Booming Industry and U.S. Cooperation... Rising Expectations for Shipbuilding

Financial Institutions Hesitant to Guarantee Due to Past Failures

Who Will Guarantee Under Sanctions?... Banks Demand Indemnity

The background behind the government granting indemnity to banks issuing ‘Refund Guarantee (RG)’ lies in the booming shipbuilding industry and former U.S. President Donald Trump. To support the shipbuilding industry's rare revival and respond to U.S. cooperation in shipbuilding, it is deemed essential that guarantees, which are crucial for ship orders, be smoothly provided. Voices are emerging that for financial institutions, which previously suffered from issuing RGs, to step up again, the government’s prompt indemnity provision is necessary.

Boom and Cooperation with the U.S.... Rising Expectations for Shipbuilding

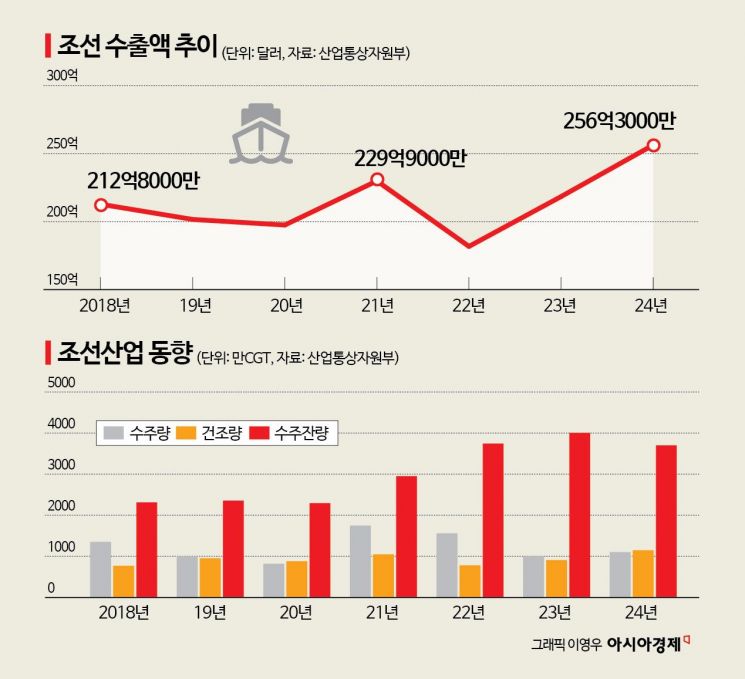

According to the Ministry of Trade, Industry and Energy on the 27th, last year’s shipbuilding export value was $25.63 billion, the highest in seven years. Shipbuilding exports had continuously declined since peaking at $56.59 billion in 2011, falling to $18.18 billion in 2022. However, as COVID-19 ended and cargo volumes increased, shipping companies’ ship orders rose. The results, typically reflected with a 2-4 year lag from the order date, are now appearing.

The trends in orders and construction performance are also not bad. Last year, shipbuilding orders reached 11.05 million CGT (Compensated Gross Tonnage). This is about a 9.6% increase from 10.08 million CGT the previous year. During the same period, actual shipbuilding volume increased by 26.2%, from 9.1 million CGT to 11.49 million CGT. The ‘order backlog,’ which refers to the volume of orders not yet delivered to shipowners, stands at about 37.02 million CGT. A large order backlog generally indicates a lot of work. Although the order backlog decreased by about 7.5% compared to the previous year, it shows a clear improvement compared to the recession years of 2017 (17.98 million CGT) and 2018 (23.13 million CGT).

There is also an aspect of preparing Korea’s shipbuilding infrastructure ahead of negotiations with the second Trump administration. A senior government official said, “Shipbuilding can also be a countermeasure that enables cooperation with the Trump administration.”

President Trump had hoped for cooperation with Korean shipbuilding since his election. On November 7 last year, when he was president-elect, he spoke with President Yoon Suk-yeol, saying, “The U.S. shipbuilding industry needs help and cooperation from Korea,” and “I am well aware of Korea’s world-class warship and shipbuilding capabilities, and we need to cooperate closely with Korea not only in ship exports but also in maintenance, repair, and overhaul.”

In particular, U.S. regulations on Chinese shipbuilding are expected to act as a boon. On the 21st, the U.S. Trade Representative (USTR) announced it would impose fees on Chinese shipping companies and Chinese-made ships entering U.S. ports, citing China’s unfair dominance of the global shipbuilding and marine logistics industry. Chinese shipping companies’ vessels must pay up to $1 million (about 1.4 billion KRW), and Chinese-made ships face fees of $1.5 million. Additionally, fees of up to $1,000 per ton of cargo volume are imposed. This means global shipowners might shift orders from Chinese shipyards, which face regulations, to Korean shipyards.

Financial Institutions Reluctant to Guarantee Due to Past Failures

The problem lies with financial institutions cautious about issuing RGs. RG is a product where a single guarantee accident can lead to massive losses. Banks must pay the shipowner’s contract deposit and also cover interest depending on the period. The smaller the company, the greater the risk banks must bear. The RG fee rate banks receive from large shipyards is typically below 1%, while for medium-sized shipyards, it is known to be higher, around 2-3%. This means that issuing RGs to medium-sized shipyards with relatively small order amounts could result in losses amounting to hundreds of billions of won.

Financial institutions suffered huge losses after the global financial crisis in 2008 as the shipbuilding industry fell into recession. Korea Development Bank (KDB) incurred losses after issuing guarantees for Hanjin Heavy Industries’ Subic shipyard in 2016. It guaranteed 109 billion KRW for four ships but suffered losses of 56.1 billion KRW. Korea Trade Insurance Corporation also suffered about 800 billion KRW in losses due to RGs issued in 2008 and was audited by the Board of Audit and Inspection. NongHyup Bank, which was the most active private issuer of RGs, faced a boomerang effect with guarantees amounting to 2 trillion KRW. In 2016, NH NongHyup Financial Group had to set aside more than 250 billion KRW in bad debt provisions due to the worsening management of shipbuilding and shipping companies. Its first-quarter net profit dropped by more than 64%, taking a direct hit.

A government official explained, “Medium-sized shipyards made excessive low-price orders despite lacking the capacity to build all ships themselves, resulting in significant losses for banks. Based on that experience, banks have no choice but to be stringent in verifying RG issuance for shipyards.”

Since then, the domestic shipbuilding industry has faced difficulties in quickly processing orders whenever financial institutions delayed issuing RGs. A representative case was the contract cancellation crisis of STX Offshore & Shipbuilding in 2017. In July of that year, STX Offshore & Shipbuilding secured an order worth $140 million from a Greek shipping company. However, it failed to obtain the RG required within 60 days after the contract. Despite pleading with the Greek shipping company to extend the deadline, the issue was not resolved. It was only in September 2018 that STX finally received the RG from Korea Development Bank.

In August 2016, Hyundai Heavy Industries faced a contract cancellation crisis despite securing orders for two ultra-large crude oil carriers worth 200 billion KRW from a Greek shipowner because RGs were not issued. At that time, the Export-Import Bank of Korea and several banks jointly provided guarantees, but some banks strongly refused, causing difficulties. In the same year, mid-sized shipbuilder SPP Shipbuilding faced a crisis after being refused RG issuance by the Export-Import Bank of Korea, a policy bank.

Who Will Guarantee If Sanctions Are Imposed? Banks Demand Indemnity

Besides institutional losses, there are concerns about personal sanctions. If an RG is issued too readily and losses occur, the responsible personnel face disciplinary actions from financial authorities and their banks. In 2014, the Financial Supervisory Service (FSS) imposed mass disciplinary actions on KDB RG officers for inadequate post-management. Bank employees appeared before the FSS disciplinary committee, arguing that private banks managed RGs similarly, but their defense was rejected. In 2010, the FSS conducted inspections targeting insurers who re-guaranteed banks’ RGs. In 2011, Meritz Fire & Marine Insurance and Green Fire & Marine Insurance received executive sanctions and warnings for poor management.

Therefore, banks believe that an indemnity system must be established for them to actively issue RGs amid the shipbuilding boom. Since they must bear guarantee risks according to government policy, at least conditions should be created so that employees can perform their duties without fear of sanctions.

Meanwhile, the government has continued policies to expand shipbuilding RGs, including supporting RG issuance for small shipyards since last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)