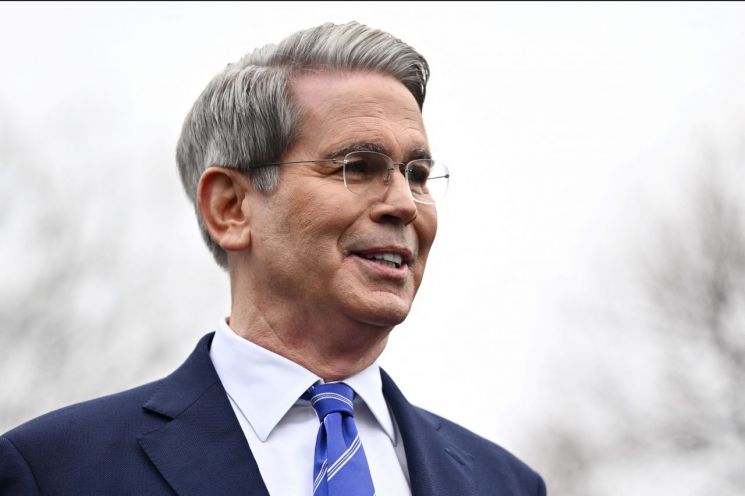

Secretary Baesant in CNBC Interview

"Inflation is Under Control"

As concerns about a recession spread on Wall Street due to the tariff bombardment by the Donald Trump administration, U.S. Treasury Secretary Scott Baesant stated on the 13th (local time) that he is focusing on the long-term health of the economy and the market, rather than short-term stock market volatility.

Secretary Baesant said in an interview with CNBC that day, "We are focusing on the real economy."

He added, "What matters is whether we can create an environment that benefits the market in the long term and also benefits Americans in the long term. I am not concerned about a bit of (market) volatility over the next three weeks."

Secretary Baesant emphasized that the Trump administration is monitoring market movements and that both the real economy and the market will prosper in the long run.

He said, "The reason stocks are a safe and great investment is because you can look at them long term. If you start looking at them from a micro perspective, stocks become very risky. That is why we focus on the medium to long term." He continued, "If appropriate policies are implemented, a foundation will be laid for real income growth, job creation, and asset increase."

When asked whether the detox period of the U.S. economy mentioned in a recent interview meant a recession, he replied, "Not at all, and it does not necessarily have to be that way," adding, "Our goal is a smooth 'transition'." He reiterated the 'transition' mentioned by President Trump in a Fox News interview aired on the 9th. During that interview, when asked about the possibility of a recession, President Trump responded, "There is a period of transition for big things," raising concerns that he intends to endure a downturn and push forward with tariff policies.

Secretary Baesant's remarks came amid increased volatility in the U.S. stock market due to President Trump's tariff policies. While reaffirming the Trump administration's determination to continue pursuing tariff policies, his comments are interpreted as an attempt to calm the market gripped by recession fears by stating that tariffs will drive U.S. economic improvement from a medium- to long-term perspective.

Regarding recent improvements in inflation indicators, Secretary Baesant said, "Inflation is probably under control," and "the market will gain more confidence in this."

The previous day, the U.S. Department of Labor announced that the consumer price index (CPI) increase rate for February was 2.8%, below both the market forecast (2.9%) and the previous month's figure (3.0%). The producer price index (PPI) for February, released that day, was flat compared to the previous month, significantly underperforming both the January figure (0.6%) and expert forecasts (0.3%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)