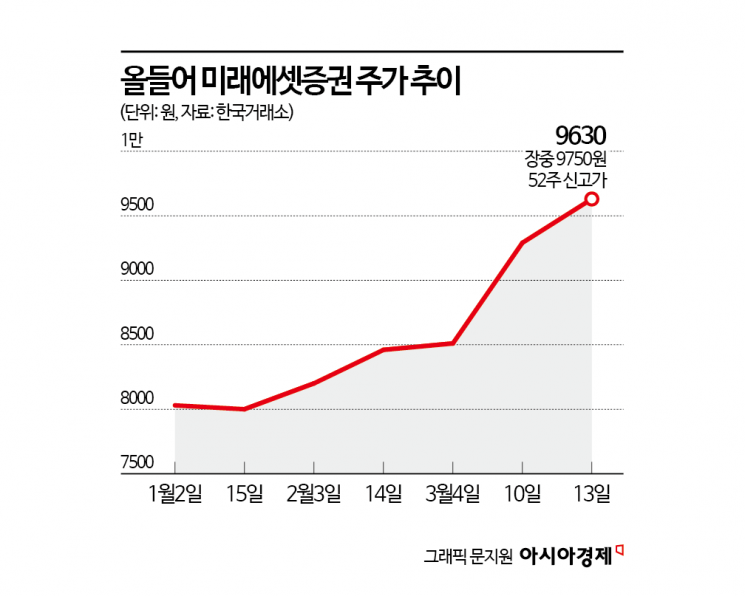

Intraday High of 9,750 Won Sets New 52-Week Record

Expectations for Improved ROE, Shareholder Returns, and Industry Recovery

Amid growing expectations for an improvement in the securities industry this year, Mirae Asset Securities, the leading securities company, is approaching a stock price of 10,000 won. With an anticipated favorable environment due to increased trading volume, attention is focused on whether it will recover the 10,000 won level for the first time in four years.

According to the Korea Exchange on the 14th, Mirae Asset Securities reached an intraday high of 9,750 won, setting a new 52-week high. It closed at 9,630 won, up 2.56% from the previous day’s close. This marks a consecutive two-day increase of over 2%. The stock price has risen nearly 20% since the beginning of the year.

A representative from Mirae Asset Securities explained, "Expectations for improved Return on Equity (ROE), prospects for bond valuation gains due to falling interest rates, and the fact that the company is not affected by tariffs appear to be factors driving the stock price increase."

Mirae Asset Securities’ overseas subsidiaries account for one-third of its equity capital, and underperformance overseas has previously been a factor lowering ROE. Earlier, Mirae Asset Securities set a target of achieving a 10% ROE through its corporate value enhancement plan last year. Youngjun Ahn, a researcher at Kiwoom Securities, analyzed, "Since 2021, Mirae Asset Securities experienced prolonged poor performance and stock price due to losses related to real estate holdings amid rising interest rates. However, as the market has entered a phase of declining interest rates, performance improvement is expected going forward. Recently, with accelerated interest rate cuts in the U.S., real estate assets are expected to contribute positively to this year’s performance. Additionally, the company holds a relatively high market share in brokerage, especially in overseas stocks, which is expected to benefit from increased overseas stock trading volume."

Continuous shareholder return efforts are also positive. At a board meeting held last month, Mirae Asset Securities decided on a total dividend of approximately 146.7 billion won (250 won per common share, 275 won per 1st preferred share, 250 won per 2nd preferred share) and a share buyback cancellation of about 136.9 billion won (15 million common shares and 2.5 million 2nd preferred shares). Including the cancellation of 10 million common shares in November last year, the total shareholder return for the 2024 fiscal year amounts to 367 billion won, the largest ever. The shareholder return ratio is about 39.8%. Researcher Ahn said, "Along with performance improvement, additional future share repurchases and cancellations will act as momentum for stock price increases."

A favorable industry environment is also expected this year. Researcher Ahn forecasted, "Since the beginning of the year, trading volume has increased due to the strong domestic stock market, and positive events such as the lifting of short-selling bans, activation of alternative trading platforms, and tax benefits for Individual Savings Accounts (ISA) are expected to create a favorable environment for increased domestic stock market trading volume." He added, "Annual domestic stock market trading volume is expected to increase by 8% compared to the previous year, and overseas stock trading volume is also expected to rise by 36% as domestic investors maintain high interest."

In particular, increased trading volume following the launch of alternative trading platforms is expected to benefit participating securities firms. Taejun Jung, a researcher at Mirae Asset Securities, said, "The combined trading volume of nine stocks traded over four days after the launch of the alternative trading platform accounted for about 30% of the combined trading volume on the Korea Exchange. With gradual expansion of listed stocks to about 800 from the second quarter, if the current trading volume trend continues, securities firms could see an approximately 30% increase in total trading volume."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)