Samsung Spends $10 Million on U.S. Lobbying in 2023

Major Conglomerates Intensify Efforts Amid Trump Uncertainty

Prolonged Diplomatic Vacuum in Korea Likely to Increase Corporate Burden

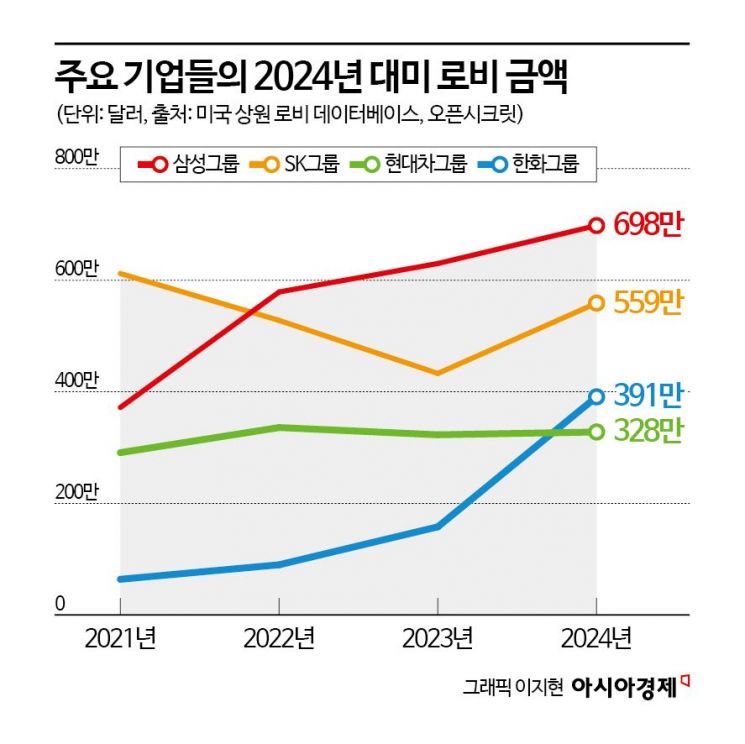

Korean companies’ lobbying expenditures in the United States reached an all-time high last year. This surge appears to be driven by expanded investments amid supply chain restructuring, as well as intensified government relations efforts during a period of uncertainty surrounding the outcome of the U.S. presidential election. The diplomatic and trade policy vacuum in Korea is expected to keep the business sector even busier for the foreseeable future.

According to company-specific lobbying disclosures submitted to the U.S. Senate on January 23, Samsung Group spent $6.98 million (10.03 billion won) in the United States last year. This figure is the combined total for four Samsung affiliates: Samsung Electronics, Samsung Semiconductor, Samsung SDI, and Imagine. Samsung Group’s U.S. lobbying expenditures surpassed $6 million in 2023, setting a new record last year.

U.S. President Donald Trump is holding a meeting with Korean business leaders at the Grand Hyatt Hotel in Yongsan-gu, Seoul, in June 2019, engaging in discussions with heads of major conglomerates. Photo by Reuters Yonhap News

U.S. President Donald Trump is holding a meeting with Korean business leaders at the Grand Hyatt Hotel in Yongsan-gu, Seoul, in June 2019, engaging in discussions with heads of major conglomerates. Photo by Reuters Yonhap News

At the end of 2023, Samsung Electronics elevated its Global Public Affairs (GPA) organization, which oversees overseas government relations, from a team to a division, and promoted Wonkyung Kim, the head of the division, to president. Kim, a former diplomat at the Ministry of Foreign Affairs and Trade with deep expertise in U.S. affairs, has consistently accompanied Chairman Lee Jae-yong on overseas business trips. Mark Lippert, former U.S. Ambassador to Korea and now Executive Vice President and Head of External Affairs at Samsung’s U.S. subsidiary, as well as Hyukwoo Kwon, Executive Director of GPA and a former official at the Ministry of Trade, Industry and Energy, were also deployed to bolster U.S. lobbying efforts.

SK Group spent $5.59 million (8.03 billion won) last year. Its lobbying activities focused on U.S. government policies regarding semiconductor export controls and supply chains, artificial intelligence (AI), and the Inflation Reduction Act (IRA). In 2021, when SK Innovation was embroiled in a battery trade secret dispute with LG Energy Solution, the group spent $6.12 million in an attempt to prevent the U.S. International Trade Commission (ITC) from imposing an import ban. While the amount has decreased since then, it continues to rise each year.

In the first half of last year, SK Group established “SK Americas” as its North American government relations control tower, aiming to strengthen its network within the U.S. administration. Vice Chairman Jungjoon Yoo, who previously oversaw government relations in the Americas, was appointed as its CEO, and Paul Delaney, former Chief of Staff at the U.S. Trade Representative (USTR), also joined as Executive Vice President. The group’s key decision-making body, the SK SUPEX Council, responded to U.S. issues primarily through the Global Public Affairs (GPA) organization, which was launched in 2023.

Last year was also when Samsung Electronics and SK Hynix concluded negotiations with the U.S. government over the size of semiconductor subsidies, securing $4.745 billion (6.8 trillion won) and $458 million (660 billion won), respectively. However, with President Donald Trump-who has consistently criticized the CHIPS Act and subsidies for foreign companies-returning to office, there is little assurance that the funds will actually be disbursed. Intense lobbying is expected to continue this year as well.

In addition, Hyundai Motor Group spent $3.28 million (4.71 billion won). Rather than a sharp increase last year, the group has maintained similar spending levels over the past three to four years. Hyundai’s key lobbying issues include policies on hydrogen and fuel cells, electric vehicle infrastructure and tax incentives, and Environmental Protection Agency (EPA) emissions regulations.

Hanwha Group reported a total of $3.91 million (5.62 billion won) in lobbying expenditures. For the first time last year, Hanwha surpassed Hyundai Motor Group in U.S. lobbying spending, recording the largest increase among major companies. As Hanwha expands its U.S. business, its lobbying activities have also intensified. The group is also exploring entry into the defense market through its acquisition of the U.S. shipbuilder Philly Shipyard.

While companies’ overseas government relations organizations are working tirelessly to manage the uncertainties of a potential “Trump 2.0” administration, there is growing concern that the government-one half of the public-private partnership-has effectively ceased to function. The absence of a final decision-maker to coordinate diplomatic and trade policy is a critical weakness when dealing with the Trump administration.

An industry official commented, “To deal with Trump’s America First policy, many decisions will need to be made directly between leaders. The longer the diplomatic vacuum persists, the greater the burden will become on companies’ government relations efforts.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)