Homeplus Begins Corporate Rehabilitation Proceedings

Expected Difficulties in Securing Operating Funds Due to Credit Rating Downgrade

Homeplus States: "Proactive Response to Potential Liquidity Issues"

Union Points to Owner MBK's Leveraged Management

Impending Labor-Management Conflict... Retail Industry Closely Watching the Situation

Homeplus, the second-largest domestic hypermarket, has entered corporate rehabilitation proceedings amid a liquidity crisis, with the labor union pointing to the aggressive leveraged management by the private equity fund (PEF) owner MBK Partners as the cause of the financial difficulties, signaling impending conflict. The offline retail industry, grappling with declining competitiveness due to domestic demand stagnation and the onslaught of online channels including e-commerce, is closely monitoring the potential impact of Homeplus's unusual decision.

According to the legal and related industries on the 4th, the Seoul Rehabilitation Court decided to commence rehabilitation proceedings for Homeplus that morning. This was 11 hours after Homeplus applied for the commencement of rehabilitation proceedings around 12:03 AM that day. Homeplus stated, "Due to a recent credit rating downgrade, there is a possibility of financial issues arising, so we applied for rehabilitation proceedings to alleviate the burden of short-term debt repayment," adding, "This application is a preventive measure."

Previously, credit rating agencies such as Korea Ratings and Korea Investors Service downgraded Homeplus's corporate commercial paper and short-term bond credit ratings from 'A3' to 'A3-' on the 28th of last month. The agencies cited weakened profit generation and excessive financial burden relative to cash flow as reasons for the downgrade. Homeplus argued that as of January 31 this year, its debt ratio and sales over the previous 12 months were 462% and KRW 7.0462 trillion, respectively, representing a 1506% improvement in debt ratio and a 2.8% increase in sales compared to a year earlier, but these improvements were not sufficiently reflected in the credit ratings.

However, since November last year, Homeplus has faced short-term liquidity issues, negotiating with suppliers to delay payments by one or two months while paying late interest. Although there have been no immediate situations where payment for goods could not be made, the credit rating downgrade has reduced the amount of operating funds that can be procured from financial institutions, and a funding shortage is expected around May. Including operating fund borrowings, Homeplus estimates its financial liabilities at about KRW 2 trillion.

Union: "Financial difficulties are structural problems and a predictable outcome"

Homeplus cited unreasonable regulations on hypermarkets, the shift of purchasing channels online due to COVID-19, and the rapid growth of large e-commerce companies such as Coupang and Chinese C-commerce as causes of difficulties in offline channels. In contrast, the Homeplus labor union views the current crisis as a predictable sequence of events.

The Homeplus branch of the Korean Confederation of Trade Unions' Mart Industry Labor Union recently released a report titled "MBK's Speculative Capital Homeplus Eat-and-Run Sale Report," stating, "The cause of Homeplus's management crisis is not the saturated hypermarket industry but structural problems that prevent operating and net profits," and pointed out, "This is due to excessive borrowings and interest costs incurred when MBK acquired Homeplus."

MBK acquired Homeplus in September 2015 for KRW 7.2 trillion through a leveraged buyout (LBO). The LBO method involves securing funds by using the target company's assets as collateral. MBK covered KRW 5 trillion of the acquisition cost through loans in Homeplus's name and acquisition financing loans on MBK's side, and the remaining KRW 2.2 trillion was raised through a blind fund. As a result, Homeplus is responsible for repaying the debt and interest incurred to finance the acquisition.

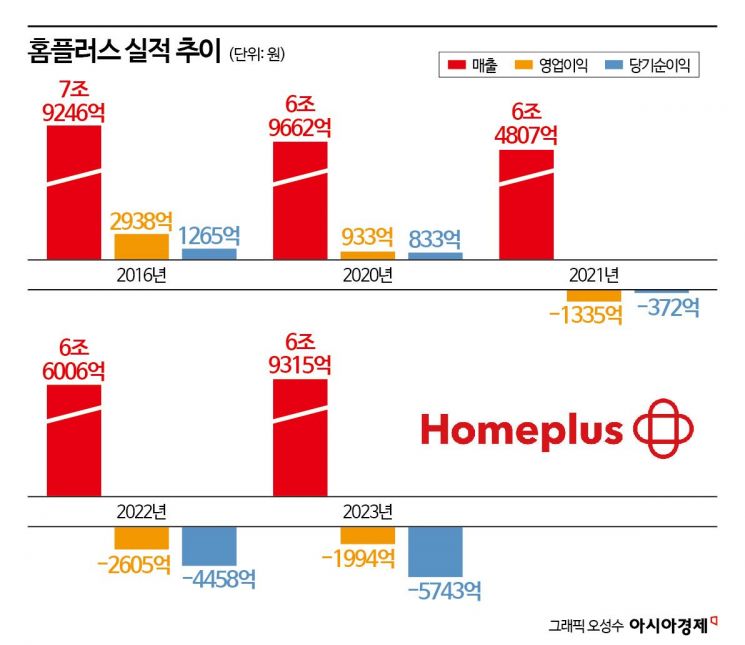

While managing Homeplus, MBK sold or closed about 20 stores from 2018 onward, repaying approximately KRW 4 trillion of debt by selling stores and various real estate. The number of Homeplus stores decreased from 140 in June 2019 to 127 currently. Nevertheless, Homeplus's financial situation did not improve. Sales were KRW 7.9246 trillion with an operating profit of KRW 293.8 billion in 2016, immediately after acquisition, but sales dropped to the KRW 6 trillion range in 2022 and 2023, with operating losses of KRW 260.2 billion and KRW 199.4 billion, respectively. Net income, which was KRW 126.5 billion in 2016, turned to a deficit of KRW -574.3 billion in 2023. MBK also sought to separately sell Homeplus's corporate supermarket division, 'Homeplus Express,' in June last year to improve profitability but failed to achieve results.

The Homeplus union stated, "The total interest expenses from 2016 to 2023 after MBK's acquisition amount to about KRW 2.9329 trillion, which is KRW 2.5 trillion more than the total operating profit of KRW 471.3 billion during the same period," adding, "Currently, Homeplus is in a position where no matter how much it earns, it cannot even properly pay interest due to MBK's LBO acquisition method, and the interest expenses prevent net profits from occurring." They further noted, "The survival of about 20,000 union members and their families is threatened," and "The company has not disclosed specific reasons or plans beyond the vague stance of 'maintaining normal operations,' causing severe anxiety."

The union plans to demand transparent information disclosure from management, hold a delegates' meeting this month to gather members' opinions, and decide on joint actions such as rallies and strikes depending on the company's response. Homeplus stated, "We unavoidably applied for rehabilitation proceedings to prevent potential financial issues due to the credit rating downgrade, but employees, the labor union, and shareholders will work together to overcome this wisely."

"Rehabilitation proceedings are a last resort"... Retail industry watches closely

Competitors such as E-Mart and Lotte Mart empathize with the difficulties faced by offline sales channels but regard Homeplus's application for rehabilitation proceedings as unusual. This is because the industry trend is to seek breakthroughs by improving financial structure through store efficiency for underperforming locations, implementing voluntary retirement, and introducing hybrid stores linked with complex shopping malls and warehouse discount stores, which differs from Homeplus's choice.

An official from a major hypermarket said, "The core of hypermarket operation is achieving economies of scale through store expansion, but Homeplus has been downsizing by selling so-called 'profitable' stores," adding, "The rehabilitation proceedings have ultimately increased concerns about debt burden."

Another official said, "Applying for rehabilitation proceedings is a decision companies cannot easily make when considering business continuity," and "Especially for hypermarkets, where the survival of many partner companies depends on them, this is a delicate issue, and this decision may cause instability among small and medium-sized companies heavily reliant on Homeplus."

In fact, after news of Homeplus's rehabilitation proceedings broke, some partner companies reportedly began debt collection procedures for Homeplus's payment claims. However, Homeplus explained that while repayment of financial claims will be deferred due to the rehabilitation proceedings, general trade debts with partner companies will be fully repaid according to the proceedings, and employee salaries will be paid normally. The court also issued a 'comprehensive permit decision for business continuation,' allowing Homeplus's hypermarket, Express, and online channels to operate normally. Homeplus expects that with real estate assets valued at about KRW 4.7 trillion, it will not be difficult to reach an agreement with financial creditors once the rehabilitation plan is finalized.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)