Philip Morris and KT&G each see heated tobacco stick sales rise by 11% and 8% year-on-year

KT&G upgrades three Lil platforms, maintains leading position

Philip Morris closes in with IQOS Iluma i

KT&G and Korea Philip Morris, the two leading companies in the domestic tobacco market, recorded strong performances last year by focusing on heated tobacco products. As the market potential of electronic cigarettes has been confirmed and the core of the domestic tobacco market rapidly shifts from traditional cigarettes to electronic cigarettes, competition among companies is expected to intensify further this year.

Yoon Hee-kyung, CEO of Korea Philip Morris, introduced the new heated tobacco device product 'IQOS Iluma I' on the 6th.

Yoon Hee-kyung, CEO of Korea Philip Morris, introduced the new heated tobacco device product 'IQOS Iluma I' on the 6th.

According to the annual results announced by Philip Morris International (PMI) on the 13th, Korea Philip Morris's market share in the domestic tobacco market (combining conventional and electronic cigarettes) last year was 19.9%, up 0.4 percentage points from 19.6% in the same period the previous year.

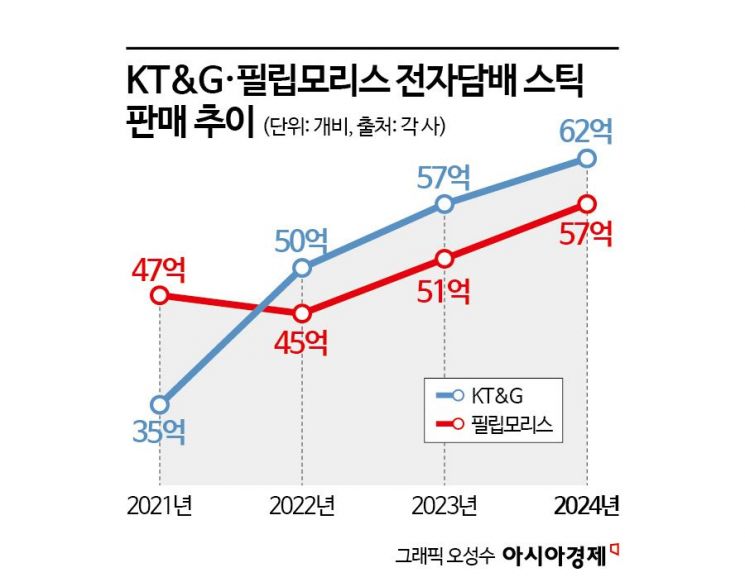

The improvement in Korea Philip Morris's market share was driven by heated tobacco products. Last year, the domestic shipment volume of conventional cigarettes was 8.3 billion sticks, down 6.7% from 8.9 billion sticks a year earlier. However, as the domestic tobacco market reorganized around electronic cigarettes, the shipment volume of heated tobacco sticks increased by 11.4% from 5.1 billion sticks the previous year to 5.7 billion sticks, leading to the rise in market share. Korea Philip Morris's domestic market share of heated tobacco sticks (HTU), including the 'Terea' brand, was 8.1% last year, up 1.0 percentage point from 7.1% the previous year.

PMI posted strong results with sales of $37.88 billion last year, up 7.7% year-on-year, and operating profit of $13.4 billion, a 16% increase. In particular, sales of smoke-free tobacco products, including heated tobacco, grew 14% year-on-year to $14.6 billion, driving performance growth. The proportion of electronic cigarettes in PMI's sales rapidly expanded from 23.8% in 2020 to 32.1% in 2022, and 38.7% last year. Earlier, Korea Philip Morris's sales in 2023 reached 790.5 billion KRW, up 15.1% from 686.8 billion KRW the previous year, and operating profit rose 31.1% from 80.6 billion KRW to 105.7 billion KRW. Given that growth continued in line with the expansion of the electronic cigarette market last year, a similar performance trend is expected.

KT&G also recorded strong results last year by focusing on electronic cigarettes. KT&G's tobacco division sales reached 3.9063 trillion KRW last year, an 8.1% increase from the previous year, and operating profit rose 10.7% to 1.0815 trillion KRW. While the overall tobacco business was driven by overseas sales of conventional cigarettes hitting record highs, the domestic market saw electronic cigarettes (NGP) lead performance growth. KT&G completed the launch of upgraded versions of its three heated tobacco platforms (Solid, Hybrid, Able), and based on this, stick sales gained momentum, driving performance growth. Last year, KT&G sold a total of 14.49 billion electronic cigarette sticks, a 4.0% increase year-on-year, with domestic sales reaching 6.15 billion sticks, up 7.7%, significantly exceeding the 1.5% growth in overseas sales.

As the tobacco market's focus gradually shifts worldwide from combustible to smoke-free tobacco, competition in the domestic electronic cigarette market is expected to heat up further this year. KT&G plans to aggressively launch new products and strengthen marketing as the market size continues to expand with increased domestic consumer adoption of electronic cigarettes. In particular, the company aims to continuously increase its stick market share and strengthen market leadership by diversifying new stick product launches across platforms to expand its customer base.

Korea Philip Morris also plans to continue the positive momentum from last year by launching new conventional cigarette products. On this day, Korea Philip Morris officially began sales of the new heated tobacco device series 'IQOS Iluma i'. The company expressed high expectations, noting that customers lined up at direct stores from early morning on the first day of pre-orders on the 7th. A Korea Philip Morris representative said, "The pre-order response for the Iluma i series was hotter than expected, confirming customers' high expectations for the new product," adding, "Many found the new features particularly attractive."

Customers lined up at the IQOS Store Yeouido IFC branch on the morning of the 7th, when the pre-order for Korea Philip Morris's 'IQOS Iluma Ai' series began.

Customers lined up at the IQOS Store Yeouido IFC branch on the morning of the 7th, when the pre-order for Korea Philip Morris's 'IQOS Iluma Ai' series began. [Photo by Korea Philip Morris]

With the market growth confirmed, the third and fourth largest companies, BAT Rothmans and JTI Korea, are also actively responding by launching related products. BAT Rothmans expanded its portfolio by releasing 'Hyper,' a new product launched in September last year that includes only the core functions of the flagship heated tobacco brand 'Glo's Hyper Pro' model, and also introduced 'Ploom X Advanced' to enter the competition.

Meanwhile, according to the Ministry of Economy and Finance, domestic sales of heated tobacco products reached 610 million packs in 2023, a 12.6% increase from the previous year. In contrast, sales of conventional cigarettes during the same period decreased by 2.8% to 3 billion packs. Market research firm Euromonitor also forecasts continuous growth in market size. The retail sales market size of heated tobacco products in Korea was 3.5546 trillion KRW in 2023, up 9.9% year-on-year, and the market size last year is estimated to have reached about 4 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)