Can HV Mid-Nickel Block China's Low-Price Offensive?

Dry Electrode Technology: The Key to 46-Series Success

Solid Electrolyte Prices Must Decrease

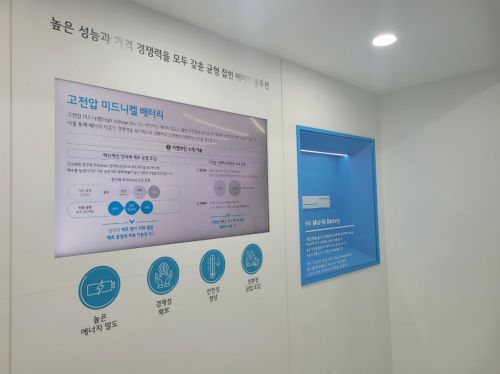

High-voltage mid-nickel battery showcased by LG Energy Solution at InterBattery 2025. Photo by Kang Hee-jong

High-voltage mid-nickel battery showcased by LG Energy Solution at InterBattery 2025. Photo by Kang Hee-jong

The 'InterBattery 2025' exhibition opened on the 5th at COEX in Seoul. LG Energy Solution, which secured the largest exhibition space, displayed lithium iron phosphate (LFP) batteries using cell-to-pack (CTP) technology alongside high-voltage (HV) mid-nickel batteries on one side of their booth. This represented a two-track strategy presenting both LFP and high-voltage mid-nickel batteries to counter China's low-price offensive.

At InterBattery 2025 this year, not only LG Energy Solution but also SK On prominently showcased high-voltage mid-nickel batteries, raising interest in whether high-voltage mid-nickel could emerge as a rival to LFP in the secondary battery market.

Can HV Mid-Nickel Block China's Low-Price Offensive?

Mid-nickel refers to batteries maintaining a nickel content of 60-70%. Among ternary batteries, NCM622, with a nickel, cobalt, and manganese ratio of 6:2:2, is a representative mid-nickel battery. Recently, domestic battery companies introduced high-voltage mid-nickel batteries that maintain the nickel content of NCM622 but reduce cobalt content and increase manganese content to raise battery voltage. This improves energy density compared to conventional mid-nickel batteries. Naturally, the price is lower and thermal stability better than high-nickel batteries with nickel content above 90%.

The focus on high-voltage mid-nickel is to counter China's LFP batteries. China is expanding its presence in the global secondary battery market by promoting LFP batteries that are cheaper and safer compared to Korea's ternary (NCM·NCA) batteries. Last year, Korea's top three battery companies suffered the humiliation of their global electric vehicle battery market share falling below 20%.

High-voltage mid-nickel cathode material explanatory display installed at the LG Chem booth at InterBattery 2025. Photo by Kang Hee-jong

High-voltage mid-nickel cathode material explanatory display installed at the LG Chem booth at InterBattery 2025. Photo by Kang Hee-jong

In response, domestic companies are belatedly developing LFP batteries, but it is difficult to overtake China, which is already ahead technologically and price-wise. It is also expected that domestic LFP batteries will be limited to the North American energy storage system (ESS) market rather than electric vehicles. Therefore, it is interpreted as a strategy for Korea to compete against LFP in the global electric vehicle market through its technological strength in high-voltage mid-nickel.

LG Energy Solution introduced two types of high-voltage mid-nickel products: the Q-line focusing on faster charging speed and the C-line focusing on price. They also emphasized that by adopting a 'spray pyrolysis' process to produce cathode materials without precursors (precursor-free), they can reduce costs by 10% compared to existing methods.

As battery cell companies strategically promote high-voltage mid-nickel, cathode material companies also exhibited many products suitable for this. At the booths of LG Chem, EcoPro, and POSCO Future M, samples of cathode materials for both LFP and high-voltage mid-nickel were available.

LG Chem presented a roadmap to develop high-voltage mid-nickel cathode materials with 60% nickel content and an energy density of 670Wh/L by 2026. A representative from a cathode material company said, "We are preparing LFP as well, but it is hard to escape the image of following China. It seems we must bet on high-voltage mid-nickel, where we can leverage our technological advantages."

Dry Electrode Technology: The Key to 46-Series Success

This year at InterBattery, many companies preparing 46-series (46mm diameter) cylindrical batteries stood out compared to last year. As the three battery giants?LG Energy Solution, Samsung SDI, and SK On?all prepare for commercialization of the 46-series, material and equipment companies also emphasized related technologies. BYD, exhibiting for the first time at InterBattery, displayed the 46120 (46mm diameter, 120mm height) cylindrical battery.

The 46-series is not just a larger version of the existing 2170 cylindrical battery but features improved performance and reduced production costs by applying dry electrode and tabless technologies.

Cylindrical battery of size 46120 exhibited by Chinese electric vehicle and battery company BYD at InterBattery 2025. Photo by Kang Hee-jong

Cylindrical battery of size 46120 exhibited by Chinese electric vehicle and battery company BYD at InterBattery 2025. Photo by Kang Hee-jong

Notably, the 46-series, first introduced by Tesla, replaces the wet process used to produce cathode and anode electrodes with a dry process, eliminating drying steps to enhance eco-friendliness and cost-effectiveness.

However, the dry electrode process for cathodes is technically challenging, and no company has yet achieved mass production. The battery industry views the success of the 46-series in the market as dependent on the completion of dry electrode technology.

At this year's InterBattery, LG Energy Solution and LG Chem detailed their dry electrode technologies, emphasizing their technical superiority. Secondary battery equipment company PNT also presented dry electrode technology at The Battery Conference event.

Solid Electrolyte Prices Must Decrease

Solid-state batteries showed signs of approaching commercialization. Not only Samsung SDI, which has been the most aggressive in solid-state batteries, but also LG Energy Solution and SK On detailed their preparation status for solid-state batteries. Samsung SDI plans to commercialize solid-state batteries as early as the second half of 2027, the fastest among domestic battery companies. LG Energy Solution also showcased various solid-state battery materials, emphasizing that they are not technologically behind.

Sample of prismatic all-solid-state battery showcased by Samsung SDI at InterBattery 2025. Photo by Kang Hee-jong

Sample of prismatic all-solid-state battery showcased by Samsung SDI at InterBattery 2025. Photo by Kang Hee-jong

Solid-state batteries replace the organic liquid electrolyte currently used with a solid electrolyte to maximize fire safety while increasing energy density. Sulfide-based and oxide-based solid electrolytes are used, with sulfide-based electrolytes becoming dominant for electric vehicle solid-state batteries due to their suitability for large-scale production.

The biggest obstacle to solid-state battery commercialization is the high price of sulfide-based solid electrolytes. No matter how good the technology is, if the price is high, it cannot succeed widely. The high price of sulfide-based solid electrolytes is due to the cost of lithium sulfide, the raw material. As of 2024, the price of lithium sulfide is around $12,000 per kilogram.

Sulfide-based solid electrolyte material showcased by LG Energy Solution at InterBattery 2025. Photo by Kang Hee-jong

Sulfide-based solid electrolyte material showcased by LG Energy Solution at InterBattery 2025. Photo by Kang Hee-jong

Therefore, for solid-state batteries to successfully settle in the market, it is important not only to mature the technology but also to establish a mass production system for materials to reduce prices. LG Chem and Lotte Energy Materials showcased sulfide-based solid electrolytes at this year's InterBattery. Lotte Energy Materials operates a pilot line for sulfide-based solid electrolytes with an annual capacity of 70 tons, supplied with lithium sulfide from Isu Specialty Chemical. EcoPro Innovation announced plans to establish a pilot line for lithium sulfide production next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)