Dongkuk Steel Weighs Color Steel Sheet Prices

Shifting Strategy from High Value-Added to Low-Margin, High-Volume

Low-Price Supply Tactics in Response to Tariff Increases

Hyundai Steel and POSCO Consider Localization Strategies

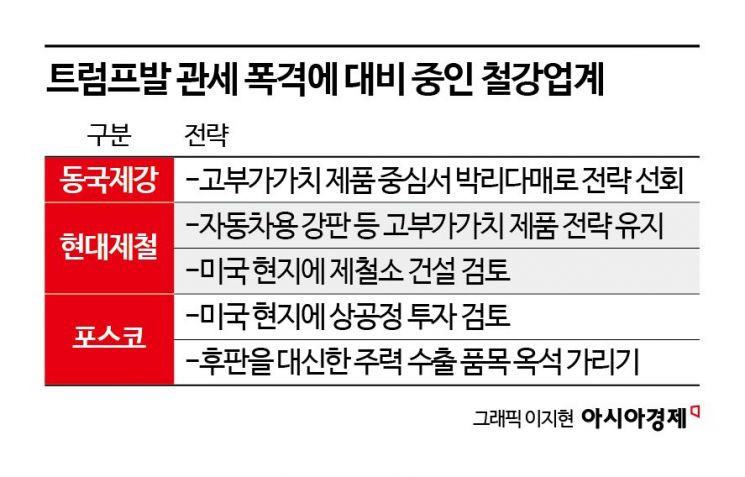

Dongkuk Steel is confirmed to be considering lowering the prices of high value-added products such as color steel sheets to avoid the tariff onslaught from U.S. President Donald Trump. The company has decided to shift its existing business strategy, which focused on high value-added products, to a low-margin, high-volume approach. Since there are no longer volume restrictions despite the tariffs, the plan is to secure profitability by supplying large quantities of steel products at reduced prices. Hyundai Steel and POSCO are also reviewing their existing business plans while contemplating the establishment of localization strategies.

A Dongkuk Steel Group official said on the 19th, "Previously, we mainly exported high-profit products duty-free within the quota (2.63 million tons), but now we are at a point where we need to change our business strategy according to changes in tariff policies," adding, "Each affiliate is also establishing new individual strategies."

Steel. Asia Economy DB

Steel. Asia Economy DB

Within Dongkuk Steel Group, the core company Dongkuk Steel produces and supplies long products and thick plates, while Dongkuk CM produces and supplies steel sheets. In particular, they are considering lowering the price of color steel sheets and expanding sales. Dongkuk CM's overseas sales account for 62%. The export price of color steel sheets produced at the Busan plant was 1,984,040 KRW per ton as of the third quarter of last year, a 7% increase from 1,858,166 KRW per ton the previous year. Dongkuk CM is reportedly deliberating how much to reduce this price.

Dongkuk Steel, which produces thick plates, had an overseas sales ratio of only 9% as of the third quarter of last year, so it is expected to face less tariff pressure from the U.S. However, due to tariffs narrowing the export route to the U.S., there is concern about an influx of low-priced Chinese thick plates, so the company plans to increase low-priced exports to the U.S. as a countermeasure. A company official said, "There is a significant quality difference compared to China, so we believe we can preserve profits."

POSCO and Hyundai Steel are also contemplating their U.S. sales strategies. Hyundai Steel has decided to overcome the tariff hurdle by focusing on high value-added products such as automotive steel sheets. It is expected that if general steel tariffs are imposed, high-priced automotive steel sheets and other high value-added products will be the first to suffer export impacts, but Hyundai Steel has chosen to confront this head-on. The company believes that new steel grades based on advanced technology will secure differentiated competitiveness.

Hyundai Steel is developing next-generation high value-added products such as carbon-reduced steel sheets and third-generation steel sheets. Among these, the third-generation steel sheets are planned to be commercialized this year. A company official said, "We are reviewing various measures to respond to global protectionism," adding, "We plan to strengthen profitability by focusing on the sales of high value-added products to enhance the company's business competitiveness."

POSCO is also considering investing in upstream processes that produce molten iron in the U.S. Although POSCO has been reserved in comments, saying "this requires thorough review," it is expected that investment plans will materialize soon, especially since Chairman Jang In-hwa emphasized the establishment of localization strategies in his New Year's address.

In addition to local investment, POSCO is reportedly deliberating on its main products. POSCO produces eight major items including hot-rolled, cold-rolled, and galvanized steel sheets, among which thick plates mainly used in shipbuilding and construction sites had a high export ratio to the U.S. A POSCO official said, "If tariffs are imposed in the future, product margins may also vary," adding, "We are considering what to do with our main products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)