Financial Authorities Select Five Key Future-Oriented Tasks at the 7th Insurance Reform Meeting

Tontine and Low-Surrender Pension Insurance to Boost Pension Market

Introduction of 'Discretionary Asset Retention Type' Transactions to Activate Joint Reinsurance

Financial authorities announced on the 16th that they have selected future-oriented tasks for the insurance industry through the 7th Insurance Reform Meeting.

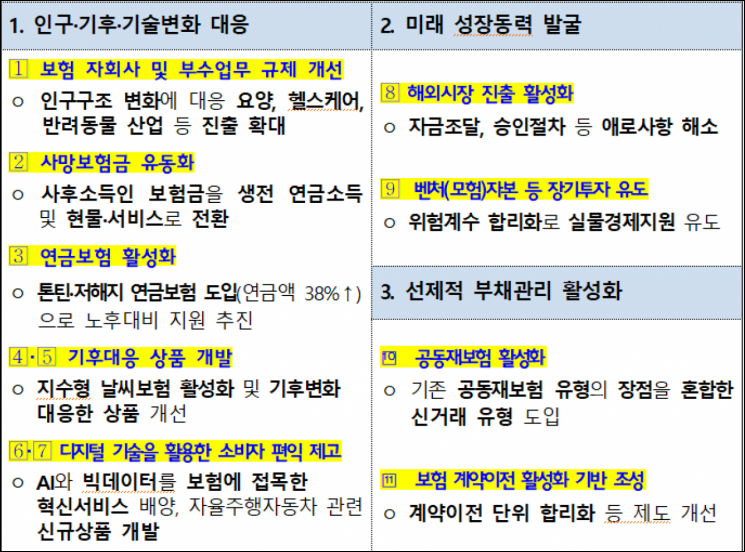

The future-oriented tasks for the insurance industry selected this time by the Financial Services Commission and the Financial Supervisory Service consist of 11 detailed tasks derived from five areas: ▲population ▲climate ▲technology ▲overseas expansion and real asset investment activation ▲debt management activation.

Considering changes in population structure, insurance company subsidiaries will be allowed to perform new tasks related to nursing care, healthcare, and long-term rental. In the nursing care industry, the scope of work will be expanded to allow subsidiaries to engage in senior food manufacturing and distribution businesses that can be linked with nursing facility operations and health management services. To promote entry into nursing facilities, cases where subsidiaries inevitably perform non-nursing tasks due to land use restrictions will also be permitted. Subsidiaries specializing only in the entrusted operation of elderly welfare facilities (Silver Housing) will also be allowed. The Ministry of Health and Welfare will also push for amendments to the Enforcement Decree of the Elderly Welfare Act to enable entrusted operations even without prior experience in Silver Town projects.

For healthcare subsidiaries, additional non-medical service tasks recognized by the Ministry of Health and Welfare will be expanded. The operation of long-term rental housing by insurance company subsidiaries will be newly permitted to support the expansion of rental housing supply. For ancillary tasks operated under the principle of comprehensiveness, requirements will be actively interpreted to allow various tasks. Related ancillary tasks will also be permitted to enable platform-based one-stop services for pet-related businesses, which are considered future growth areas of the insurance industry amid population decline.

Tontine and low-surrender pension insurance products will be introduced to revitalize pension insurance and support the public’s retirement preparation. Tontine and low-surrender pensions are products that pay a lower amount than the accumulated premium if the insured dies or surrenders before pension commencement, in exchange for increasing the pension amount for contract holders who maintain their contracts. Compared to general products, this results in a 38% increase in pension amounts. However, payments decrease if death or surrender occurs before pension payment. Therefore, the goal is to launch the product in early 2026 after establishing sufficient consumer explanation measures such as contract confirmation forms, product sales qualification systems, and happy calls.

Index-based weather insurance will also be promoted. To respond to climate risks such as abnormal weather, support will be provided for the development of various index-based weather insurance products. Index-based weather insurance pays insurance benefits proportionally to the level of a pre-determined weather index (such as precipitation, snowfall, or number of heatwave days) when it deviates from normal levels.

The scope of bonded warehouse insurance coverage will be expanded to guarantee losses of cargo owners and warehouse operators caused by natural disasters, thereby increasing public awareness. New coverage will be provided for damages caused by natural disasters such as typhoons, storms, and earthquakes for cargo owners and warehouse operators. If insurance subscription is difficult due to warehouse aging, liability will be guaranteed through joint underwriting by associations. It is expected that risk coverage for approximately 500 bonded warehouse cargo owners and warehouse operators nationwide will be expanded through these institutional improvements.

With the advancement of 4th industrial revolution technologies, the insurance industry is undergoing digital transformation. Support will be provided to enable innovative insurance services at all stages of insurance, including product development, underwriting, and claims payment, through InsurTech (insurance + technology) and other means.

Five Major Future Preparedness Tasks and 11 Detailed Tasks Selected by the Financial Authorities at the 7th Insurance Reform Meeting. Provided by the Financial Services Commission

Five Major Future Preparedness Tasks and 11 Detailed Tasks Selected by the Financial Authorities at the 7th Insurance Reform Meeting. Provided by the Financial Services Commission

Big data and artificial intelligence (AI) infrastructure will be expanded at institutions such as the Korea Insurance Development Institute and the Credit Information Agency for joint use by the insurance industry. For tasks proven effective through the network separation innovative financial services promoted since last year, prompt institutionalization will be considered in related areas such as sales channels.

In preparation for the commercialization of fully autonomous vehicles in 2027, dedicated autonomous vehicle insurance products will also be introduced. New coverage will be developed to cover accidents caused by defects in autonomous driving systems, and measures to discount insurance premiums by reflecting lower accident rates compared to general vehicles when calculating autonomous vehicle insurance premiums will be reviewed.

To support overseas expansion of insurance companies, industry difficulties such as overseas subsidiary financing and ownership approval procedures will be actively resolved. The solvency ratio (K-ICS) requirement related to overseas subsidiary debt guarantees will be relaxed from the current 200%. The practice of requiring confirmation documents from overseas supervisory authorities first when approving subsidiary ownership will also be rationalized.

Since the insurance industry operates on a long-term horizon, social service supply through support for the national real economy, such as venture companies and real estate listed REITs, will also be activated. To this end, the K-ICS capital requirement regulations applied to investments in qualified ventures and listed REITs will be rationalized.

Joint reinsurance will also be promoted. Previously, transaction types of 'asset transfer type' and 'contractual asset retention type' were introduced for joint reinsurance. These caused structural limitations and hindered the activation of joint reinsurance. Therefore, a discretionary asset retention type transaction combining the advantages of the two types will be introduced to support joint reinsurance activation. Explanation support by domestic branches of foreign reinsurers, currently prohibited during transactions, will be allowed to facilitate smooth negotiations.

A foundation for activating insurance contract transfers will also be established. Although insurance companies can transfer contracts voluntarily under the Insurance Business Act, the comprehensive transfer regulation requiring all insurance contracts with the same basis for reserve calculation to be transferred to another insurer has limited the use of the system. Therefore, to enable insurance companies to use contract transfers for non-core business restructuring and capital reallocation, the contract transfer unit will be subdivided to facilitate transfers, including cases where business expenses differ by sales channel in addition to existing risk rates and assumed interest rates. Review requirements will also be rationalized to approve contract transfers when necessary, even if the insurer’s management or financial condition is poor.

Kim So-young, Vice Chairman of the Financial Services Commission, said, "It is necessary to prepare in advance for shocks such as population, climate, and technological changes by utilizing insurance and to expand and diversify insurance and systems for this purpose." She added, "I hope that through the future-oriented tasks prepared this time, the insurance industry will actively respond to environmental changes and become an insurance sector that continuously innovates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)