Kim Hong-guk's Ambitious Project 'Themisik'

Harim Industry Posts 127.6 Billion KRW Operating Loss Last Year

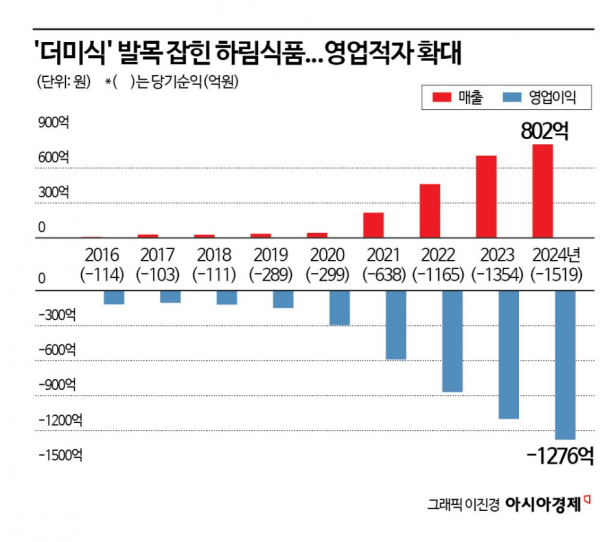

Widening Losses Since Founding... Perpetual Deficit

Sluggish Sales, Revenue Stuck at 80 Billion KRW Last Year

Located in Iksan, Jeonbuk, Harim Foods' production plant 'First Kitchen' is named to mean 'the first kitchen.' This facility serves as a forward base for Harim's transformation from a chicken-specialized company into a comprehensive food enterprise, backed by an investment of 150 billion KRW. Within a space equivalent to 17 soccer fields, measuring 123,429㎡ (approximately 37,000 pyeong), all processed products of Harim Foods are produced, including broth, sauces, frozen foods, as well as instant rice and ramen.

Harim Industry, the food subsidiary of Harim Holdings, saw its operating loss balloon to nearly 130 billion KRW last year. Despite pouring massive costs into producing the home meal replacement (HMR) brand 'The (The)misik' at First Kitchen, a project ambitiously launched by Harim Group Chairman Kim Hong-guk, sales fell short of expectations, significantly widening the deficit.

According to the Financial Supervisory Service's electronic disclosure system on the 19th, Harim Industry recorded an operating loss of 127.6 billion KRW last year. This represents a 17.7 billion KRW increase in losses compared to 109.9 billion KRW in 2023. During the same period, sales increased by just over 10 billion KRW, from 70.5 billion KRW to 80.2 billion KRW.

Operating Loss of 130 Billion KRW Last Year... Sales Stuck at 80 Billion KRW

The company was established in February 2012 to develop the logistics center in Yangjae-dong, Seoul, a key project for Harim Group. However, delays in Seoul's development permits led to the absorption merger of Harim Foods in 2019, transforming it into a food company.

The company has continued to post losses since its inception. Starting with an operating loss of 11.6 billion KRW in 2016, when Harim Industry first disclosed its audit report, it has recorded losses exceeding 10 billion KRW annually. After merging with Harim Foods in 2019, the deficit widened sharply. Especially after the launch of Themisik, Chairman Kim's ambitious project, operating losses have ballooned like a snowball.

In October 2021, Harim Industry officially declared itself a comprehensive food company and launched the HMR brand Themisik. At that time, Chairman Kim made a surprise appearance to introduce 'Themisik Artisan Ramen,' showing his affection for the brand. He stated, "We will grow Themisik into a mega brand with annual sales of 1.5 trillion KRW and leap forward as a comprehensive food company."

Harim Industry also launched an extensive marketing campaign featuring Lee Jung-jae, the lead actor of the global hit 'Squid Game,' as the advertising model. Subsequently, Harim Industry expanded its product lineup to include noodle products such as spicy ramen and jajangmyeon, soup dishes like army stew and seaweed soup, and instant rice. It also consecutively introduced the street food brand 'Melting Peace' and the children's food brand 'Foodie Buddy.'

However, the performance was underwhelming. Sales in the first year of Themisik's launch in 2021 reached 20 billion KRW, about five times the previous year, but growth slowed to 70.5 billion KRW (52.9%) in the following year and 80.2 billion KRW (13.8%) last year. The company spent 26.7 billion KRW on advertising last year.

Especially when compared to Nongshim, the number one player in the ramen industry, which generates over 1 trillion KRW annually from a single product, Shin Ramyun, domestically and internationally, Harim Industry's poor performance stands out more. Recently, Harim Industry partnered with E-Mart to launch 'Baekjemyeon,' challenging Shin Ramyun's dominance.

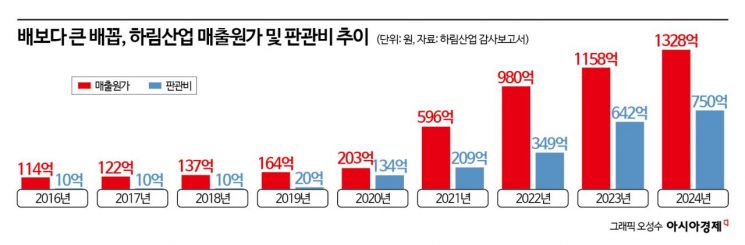

"The More They Make, The More They Lose"... Cost of Sales Larger Than Revenue

Harim Industry's ongoing losses are due to a surge in cost of sales and selling and administrative expenses amid sluggish sales.

Last year, the company's cost of sales was 131.8 billion KRW, a 14.68% increase from 115.8 billion KRW the previous year. Raw material costs accounted for 57.8 billion KRW of the cost of sales, nearly 10 billion KRW more than the previous year. However, raw materials accounted for less than half, 43.5%, of the cost of sales. Other expenses, including logistics and electricity costs amounting to 32 billion KRW and labor-related expenses of 23.9 billion KRW, were costs incurred to operate the production plant.

Selling and administrative expenses also rose by over 10 billion KRW to 75 billion KRW last year, with electricity costs increasing fourteenfold from 57 million KRW to 800 million KRW. During this period, transportation costs jumped from 4.5 billion KRW to 8.3 billion KRW, and outsourcing fees increased from 6.3 billion KRW to 9.7 billion KRW.

In July last year, Harim Industry invested 68.9 billion KRW in additional investments in the Iksan plant and logistics facilities in Jeonbuk, but profitability declined due to weaker-than-expected sales.

In fact, Harim Industry recognized a 2.4 billion KRW provision for inventory valuation losses last year and reflected inventory valuation losses of over 1 billion KRW in the cost of sales. Inventory valuation losses are accounted for when product prices fall below acquisition costs due to expiration dates passing, making sales impossible or requiring discount sales, indicating that produced products could not be sold. The company's inventory valuation losses increased nearly fourfold from 61.15 million KRW in 2022 to over 200 million KRW in 2023, then surged nearly fivefold last year.

Within the food industry, the premium pricing strategy is cited as the cause of Themisik's poor sales. Harim Industry generally prices its products higher than competitors. The price of one pack of Themisik Artisan Ramen is 2,200 KRW, more than twice the price of Nongshim's Shin Ramyun (1,000 KRW). A food industry insider said, "In a domestic market that has long been stagnant, excessively high prices are one of the factors that reduce product competitiveness," adding, "It seems difficult for the brand to settle in the market."

Some in the industry predict that Harim Industry's convenience food business could follow the footsteps of Binggrae. Binggrae entered the ramen market in 1986 but eventually withdrew from the business in 2003 after being unable to sustain increasing losses.

A Harim representative explained, "Expansion of instant rice and ramen production, which was planned, is ongoing, and investments related to the online logistics center are also continuing, so losses are occurring. Sales are continuously increasing, and once investments are completed, the deficit will decrease."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)