Development of the Korean-Style Large-Scale Semi-Structural Macroeconomic Model (BOK-LOOK)

Including Housing Prices and Household Debt-to-GDP Ratio

Also Performs Financial Stability Analysis

The Bank of Korea has completed the development of a macroeconomic model that flexibly reflects rapidly changing domestic and international financial and economic conditions, and will use it for quarterly gross domestic product (GDP) forecasts. The model also includes housing prices and the household debt-to-GDP ratio, enabling it to perform financial stability analysis. With scenario analysis and policy simulations that reflect rapidly changing situations such as the policy stance shift of the U.S. Federal Reserve (Fed), changes in the economic conditions of major trading partners like China, and fluctuations in exchange rates and international oil prices, it is expected that forecast errors will be significantly reduced not only for medium- to long-term GDP forecasts but also for inflation, which had high uncertainty since the outbreak of COVID-19.

On the 3rd, the Bank of Korea announced that it has completed the development of the "Korean-style large-scale semi-structural macroeconomic model (BOK-LOOK)" and will utilize it starting from this month's economic forecast figures. This is the first macroeconomic model released by the Economic Modeling Office, newly established in March 2023, following Governor Lee Chang-yong’s expressed desire to strengthen the linkage between economic forecasts and monetary policy through a model. It is also the fifth large-scale semi-structural macroeconomic model built worldwide.

The model is characterized by its development to enable both medium-term forecasts and risk analysis simultaneously. As domestic and international financial and economic conditions have rapidly changed through the financial crisis and COVID-19, the need for developing and operating a semi-structural model that can flexibly reflect monetary policy-related analyses (FRB/US) has increased. Semi-structural models utilize both economic theory and data characteristics. They have the advantage of being relatively easy to set up, expand, and modify, allowing for quick and flexible reflection of changes in economic conditions. After the financial crisis, central banks of Canada, France, and the European Central Bank (ECB) introduced semi-structural macroeconomic models, and recently, the Bank of England is also promoting the development of such models.

Korea has also embarked on developing the large-scale BOK-LOOK model in the form of FRB/US, considering the rapidly changing financial and economic conditions such as strengthened domestic and international financial linkages, intensified segmentation due to U.S.-China trade conflicts, and the accumulation of household debt.

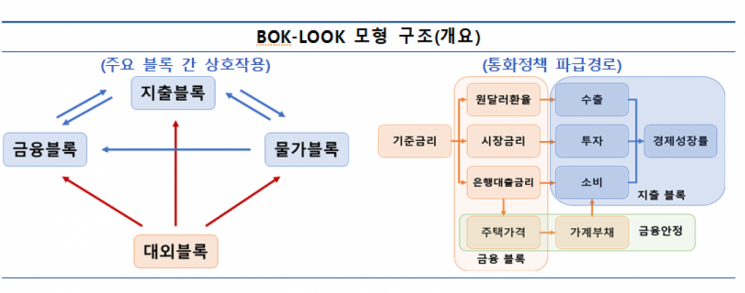

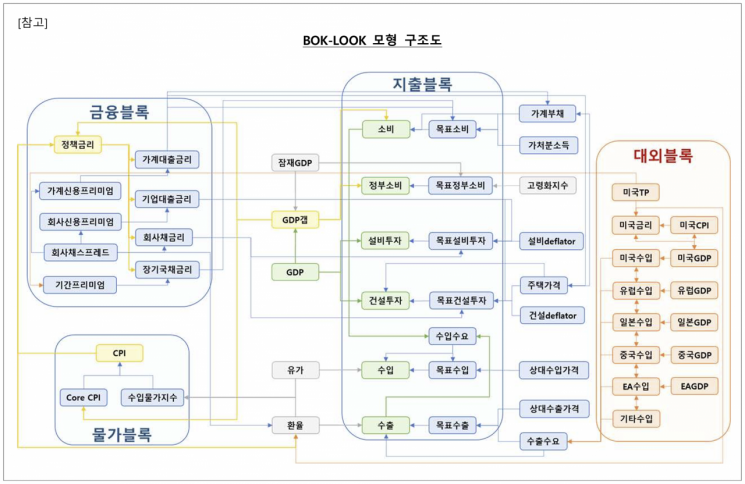

BOK-LOOK was designed to effectively harmonize economic theory and data consistency while sufficiently reflecting Korea’s unique financial and economic conditions. The Bank of Korea explained that it paid the most attention to strengthening the external sector. Seung-ryeol Jeong, head of the macro model team at the Bank of Korea’s Economic Modeling Office, said, "To reflect the characteristics of a small open economy, the external trade area was subdivided into six blocks: the U.S., China, Eurozone, Emerging Asia, Japan, and other countries." He added, "The trade channels are diversely reflected in the economic model, enabling more varied analysis of domestic ripple effects when economic shocks occur in each country."

In terms of domestic and international financial linkages, the model is the first macroeconomic model to reflect the increased synchronization of long-term domestic and foreign interest rates after the financial crisis. Accordingly, it is now possible to analyze the effects of U.S. monetary policy and market interest rate changes on domestic long-term interest rate fluctuations, financial conditions, and the macroeconomy.

The financial sector was also refined. In the domestic financial sector, key variables such as the government bond term structure, borrower-specific credit premiums, and corporate bond spreads were incorporated to enable analysis of the effects of various financial shocks, including changes in monetary policy stance and credit risks of households and firms. By including housing prices and the household debt-to-GDP ratio within BOK-LOOK, the Bank of Korea has also strengthened the financial stability analysis function, which is one of its main policy objectives.

The Bank of Korea plans to provide integrated policy analysis on major financial and economic situation changes based on this large-scale model that sufficiently reflects domestic and international macroeconomic and financial sectors. Jeong said, "It is possible to conduct various scenario analyses and policy simulations, including the U.S. Fed’s policy stance shifts, changes in economic conditions of major trading partners such as China, fluctuations in exchange rates and international oil prices, and the financial and economic ripple effects of household debt accumulation."

BOK-LOOK is divided into four major blocks: external, expenditure, inflation, and financial. It consists of about 150 endogenous variables and 200 equations. The main variables within the model are designed to be endogenously determined through interactions among the blocks. Major expenditure components of the national accounts, such as consumption and investment, are composed of long-term behavioral equations based on economic theory and polynomial adjustment cost equations with error correction terms that incorporate economic agents’ expectations. The long-term behavioral equations are based on theoretical and long-term relationships among key economic variables and represent the long-term target levels of each variable.

Results from BOK-LOOK show that forecast errors have significantly decreased not only for medium- to long-term GDP forecasts but also for inflation forecasts, which had high uncertainty since the COVID-19 outbreak. Jeong said, "Based on quarterly conditional forecast tests conducted for the period after 2021, BOK-LOOK’s forecasting ability was relatively superior compared to forecasts from various benchmark models and major institutions’ projections."

The Bank of Korea stated, "We will continue to closely analyze changes in domestic and international policy conditions and promote improvements and enhancements to the economic model, supporting the advancement of the forecasting system and monetary policy framework. We also plan to strengthen research exchanges and cooperation with major central banks such as the U.S. Fed and ECB for the development of macroeconomic models."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)