Battery Business Posts 359.4 Billion KRW Loss in Q4

"Battery Sales and Profitability Expected to Improve This Year"

SK Innovation succeeded in turning a profit in the fourth quarter of last year, thanks to its merger with SK E&S, the group's cash cow. However, despite increased sales, the battery business returned to a loss of around 300 billion KRW, raising concerns.

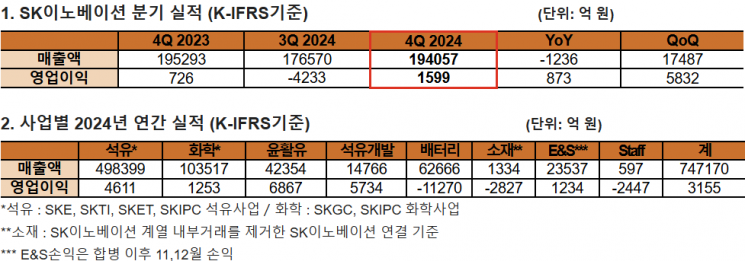

SK Innovation announced in its earnings report held on the 6th that it recorded sales of 19.4057 trillion KRW and an operating profit of 159.9 billion KRW in the fourth quarter of last year. Sales decreased by 0.6% compared to the previous year, but operating profit increased by 120.2%. The annual performance for last year showed sales of 74.717 trillion KRW and an operating profit of 315.5 billion KRW, down 3.3% and 83.4% respectively from the previous year.

SK Innovation explained, "In the fourth quarter of last year, the turnaround to profitability was due to improved refining margins and the reflected performance of the merged SK Innovation E&S." SK Innovation completed its merger with SK E&S on November 1 last year, emphasizing a total energy value chain including oil and liquefied natural gas (LNG). The market viewed this as a move to continue investing in and improve the performance of the battery business (SK On), which has been experiencing deteriorating results.

Battery Q4 Operating Loss of 359.4 Billion KRW... Returns to Loss After Brief Profit

The battery business, which posted its first quarterly profit in three years after becoming independent in the third quarter, returned to a loss. The battery business recorded sales of 1.5987 trillion KRW and an operating loss of 359.4 billion KRW. The company explained that although sales increased by 167.9 billion KRW due to higher sales volume, one-time costs such as inventory valuation losses were reflected. The benefit from the Advanced Manufacturing Production Tax Credit (AMPC) under the U.S. Inflation Reduction Act (IRA) in the fourth quarter increased by about 34% from the previous quarter to 81.3 billion KRW.

Other business segments recorded the following: ▲Oil business sales of 11.6868 trillion KRW, operating profit of 342.4 billion KRW ▲Chemical business sales of 2.3734 trillion KRW, operating loss of 84.2 billion KRW ▲Lubricants business sales of 970.7 billion KRW, operating profit of 139.5 billion KRW ▲Oil development business sales of 379.2 billion KRW, operating profit of 145.8 billion KRW ▲Materials business sales of 31.2 billion KRW, operating loss of 74.2 billion KRW ▲SK Innovation E&S business sales of 2.3537 trillion KRW, operating profit of 123.4 billion KRW. For SK Innovation E&S, only the profit and loss from November to December last year were reflected, with an annual operating profit of 1.1157 trillion KRW.

The oil business turned profitable compared to the previous quarter due to improved refining margins and inventory gains driven by increased demand for petroleum products such as heating oil and the effect of exchange rate rises. The chemical business recorded an operating loss despite increased sales volume, due to inventory effects caused by a decline in spreads (margins) of key products.

The lubricants business saw a decrease in operating profit compared to the previous quarter due to seasonal off-season and margin declines caused by weak selling prices, but maintained stable profitability on an annual basis following last year. The oil development business expanded operating profit compared to the previous quarter despite a drop in international oil prices, due to increased sales volume and the effects of exchange rate and gas price rises.

The materials business recorded an operating loss due to one-time costs related to inventory despite increased sales volume, while SK Innovation E&S business saw a decrease in operating profit compared to the previous quarter due to a drop in electricity market prices (SMP) caused by seasonal fluctuations and reduced power demand, according to the company.

"Battery Performance Improvement Expected This Year"... Dividend of 2,000 KRW per Share Approved

The company expects the battery business, which recorded an annual loss of about 1.127 trillion KRW last year, to improve this year with double-digit sales growth. It is anticipated that both sales and profits will improve thanks to expanded sales in North America and increased AMPC benefits. Additionally, the company expects performance improvement through strengthened profitability enhancement activities such as cost structure improvements and synergies from mergers with SK Trading International and SK Entum.

For the oil business, despite increased crude oil production in countries such as the U.S. and Canada excluding OPEC+ members, refining margins are expected to remain stable due to increased demand for some petroleum products like jet fuel.

The chemical business is expected to see limited spread improvements due to concerns about economic slowdown in major global countries. The lubricants business is forecasted to maintain stable profitability based on demand for SK Enmove's premium lubricating base oil products.

The oil development business successfully conducted a test production of up to 10,000 barrels per day of high-quality crude oil at the Vietnam 15-2/17 block this month, and plans to proceed with full-scale development after confirming reserves through additional exploration and evaluation work.

The materials business is expected to gradually increase sales volume through expanded sales to existing customers and new orders and shipments to new customers. SK Innovation E&S business plans to stabilize profits by timely introducing the 1.3 million ton per year Australia Caldita-Barossa (CB) gas field, scheduled for commercial production in the second half of this year.

Seogun Ki, Chief Financial Officer of SK Innovation, said, "Although an uncertain management environment is expected this year due to changes in the global situation affecting energy business environments such as oil and gas, we plan to accelerate securing the entire energy value chain and creating synergies through the merger with SK E&S," adding, "We will continue to pursue challenges to grow into a world-class energy company in the global market."

Meanwhile, SK Innovation's board of directors approved a dividend payment of 2,000 KRW per share, which is expected to be finalized at the regular shareholders' meeting scheduled for March.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)