Hyundai Motor and Kia Achieve Record-High Earnings, Yet Stocks Remain Undervalued

MSCI Auto Index Includes BYD, Excludes Hyundai Motor

Capital Market Experts Question Competitiveness in Autonomous Driving and Software

Need to Consolidate New Technology Businesses Scattered Across Affiliates

Prioritizing Cash Investment in New Businesses Over Dividends is Essential

In February 2025, Hyundai Motor India Private Limited was newly included in the Morgan Stanley Capital International (MSCI) Global Standard Index. The MSCI index is considered the most influential stock index worldwide. Inclusion in this index not only increases global market attention but also anticipates large-scale capital inflows. This is because major global investors prioritize stocks listed on this index when discussing investment portfolios.

The inclusion of Hyundai Motor India was largely influenced by MSCI increasing its weighting in India instead of China. MSCI has focused on India among emerging markets worldwide and particularly viewed Hyundai Motor's growth potential in India highly. Hyundai Motor raised 4.5 trillion KRW by listing on the Indian stock market in October 2024. This is the largest amount ever raised through an initial public offering (IPO) on the Indian stock exchange.

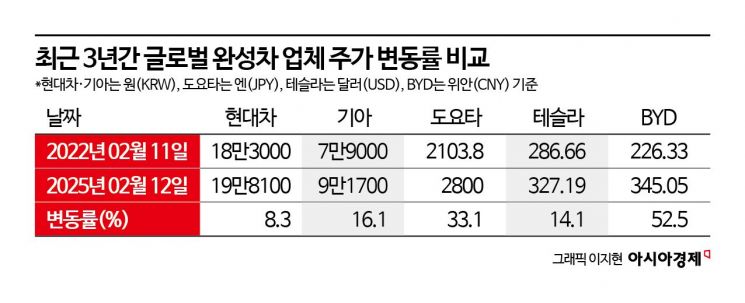

On the other hand, how about the stock price of Hyundai Motor's common shares listed on the Korean stock market? Even considering the 'Korea Discount'?the undervaluation of the Korean stock market due to geopolitical, political, and governance issues pointed out in global financial markets?the stock is severely undervalued. Over the past three years (as of February 12, 2025), Tesla and Toyota stock prices rose by 14% and 33%, respectively, while BYD surged by a remarkable 52%. In contrast, Hyundai Motor's stock price increased by only 8%, and Kia rose by 16%.

As of January 2025, let's look at the world's top 10 automobile stocks comprising the MSCI ACWI Automobiles and Components Index. The order is Tesla, Toyota, General Motors (GM), Ferrari, Mercedes-Benz, Honda, Ford, BYD, Mahindra, and Stellantis. BYD has been ranked for three consecutive years since 2023, but Hyundai Motor and Kia are not on the list.

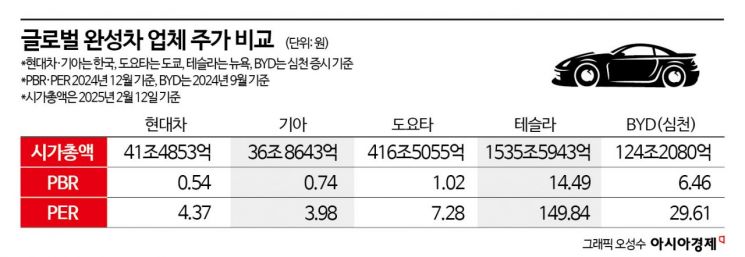

In terms of global sales volume in 2024, Hyundai Motor and Kia ranked third, and based on cumulative operating profit margin from Q1 to Q3 of the same year, Kia was overwhelmingly first (12.4%). Hyundai Motor (8.9%) also surpassed Tesla and BYD. However, in terms of market capitalization, Hyundai Motor and Kia fall far short of Tesla and even BYD. As of February 12, 2025, the combined market capitalization of Hyundai Motor and Kia is approximately 78.45 trillion KRW. Tesla's market cap is 19.6 times that of Hyundai Motor and Kia combined, Toyota's is 5.3 times, and BYD's is 1.6 times.

Let's compare using valuation indicators such as the Price-to-Earnings Ratio (PER) and Price-to-Book Ratio (PBR), which reflect current stock price evaluations. PER is calculated by dividing market capitalization by net income; a higher PER means the stock price is high relative to earnings. Generally, a PER above 10 is considered overvalued. As of the end of December 2024, Hyundai Motor's PER was 4.37, and Kia's was 3.98. During the same period, Tesla's PER was 149.8, Toyota's was 7.2, and BYD's was 29.6.

Looking at PBR, which divides market capitalization by net assets, undervaluation is also evident. Typically, a PBR of 1 is the benchmark; above 1 indicates overvaluation, below 1 indicates undervaluation. Hyundai Motor's PBR is 0.54, and Kia's is 0.74, both below 1. Among traditional automakers, only Toyota (1.02) exceeds a PBR of 1, while newer companies like Tesla (14.5) and BYD (6.4) are significantly overvalued relative to their asset values.

According to these indicators, Tesla and BYD are currently overvalued relative to their earnings and assets. Toyota is fairly valued, whereas Hyundai Motor and Kia are seriously undervalued. Why have Hyundai Motor and Kia's stock prices stagnated despite achieving record-high sales and operating profits over the past three years? We met with four capital market experts familiar with Hyundai Motor Group (▲Ko Taebong, Head of Research at iM Securities (hereafter Ko) ▲Lim Eunyoung, Research Fellow at Samsung Securities (hereafter Lim) ▲Value Investment Fund Manager (hereafter Ga) ▲Activist Fund Manager (hereafter Haeng)) to hear their perspectives. This has been restructured as a roundtable discussion; Part 1 diagnoses stock prices, and Part 2 will analyze governance.

Hyundai Motor Group's affiliate, the American autonomous driving company Motional, developed the Ioniq 5 autonomous driving robotaxi. Photo by Motional, Yonhap News Agency

Hyundai Motor Group's affiliate, the American autonomous driving company Motional, developed the Ioniq 5 autonomous driving robotaxi. Photo by Motional, Yonhap News Agency

A. Hyundai Motor and Kia have achieved record-high sales and operating profits for three consecutive years. Despite this, why hasn't the stock price risen as expected?

▲Lim: The focus of the automotive industry has shifted from electric vehicles to autonomous driving. The AI boom that started two years ago with ChatGPT is now approaching a phase where it can be experienced in the physical world we live in. In the U.S., Waymo and Tesla, and in China, Baidu, Huawei, Xiaomi, NIO, and other leading electric vehicle companies are offering robotaxi services and showcasing autonomous driving technologies that minimize driver intervention. This year marks the beginning of widespread autonomous driving services. Although Hyundai Motor and Kia's sales volume and financial performance remain solid, investors seem uneasy about their performance after autonomous driving services become fully operational.

▲Ko: The biggest driving force behind Hyundai Motor's rise to this point has been the 'Hyundai speed.' Once a market with potential was identified, Hyundai Motor immediately established factories and started vehicle production. Hyundai's speed was unmatched in the past. But look at China's BYD recently. They built 22 global factories in the last four years. Now Hyundai is starting to fall behind in the speed race. China is moving at light speed. We have lost the 'fast' edge. Also, Hyundai's speed has been focused on mechanical engineering. They developed the electric vehicle dedicated platform 'E-GMP' with remarkable speed and quality, and hybrids similarly. But the AI era is completely different in nature. We must face this reality.

▲Ga: From a stock price perspective, Hyundai Motor is currently in a somewhat ambiguous phase. Performance has been excellent in recent years, and new businesses like robotics and urban air mobility (UAM) are promising, but concerns exist that the core business has peaked and may start to decline slightly from this year. There is worry about whether they can continue to perform well in the future. Although they have introduced aggressive value-up policies to enhance shareholder returns, the stock price is not rising because of these concerns.

A. How significant are market concerns about Hyundai Motor and Kia's autonomous driving and software technologies?

▲Lim: Hyundai Motor and Kia's software technology is still lacking. They declared applying software-defined vehicles (SDV) to all models by 2026 but significantly reduced the scope to apply it first to the 'Pace Car.' Level 3 autonomous driving (conditional automation) has yet to be commercialized. Of course, Tesla and Chinese electric vehicles' autonomous driving cannot yet be called Level 3 either. However, the degree of driver intervention and object recognition on the road is far ahead (compared to Hyundai). When a 'Chat-drive moment' (implementing all technologies needed for robotaxis) arrives in autonomous driving in 2025, concerns about Hyundai Motor Group's software capabilities are likely to increase.

▲Ko: In the past, the smartphone market saw all feature phone companies disappear with the advent of smartphones. Although both are phones, their functionalities are completely different. Smartphones revolutionized our lives by enabling internet and data transmission. The same applies to electric vehicles. From a consumer perspective, the difference in benefits between autonomous and non-autonomous vehicles is huge. Now, cars without AI-based autonomous driving will inevitably be excluded from the market.

A. What direction should Hyundai Motor and Kia take in developing autonomous driving going forward?

▲Ko: Strategies should differ regionally. In the U.S., they should partner with Tesla, which leads autonomous driving technology. Even if it requires some cost, they should actively adopt Tesla's system for U.S. releases and extract as much technological know-how as possible during the process.

On the other hand, Korea must develop Korean-style autonomous driving technology. Globally, autonomous driving technology development originated in the defense industry, aiming to create unmanned military weapons like autonomous armored vehicles and tanks. From a national security perspective, developing autonomous driving technology specialized for Korea is urgent, and Hyundai Motor Group must take on this role. It is unacceptable that our military weapons cannot be controlled by our own software.

A. What challenges must be addressed first for Hyundai Motor and Kia's stock prices to rise significantly?

▲Lim: Active promotion is needed so the market recognizes the elemental technologies Hyundai Motor and Kia possess. Since 2020, Hyundai Motor Group has invested in many new businesses and technologies such as battery design, smart factories, autonomous driving, and robotics. However, the stock market still lacks understanding of how Hyundai Motor Group's technological level compares to global competitors and how these elemental technologies contribute to profitability.

▲Ga: I want to speak from an investor's portfolio perspective. Even if investors want to invest in future industries like robotics and autonomous driving, the businesses are dispersed across subsidiaries. For example, if one wants to invest in autonomous driving technology, it is unclear whether Hyundai Motor, Kia, or Hyundai AutoEver is responsible. Hyundai Motor, Hyundai Mobis, and Hyundai Glovis all hold divided shares in robotics company Boston Dynamics. So, even if investors want to invest in new technologies, they don't know which company to choose.

What Hyundai Motor urgently needs now is concentration on growth industries. Creating independent businesses for new industries like robotics, UAM, and autonomous driving, streamlining financial structures, and focusing cash reserves on investments seem to be what Hyundai Motor must do for Korea. If Hyundai Motor falls behind in autonomous driving while Samsung Electronics falters, there is no answer for the Korean economy. Of course, increasing dividends is good from a shareholder perspective. But business growth through investment comes first. Separating existing and new businesses to reorganize the group structure and increasing cash investments in promising businesses are urgently needed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)