Concerns Over Entrenched Low Growth Rise...

'February Rate Cut' Gains Traction

Korea-US Rate Gap and Inflation Concerns

Cautious Approach Expected Going Forward

As the Bank of Korea prepares to make its interest rate decision this month, its dilemma has deepened. While concerns over an economic slowdown have increased the likelihood of a rate cut in February, there is growing consensus that the pace of easing will inevitably need to be moderated in response to the Federal Reserve's wait-and-see approach to monetary easing in the United States.

Lee Changyong, Governor of the Bank of Korea, is greeting members at the Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 16th. 2025.01.16 Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is greeting members at the Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 16th. 2025.01.16 Photo by Joint Press Corps

Concerns Over Entrenched Low Growth Rise... 'February Rate Cut' Gains Traction

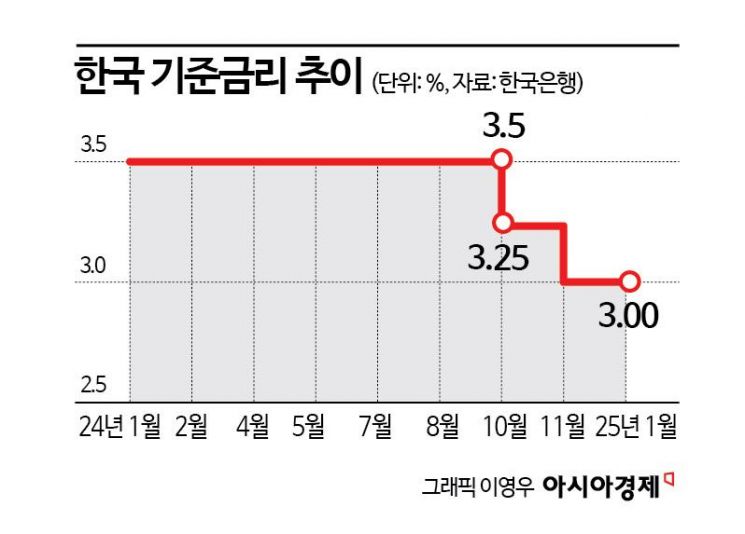

In the market, the prevailing expectation is that the Bank of Korea will lower the base rate by 0.25 percentage points at the Monetary Policy Committee (MPC) meeting scheduled for the 25th of this month. The MPC cut rates consecutively in October and November last year, but kept the rate unchanged at 3.00% in January this year. Lee Changyong, Governor of the Bank of Korea, stated, "Due to political reasons such as martial law, the won-dollar exchange rate has risen by about 30 won above fundamentals. It is more prudent and desirable to take a breather and observe the effects of the two previous rate cuts, and then make a decision on further cuts depending on the political situation." However, he also noted, "From an economic perspective alone, it is only natural to cut rates now." The 'forward guidance' (the aggregation of base rate forecasts from MPC members excluding the Governor) also increased the likelihood of a rate cut. All six members, except the Governor, expressed the opinion that 'the possibility of a base rate cut within three months should be kept open.'

The economic growth rate for last year, announced after the January MPC meeting, has heightened concerns about a prolonged period of low growth and is adding weight to the case for a February rate cut. Last year, South Korea's real gross domestic product (GDP) remained at 2.0%, 0.2 percentage points lower than the Bank of Korea's initial forecast of 2.2%, as domestic demand, including consumption and construction investment, remained sluggish, and political instability following the martial law situation compounded the issue. In particular, the growth rate in the fourth quarter (compared to the previous quarter) was only 0.1%, mainly due to weak construction investment (-3.2%) and other factors. This was a 'growth shock,' significantly below the Bank of Korea's projection of 0.5%.

Additionally, concerns are mounting over a potential decline in exports due to tariff policies under the second Trump administration in the United States, as well as deteriorating economic indicators such as industrial activity and employment. Expectations for South Korea's economic growth rate this year continue to be revised downward. The UK-based market research firm Capital Economics has forecast annual growth of 1.1%, while JP Morgan has lowered its projection from 1.3% to 1.2%, and Citi has revised its outlook from 1.5% to 1.4%. With both domestic and external economic uncertainties persisting, discussions on formulating a supplementary budget have intensified, and the pressure on the Bank of Korea to cut rates has also grown stronger.

Korea-US Rate Gap·Inflation Concerns... Cautious Approach Expected Going Forward

However, a cautious stance prevails regarding the pace and scale of further rate cuts. The US Federal Reserve kept its policy rate unchanged at 4.25-4.50% at its first Federal Open Market Committee (FOMC) meeting of the year, making it difficult for the Bank of Korea to move preemptively, and reflecting the limited room for additional rate cuts.

Indeed, considering the inverted Korea-US interest rate differential, further rate cuts would be burdensome. With the Fed's latest decision, the policy rate gap between Korea and the US (upper bound) remains at 1.50 percentage points. If the Bank of Korea lowers its base rate to 2.75%, the gap would widen to 1.75 percentage points. As US rates are not falling as quickly as the market had hoped, if only the Bank of Korea accelerates rate cuts, the value of the won could fall sharply, triggering a rapid rise in the exchange rate. This could lead to higher inflation and capital outflows by foreign investors.

Ha Geonhyeong, economist at Shinhan Investment Corp., said, "While policies such as anti-immigration, high tariffs, and expanded fossil fuel development under the second Trump administration are taking shape, their impact will not be reflected in the data until at least the second half of this year. Given the current trajectory of the US Fed's policy, as long as the current trends in the economy and inflation persist, the Fed is likely to maintain its rate freeze. Further rate cuts are expected after price stability resumes from the second quarter onward."

Concerns over inflation, which reinforce the case for caution, also persist. After rising sharply to 5.1% in 2022, consumer price inflation slowed to 3.6% in 2023 and 2.3% in 2024. However, on a monthly basis, after falling into the 1% range in September last year, inflation hit a low of 1.3% in October, but then rebounded to 1.5% in November and 1.9% in December. Producer prices, which are reflected in consumer prices with a time lag, also rose 0.3% month-on-month in December last year, marking a second consecutive monthly increase. Last year, prices of food items that consumers are sensitive to, such as pears and tangerines, rose sharply, and according to last month's consumer sentiment survey, prices are expected to rise again this year, especially for agricultural, marine, and livestock products, as well as public utility fees and petroleum products. Concerns over import price instability due to a weaker won also remain unresolved. According to the Bank of Korea, import prices in won terms rose for three consecutive months starting in October last year. In December, import prices increased by 2.4% month-on-month and surged by 7.0% year-on-year. Rising import prices lead to higher producer prices, which in turn drive up consumer prices.

After the January MPC meeting, Governor Lee stated, "If the exchange rate remains at the 1,470-won level, this year's consumer inflation rate will rise by 0.15 percentage points to 2.05%, up from the previously forecast 1.9%. I am very concerned about inflation." At the beginning of the year, the exchange rate fell to the 1,430-won range and has since stabilized somewhat, hovering around 1,450 won. However, it remains necessary to closely monitor the trend.

Experts believe that even if the Bank of Korea cuts rates this month in response to deepening recession concerns, it is likely to take a wait-and-see approach thereafter. Kim Wanjung, senior research fellow at Hana Institute of Finance, said, "The prolonged rate freeze and smaller rate cuts by the Fed will limit the Bank of Korea's ability to pursue aggressive monetary easing, and will also limit the decline in market rates," predicting a single rate cut in the first half of the year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)