Dispelling the 'DeepSeek Shock' with a Positive Outlook

"Tremendous Demand... Strong Growth Expected This Year"

New 'Rubin' Chipset to Launch Next Year

Increased Orders for Domestic HBM Suppliers

SK Hynix's 'Triangular Alliance' Grows Stronger

AI leader Nvidia raised expectations for growth in the AI sector by presenting a positive outlook despite the 'DeepSeek' shock. Since inference-type AI models like DeepSeek require significantly more computational processing than before, demand for AI chips could actually increase. Nvidia plans to accelerate growth by launching the 'Blackwell Ultra' chip in the second half of the year and diversifying its business into areas such as automobiles and robotics.

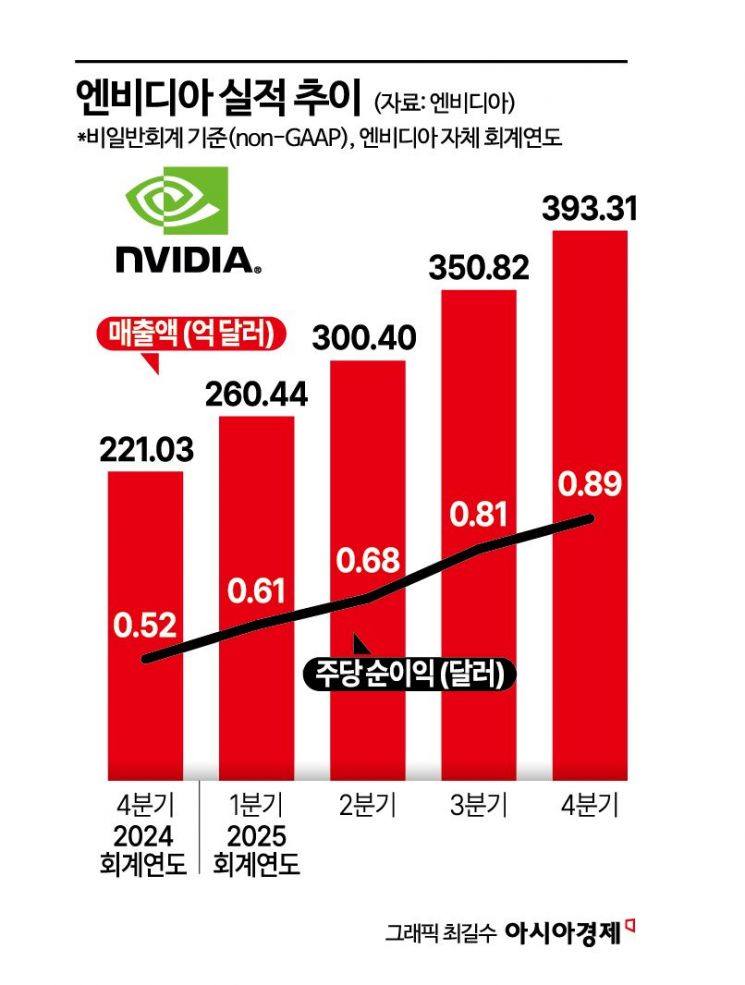

Nvidia announced on the 26th (local time) that it recorded sales of $39.33 billion and earnings per share of $0.89 in the last quarter (November 2024 to January 2025). These figures represent increases of 78% and 82%, respectively, compared to the same period last year. Recently, China's DeepSeek raised doubts about Nvidia's demand by achieving results using low-spec chips for AI development, but Nvidia completely dispelled these concerns.

Jensen Huang, CEO of Nvidia, said immediately after the earnings announcement, "Demand for Blackwell is tremendous," focusing on the potential demand created by inference AI and interpreting it as an 'opportunity.' He emphasized that "inference AI can require 100 times more computations per task," and that Nvidia chips handle all processes from training to inference and reasoning. He added, "The significance of DeepSeek R1 lies in open-sourcing the inference AI model," and said, "We designed Blackwell for this moment." He also stated, "This is just the beginning of the AI era. We will grow strongly in 2025." According to the company, more than 40% of data center revenue last year came from inference. CEO Huang said AI software will become an essential element of data centers, adding, "Data centers will increasingly become AI factories."

He also announced new product launches for the second half of the year. CEO Huang said, "In the second half of the year, we plan to release Blackwell Ultra, the next version after Blackwell." He stated that all production delays for Blackwell have been resolved, and unlike the transition from Hopper to Blackwell, Blackwell and Blackwell Ultra fundamentally use the same system approach, so the new product launch is expected to proceed smoothly. Next year, a new chipset called 'Rubin' is scheduled for release. On the day, Nvidia's stock price closed up 3.67% in regular trading on the New York Stock Exchange, then fell 1.18% in after-hours trading.

With Nvidia, which receives high-bandwidth memory (HBM) necessary for AI chip production, revealing solid results and new product launch plans, the possibility of benefits for domestic companies such as SK Hynix and Samsung Electronics has increased.

If Nvidia releases Blackwell Ultra as planned in the second half of this year and follows up with Rubin next year, SK Hynix and Samsung Electronics, which supply HBM, are also expected to see increased orders. Blackwell Ultra will primarily use the 5th generation HBM3E 12-stack product as a key component, and starting with Rubin next year, the 6th generation HBM4 will be installed.

The 'triangular alliance' formed by SK Hynix, Nvidia, and TSMC is also expected to become stronger. SK Hynix is reportedly already accelerating HBM development speed in line with Nvidia's new product launch plans. The company has also internally decided to focus all efforts this year on mass production of the HBM3E 12-stack product. In an interview released yesterday on the company's newsroom, Kwon Hwan Han, Vice President of HBM Convergence Technology at SK Hynix, revealed, "The HBM3E 12-stack product, which will be the main product produced this year, has a higher process technology difficulty compared to the existing 8-stack product." Samsung Electronics is also expected to tighten its grip on memory development.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)