staged car accidents. They then conspired by dividing roles into perpetrators and victims to cause staged accidents. Although the revised Special Act on Insurance Fraud Prevention, which includes provisions for punishing solicitation, inducement, and advertising of insurance fraud, came into effect on August 14 last year, illegal activities persist. Violations of solicitation and inducement prohibitions are punishable by up to 10 years imprisonment or fines up to 50 million KRW, but some say the penalties are still too lenient.

Suspect of intentional car accident captured on black box and map of intentional accident. Provided by Financial Supervisory Service

Suspect of intentional car accident captured on black box and map of intentional accident. Provided by Financial Supervisory Service

The FSS also provided guidelines to prevent staged car accidents. First, it is necessary to make safe driving a habit by complying with traffic laws. Drivers should thoroughly learn prevention tips for the three major accident types (lane changes, intersections, reversing) in complex road situations, including adhering to left-turn lanes and yielding.

If a staged car accident is suspected, actively report it to the relevant authorities. If a staged accident is suspected, be cautious about settlements and notify the insurance company and police to seek help. Reporting to the FSS and insurance company’s reporting centers after accident handling can help prevent further damage.

It is also important to secure evidence such as accident scene photos, witness statements and contact information, and black box footage to clearly prove fault. The original black box video necessary for analyzing the intentionality of insurance fraud must be submitted to the insurance company. Drivers should familiarize themselves in advance with how to use the device, including whether the power is on, if it is installed in a position clearly showing the other vehicle, and whether the recorded footage can be immediately extracted.

Soliciting or performing insurance fraud under the pretext of short-term or high-paying part-time jobs is a criminal act punishable by law and should be firmly rejected. If there are advertisements or solicitations inducing or arranging staged accidents, providing evidence (recordings, messages, etc.) to the FSS or insurance company can be helpful.

The FSS plans to strengthen ongoing monitoring of staged car accidents and solicitation/inducement and expand planned investigations. An FSS official said, "We plan to strengthen prevention activities at intersections with frequent staged accidents in cooperation with the General Insurance Association. We will also work to raise awareness and improve perceptions through financial education so that young people are not swayed by the temptation of staged car accidents."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)