Bank of Korea Monetary and Credit Policy Report

Review of the 75bp Benchmark Rate Cut Since Last October

Expected to Raise GDP by 0.17 Percentage Points This Year and 0.26 Percentage Points Next Year

Limited Impact on Consumer Sentiment When Uncertainty Is High

Analysis suggests that the benchmark interest rate, which was lowered by 0.75 percentage points (75bp) following the pivot (monetary policy shift) in the second half of last year, will increase South Korea's economic growth rate by 0.17 percentage points this year.

On the 13th, the Bank of Korea revealed this in its Monetary and Credit Policy Report issue analysis titled "Review of the Effects of Benchmark Interest Rate Cuts and Implications." Using a macroeconometric model to analyze the average past impact, it explained that the 75bp cut in the benchmark interest rate since October last year is expected to raise the domestic gross domestic product (GDP) growth rate by 0.17 percentage points this year and 0.26 percentage points next year.

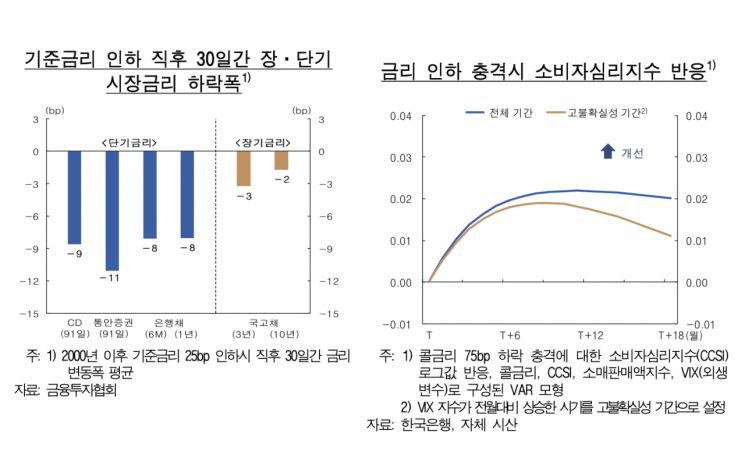

Park Jong-woo, Deputy Governor of the Bank of Korea, analyzed, "The effect of benchmark interest rate cuts on economic growth spreads through channels such as declines in long- and short-term interest rates and improvements in sentiment. In this round of cuts, the long-term interest rate channel appears more pronounced than in the past, whereas the sentiment improvement effect is likely to be relatively constrained."

The expectation of a benchmark interest rate cut had been priced into long-term interest rates for about a year. As long-term interest rates fell sharply, centered on expected short-term interest rates, the economic stimulus effect through the long-term interest rate channel was greater than in the past. This was significantly influenced by the large magnitude of the previous rate hike cycle (3.00 percentage points), the long duration at the peak rate (3.50%) lasting 20 months, and the substantial decline in global interest rates since November 2023 due to expectations of monetary policy pivots in major countries. According to the Bank of Korea’s term structure model analysis, the 3-year government bond yield fell by 142bp from November 2023 to last February, of which 107bp was due to declines in expected short-term interest rates. Deputy Governor Park stated, "Historically, the effect through long-term interest rates tended to show a decline of about 40-50bp approximately 4-5 months before a benchmark rate cut on average, but this time it began to decline more than a year ago and dropped by over 100bp, showing a significant effect."

However, since the decline in long-term interest rates reflects not only the three benchmark rate cuts but also expectations about future monetary policy, the growth-enhancing effect may vary depending on changes in market expectations and corresponding long-term interest rate fluctuations.

Short-term interest rates also adjusted significantly following the benchmark rate cuts. Since 2000, looking at the 30-day decline after a 25bp benchmark rate cut, long-term rates such as the 3-year and 10-year government bonds fell by only 2-3bp on average, whereas short-term rates more closely linked to the benchmark rate, such as negotiable certificates of deposit (CDs) and 91-day monetary stabilization bonds, fell by 8-11bp on average. It is expected that the decline in lending rates linked to short-term interest rates will have a stimulative effect on the economy. Since most variable-rate loans are linked to short-term interest rates under one year, the decline in short-term rates is expected to reduce interest burdens not only on new loans but also on existing loans. As of the end of last year, variable-rate loans at deposit banks accounted for 54.4% of household loan balances and 61.3% of corporate loan balances.

On the other hand, the effect of benchmark rate cuts on improving sentiment is expected to be limited. This is because the effect tends to diminish when uncertainty is high. Deputy Governor Park said, "Benchmark rate cuts have the effect of stimulating the real economy by improving the sentiment of economic agents, and especially since consumer sentiment has been sharply depressed in the short term, the additional cut in February this year is expected to help restore sentiment," but he also pointed out, "Considering that the effect is estimated to diminish when uncertainty is high, if high domestic and external uncertainties persist for a long time, the economic stimulus effect through sentiment improvement will be constrained."

Meanwhile, the Bank of Korea conducted this analysis based on the view that the three 75bp benchmark rate cuts since last October will affect growth, inflation, household debt, and exchange rates with a time lag. A Bank of Korea official said, "Since the effect of benchmark rate cuts can vary depending on the financial and economic conditions at the time of policy decisions, we reviewed the average effects estimated by the macroeconometric model together with the characteristics of the transmission channels observed during this rate cut period."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)