Experts View Abolishing Heavy Taxation on Additional Provincial Home Purchases Positively

"Lower Tax Burden Could Boost Transaction Volume"

Concerns Remain Over "Transactions Concentrating Only in Major Provincial Areas"

Experts expect that the plan to abolish the heavy taxation on multi-homeowners when existing homeowners purchase additional homes in provincial areas could serve as a catalyst for revitalizing the local real estate market. In particular, even if investment enthusiasm revives in the provinces, it is anticipated that it will be difficult for this to spread to Seoul and the metropolitan area. However, some opinions suggest that investments may concentrate only in higher-tier provincial areas, so the government should leave it to the market rather than intervene.

Park Won-gap, Senior Real Estate Specialist at KB Kookmin Bank, stated on the 21st, "If the ruling party's proposal is realized, it will naturally help activate the provincial real estate market. As the tax burden decreases and interest rates are also lowering in the long term, transaction volumes could increase."

Potential for Provincial Revitalization

Besides Park, many experts evaluated that "this could be a measure to increase transactions." As the tax burden decreases, demand for additional home purchases may rise, which is expected to lead to revitalization of the provincial real estate market.

The People Power Party proposed this plan in response to the problem that the current tax system based on the number of homes owned has caused a preference for a "smart single home," leading to a concentration of real estate purchases in Seoul and the metropolitan area. On the 18th, Kwon Seong-dong, floor leader of the People Power Party, said, "If the second or subsequent home purchased is located in the provinces, the heavy taxation on multi-homeowners will be abolished by not considering it in the housing count," adding, "We need to accept the market function of multi-homeowners who act as private rental business operators and create a channel for real estate funds to flow into the provinces."

Currently, owning two or more homes subjects one to acquisition tax, capital gains tax, and comprehensive real estate tax. If the ruling party's proposal is realized, the acquisition tax burden for multi-homeowners purchasing provincial real estate from the second home onward will decrease from the current 8-12% to 1-3%. Capital gains tax, which currently adds 20-30% on top of the basic rate of 6-45% depending on the home price, will no longer have the additional tax burden. For the comprehensive real estate tax, the rate is 5% for those owning three or more homes with a tax base exceeding 9.4 billion KRW, but if the heavy taxation on multi-homeowners is abolished, it will be reduced to 2.7%.

Difficult for Investment Enthusiasm to Spread to Seoul

Even if funds flow into the provinces and transaction volumes increase, it is expected to be difficult for investment enthusiasm to spread to the metropolitan area, especially Seoul. Experts agree that Seoul and the provinces are completely different markets in the real estate sector. Additionally, the ruling party plans to establish a safeguard to maintain the existing taxation method if the second home is located in the metropolitan area.

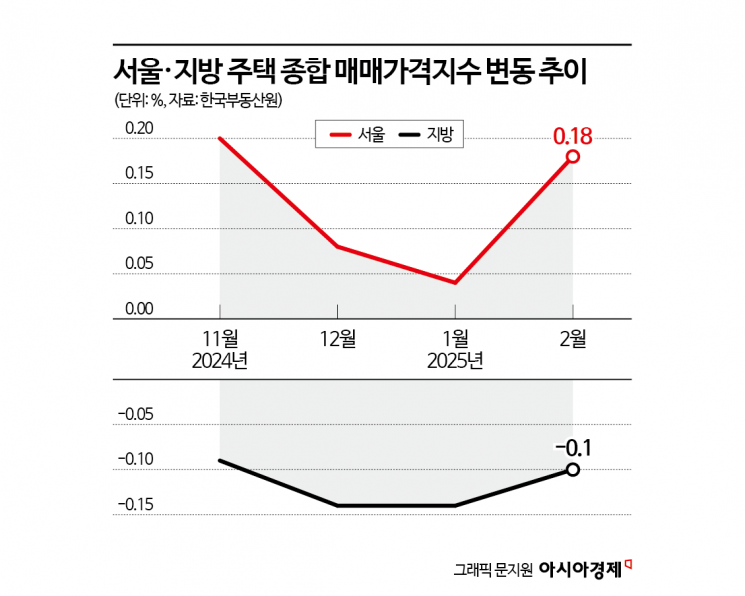

Currently, the housing markets in Seoul and the provinces are sharply polarized. While housing prices in Seoul continue to rise, the provinces are in a declining phase. According to the "National Housing Price Trend Survey" released by the Korea Real Estate Board, the housing price index for Seoul (including apartments, row houses, and detached houses) rose by 0.18% compared to the previous month last month. This marks a continuous upward trend since March last year. On the other hand, the provinces have been recording a continuous decline since November 2023, with unsold units after completion, such as 3,075 units in Daegu, increasing rapidly.

Yoon Soo-min, Real Estate Specialist at NH Nonghyup Bank, said, "Seoul is a market where people want to own one expensive and scarce home, while the provinces are a market where people hold multiple affordable homes to gain profits." He explained, "If regulations on multi-homeowners in the provinces are eased, demand for Seoul could be dispersed, potentially stabilizing housing prices in the metropolitan area."

Since tax law amendments are required, cooperation from the opposition party is necessary, but it is expected that agreement will not be very difficult once specific proposals are presented. There is a consensus that the provincial real estate market is currently in a difficult state. Yoon said, "(The abolition of heavy taxation on multi-homeowners) focuses on restoring the provincial housing market, so it is unlikely to become a political issue."

However, some experts expressed opinions that there may be limits to artificial policies promoting the provinces through government intervention. Jang Jae-hyun, Head of Research at RealToday, said, "Since the economy and real estate market are not in good condition, only those with capital can invest," adding, "It is highly likely that transactions will occur only in so-called profitable major cities or regions in the provinces."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)