10-Year and 3-Month Yield Curve Inversion

"Often Observed in the Late Stages of the Economic Cycle"

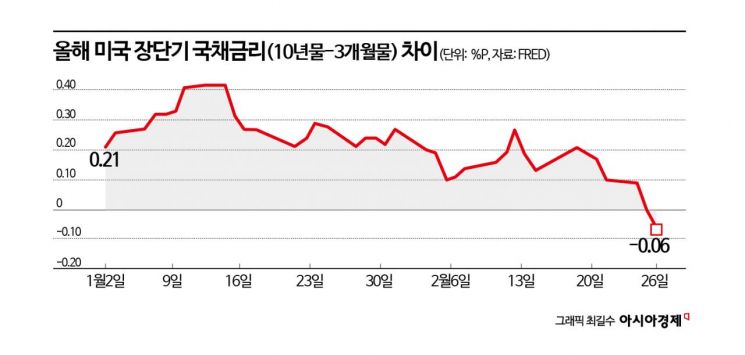

The yield curve between long-term and short-term U.S. Treasury bonds has inverted again after about two months, raising concerns about an economic recession. On Wall Street, this phenomenon is seen as identical to what occurred during past U.S. economic downturns, with some voices even warning of stagflation, where recession and high inflation occur simultaneously.

On the 26th (local time), CNBC reported that the yield spread between the 10-year and 3-month U.S. Treasury bonds inverted (yield curve inversion). In the New York bond market's afternoon trading session, the 10-year yield fell by 4.9 basis points (1 bp = 0.01 percentage points) from the previous day to 4.271%, dropping below the 3-month yield of 4.327%. This is the first time since December 13, 2023.

Generally, the bond yield curve slopes upward because longer maturities typically offer higher returns. However, when the yield spread between long-term and short-term bonds inverts, it creates a downward sloping graph, indicating that longer maturities do not promise significantly higher returns.

Markets usually judge yield curve inversion based on the spread between 10-year and 2-year Treasury yields. Although the yield spread between the 10-year and 2-year U.S. Treasuries has not yet inverted, CNBC reported that the New York Federal Reserve recently considers the 10-year and 3-month Treasury yield spread as one of the reliable indicators for predicting future recessions.

Experts explained that while this phenomenon has often been observed during past economic recessions, caution is needed when interpreting the correlation between yield curve inversion and recession. Joseph Brusuelas, Chief Economist at consulting firm RSM, stated, "It is not yet clear whether the yield curve inversion is merely market noise or a signal that the U.S. economy will noticeably slow down."

He added, "However, yield curve inversion often occurs in the late stages of the economic cycle. It can also be seen as a reaction when investors, fearing an economic slowdown, try to avoid risk."

Some speculate that stagflation similar to that of the 1970s could reoccur. This concern arises from the possibility that inflation may not be controlled even as the economy slows following the yield curve inversion.

Previously, the U.S. Consumer Price Index (CPI) rose 3.0% year-over-year last month, marking the largest increase since August 2023.

Alongside this, private research organization The Conference Board (CB) reported that the U.S. Consumer Confidence Index fell by 7 points from the previous month to 98.3 this month. This is the largest monthly drop since August 2021 and below the market expectation of 102.5.

Additionally, the expectations index, which reflects consumers' short-term outlook on business and the labor market, dropped 9.3 points from the previous month to 72.9. The expectations index falling below 80, considered a warning sign of recession risk, is the first time in eight months since June last year.

Mark Hackett, Chief Market Strategist at Nationwide, said, "Stagflation is the biggest risk currently facing the market," adding, "If the economy slows while prices rise again, the Federal Reserve (Fed) could face a difficult situation with no clear solution."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)