Medical Reform Special Committee Announces '2nd Medical Reform Implementation Plan' on the 19th

Emergency Room Costs for Non-Severe Patients to Rise from 180,000 KRW to 810,000 KRW

Non-Reimbursable Treatments with Overtreatment Concerns to Be Included as 'Managed Reimbursable Treatments'

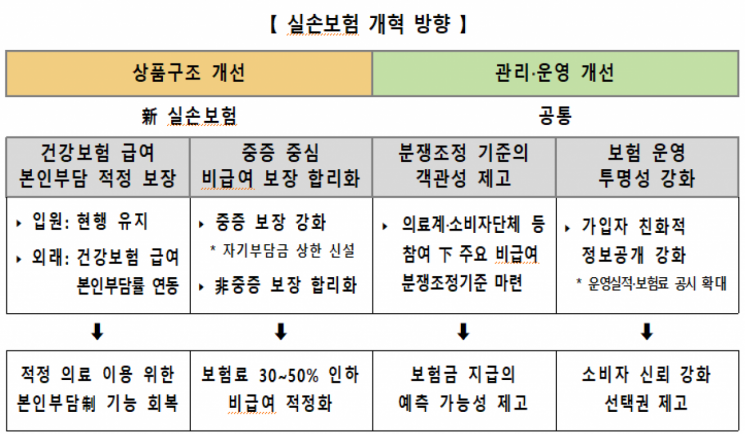

The government is undertaking a major reform of indemnity health insurance, which has caused issues such as excessive medical treatment and medical shopping. The key points include introducing the '5th generation indemnity insurance,' reducing coverage for non-severe and non-reimbursable treatments, and raising the co-payment rate for certain items to over 90%.

Noh Yeon-hong, Chairman of the Medical Reform Special Committee, is attending and speaking at the plenary meeting of the Medical Reform Special Committee held at the Government Seoul Office in Jongno, Seoul on the 19th. The meeting was attended by Cho Kyu-hong, Minister of Health and Welfare, and Kim Byung-hwan, Chairman of the Financial Services Commission. 2025.3.19 Photo by Jo Yong-jun

Noh Yeon-hong, Chairman of the Medical Reform Special Committee, is attending and speaking at the plenary meeting of the Medical Reform Special Committee held at the Government Seoul Office in Jongno, Seoul on the 19th. The meeting was attended by Cho Kyu-hong, Minister of Health and Welfare, and Kim Byung-hwan, Chairman of the Financial Services Commission. 2025.3.19 Photo by Jo Yong-jun

The Presidential Commission on Medical Reform announced the '2nd Medical Reform Implementation Plan' containing these details on the 19th. This second plan is being released seven months after the first plan was announced in August last year. The second plan includes the non-reimbursable management improvement measures and indemnity insurance reform plans announced by the Ministry of Health and Welfare and the Financial Services Commission in January.

The core of the indemnity insurance reform plan is the introduction of the '5th generation indemnity insurance.' The current 4th generation indemnity insurance guarantees the insured's co-payment for National Health Insurance-covered treatments as the main contract and for non-reimbursable treatments not covered by the National Health Insurance as a special contract. The co-payment rates are 20% for reimbursable and 30% for non-reimbursable treatments.

The 5th generation indemnity insurance differentiates between severe and non-severe patients in reimbursable treatments and applies different co-payment rates accordingly. In the case of hospitalization, since severe cases are common and medical expenses are high with low risk of abuse, the co-payment rate remains at 20%, the same as the current 4th generation indemnity insurance. For outpatient care of non-severe patients, the indemnity co-payment rate for reimbursable treatments will be linked to the National Health Insurance co-payment rate. Currently, when a non-severe patient uses the emergency room of a regional emergency medical center as an outpatient, the National Health Insurance co-payment rate is 90%. For example, if the medical bill is 1 million KRW, the patient pays 900,000 KRW. Previously, indemnity insurance reimbursed 720,000 KRW of the 900,000 KRW, so the patient actually paid 180,000 KRW (20% co-payment). This was because the indemnity insurance co-payment rate could be set independently of the National Health Insurance co-payment rate. However, with the 5th generation indemnity insurance linking the indemnity co-payment rate to the National Health Insurance co-payment rate, the indemnity co-payment rate is expected to rise above 90%. Consequently, the patient's out-of-pocket expense will increase from 180,000 KRW to 810,000 KRW (90% of 900,000 KRW). However, the government plans not to apply this linkage to reimbursable medical expenses for severe patients.

The 4th generation indemnity insurance only offered a single special contract for non-reimbursable coverage. In the 5th generation indemnity insurance, the non-reimbursable special contract is subdivided into 'Special Contract 1,' which covers non-reimbursable medical expenses for severe diseases and injuries, and 'Special Contract 2,' which covers non-severe and non-reimbursable medical expenses. Special Contract 1's coverage limits and co-payment rates are not significantly different from the 4th generation. However, Special Contract 2's indemnity coverage limit is drastically reduced from the current 50 million KRW to 10 million KRW, and the co-payment rate increases from 30% to 50%. Insurance premiums for Special Contract 1 and Special Contract 2 will be adjusted according to their respective loss ratios. Policyholders will be able to choose whether to subscribe to the non-reimbursable severe or non-severe special contracts based on premium levels, health status, and medical usage tendencies, potentially reducing their premium burden. The government expects the premium burden for the 5th generation indemnity insurance to decrease by about 30-50% compared to the current level.

The government has newly established 'managed reimbursable treatments' to separately manage non-reimbursable treatments with high concerns of overtreatment, such as manual therapy. In the 5th generation indemnity insurance, the patient co-payment rate for managed reimbursable treatments is expected to rise to between 90% and 95%, depending on the item.

As with the 4th generation, the 5th generation indemnity insurance will continue to apply a premium discount and surcharge system based on the policyholder's non-reimbursable usage volume. The current 4th generation indemnity insurance surcharges the non-reimbursable special contract premium based on the volume of non-reimbursable usage in the year before premium renewal. If no non-reimbursable services are used, the surcharge amount is used to discount the premium. However, the discount and surcharge system does not apply to severe and non-reimbursable cases, as with the 4th generation.

The 1st and 2nd generation indemnity insurances, which were major causes of insurance payout leakage, will be repurchased. The financial authorities plan to minimize consumer rights infringement concerns by providing sufficient explanations and consultations, allowing a considerable reflection period, and guaranteeing withdrawal and cancellation rights during the repurchase process. Policyholders will be able to compare the expected future premium burden and repurchase conditions and switch their contracts to currently sold products.

Currently, under the Insurance Business Act and related regulations, life insurance and non-life insurance companies disclose their overall management performance, the 4th generation indemnity insurance premium increase rates over the past three years, and the loss ratios of the 2nd to 4th generation indemnity insurances. Going forward, to guarantee policyholders' right to know, insurers will disclose not only overall management performance but also premiums earned, insurance profits and losses, expense ratios, and loss ratios (risk, lapse, combined) by generation for indemnity insurance companies. For consumer convenience, premiums by age, gender, and insurer will be disclosed not only for the 4th generation but for all generations (1st to 4th). Through this, policyholders will be able to check whether their indemnity insurance premiums are high compared to other insurers or generations and how premium burdens vary by age.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)