Encouraging Fixed-Rate Loans...

Household Loans Under 100 Million Won Also Subject to Management

Jeonse Loan Guarantee Ratio Limited to 90%...

Strengthened Verification of Jeonse Properties and Landlords

Families with Two Children Also Eligible for "Multi-Child" Benefits...

Support for Vulnerable Groups Resumes

The financial authorities are encouraging the expansion of purely fixed-rate loan products. To this end, they will raise the interest rate reflection ratio of the stress Debt Service Ratio (DSR) for mixed-type and periodic loans. Income screening for DSR will also be strengthened, so that even property situations that were not subject to income screening, such as household loans under 100 million won, will be utilized in credit management. In addition, the guarantee ratio for jeonse loans will be lowered to 90%.

Kwon Dae-young, Secretary General of the Financial Services Commission, is briefing on the 2025 household debt management plan at the Government Seoul Office in Jongno-gu, Seoul on the 26th. Photo by Yonhap News

Kwon Dae-young, Secretary General of the Financial Services Commission, is briefing on the 2025 household debt management plan at the Government Seoul Office in Jongno-gu, Seoul on the 26th. Photo by Yonhap News

On the 27th, the Financial Services Commission held a household debt inspection meeting chaired by Secretary General Kwon Dae-young and announced this year's household debt management plan with these details.

With the implementation of the '3-stage stress DSR' scheduled for July, the focus in the first half of the year was on preparing the system so that it can be implemented anytime if household debt increases. In the second half, they plan to closely monitor the household debt growth and real estate market conditions and implement the prepared measures accordingly.

Encouraging Fixed-Rate Loans... Household Loans Under 100 Million Won Also Subject to Management

Going forward, the stress DSR interest rate reflection ratio for mixed-type loans will be raised from 60% to 80%. The stress interest rate ratio for periodic loans will also increase from 30% to 60%.

The stress DSR is a system that calculates the loan limit by applying a certain level of additional interest rate (stress interest rate) when calculating the DSR, considering the possibility that borrowers using variable interest rate loans may face increased principal and interest repayment burdens due to interest rate hikes during the loan period. It has been gradually implemented since February last year to ensure smooth adoption.

The Financial Services Commission plans to finalize the specific scope of application and stress interest rate levels for the 3-stage stress DSR around April to May, after reviewing household debt trends and real estate market conditions. Once the details are set, the system will be implemented starting in July.

DSR income screening will also be strengthened. Currently, policy mortgage loans such as Didimdol, jeonse loans, interim payment and moving cost loans, and loans under a total amount of 100 million won, which are not subject to DSR, will also be reviewed by banks during loan screening.

Furthermore, to expand fixed-rate loan products, the development of long-term fixed-rate mortgage products by financial companies themselves will be encouraged in the long term. Currently, the maturity of bank bonds issued by banks for funding is 1 to 3 years. Since the maturity of home purchase loans is 10 to 30 years, there is a mismatch in funding and operation. For this reason, the mortgage market heavily depends on policy loans from institutions such as the Housing and Urban Guarantee Corporation (HUG) and the Korea Housing Finance Corporation. If necessary, the option for banks to raise funds by issuing mortgage-backed securities (MBS) or covered bonds will also be discussed as a long-term task.

Jeonse Loan Guarantee Ratio Limited to 90%... Strengthened Verification of Jeonse Properties and Landlords

Along with the implementation of the 3-stage stress DSR, the guarantee ratio for jeonse loans will be lowered to 90%. This is to encourage banks to strengthen credit screening and risk management. Accordingly, all three jeonse loan guarantee institutions?HUG, Seoul Guarantee Insurance, and Korea Housing Finance Corporation?will unify the guarantee ratio at 90%. For the metropolitan area, there is a plan to further lower the guarantee ratio depending on real estate market conditions.

Jeonse deposit repayment ability screening will also be strengthened. HUG will introduce an income screening system for tenants when providing jeonse guarantees. Previously, only Seoul Guarantee Insurance and Korea Housing Finance Corporation conducted such screenings. Additionally, when calculating the guarantee limit, the size of senior mortgage loans on the jeonse property will be considered, and verification of problematic landlords will be strengthened. Penalties will be applied to landlords who failed to return jeonse deposits to tenants.

The Financial Services Commission strengthened jeonse loan management due to concerns that if loan interest rates fall following a base rate cut, jeonse and sales prices could rise. While jeonse loans have helped housing stability, they have also driven up jeonse prices when gap investment sales increased.

The government plans to establish a system to closely monitor the annual guarantee volume of the three guarantee institutions to prevent excessive jeonse loans from increasing household debt and acting as a factor in housing price rises.

Families with Two Children Also Eligible for 'Multi-Child' Benefits... Support for Vulnerable Groups Resumes

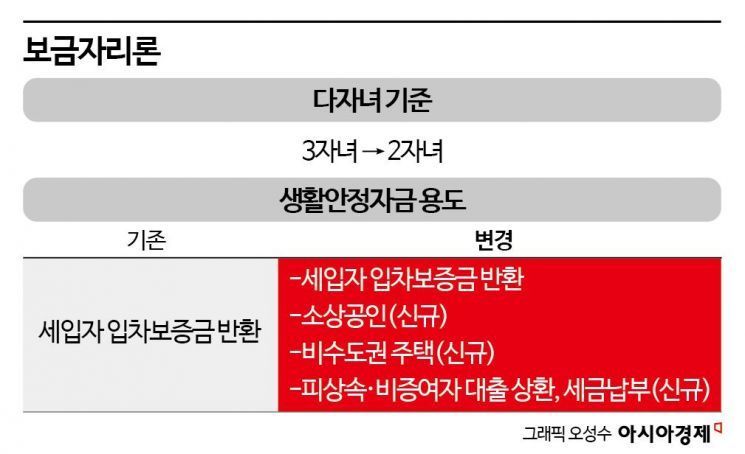

Going forward, families with two children will also be eligible for 'multi-child' benefits when applying for the Bogeumjari Loan. The multi-child criteria have been relaxed as part of measures to address low birth rates. In principle, income and housing price requirements remain, but the multi-child criterion has been eased from three children to two.

The Bogeumjari Loan interest rate will also be based on 3.65% to 3.95%, reflecting the base rate cut. The interest rate may be adjusted according to market rate trends. The preferential interest rate for newlyweds will be expanded from 0.2 percentage points to 0.3 percentage points.

At the same time, support for vulnerable groups will be partially strengthened. There are concerns that if banks independently manage household loans, vulnerable groups may not receive practical support. At the end of last year, the scale of household debt was about 2,300 trillion won, and the estimated increase in household debt within this year's nominal growth rate (3.8%) is about 8.74 trillion won. Of this, the scale of bank loans is only about 2.55 trillion won.

Therefore, this year, the Bogeumjari Loan benefits will be adjusted to be available again for living stabilization funds. Previously, Bogeumjari Loans could be used only for returning tenant deposits if it was not for purchasing a new house. Going forward, the loan can be used for small business owners, non-metropolitan housing, repayment of loans for heirs or donees, and tax payments.

Starting in April, the prepayment fee rate for early repayment within three years from the Bogeumjari Loan execution date will also be reduced from the current 0.7% to 0.5%. In addition, internet-only banks such as KakaoBank and K Bank will be able to handle Bogeumjari Loans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)