Attempt to Acquire 58% Stake Held by Four Siblings of the Owner Family

Hanwha Vision Provides Group-level Financial Support

Difficulties Expected in Securing Remaining Shares... Possibility of Capital Increase After Acquisition

Seeking New Growth Engines Linked to Distribution, Leisure, and Dining Businesses

Hanwha Group is accelerating its bid to acquire Ourhome, the second-largest corporate catering company in South Korea. The acquisition, led by Kim Dong-seon, the third son of Hanwha Group and Vice President of Hanwha Galleria and Hanwha Hotels & Resorts Future Vision Division, is expected to involve an investment of approximately 1.5 trillion KRW. Attention is focused on the background of Hanwha's decision to re-enter the corporate catering business with a multi-trillion KRW investment just four years after selling the business for 100 billion KRW.

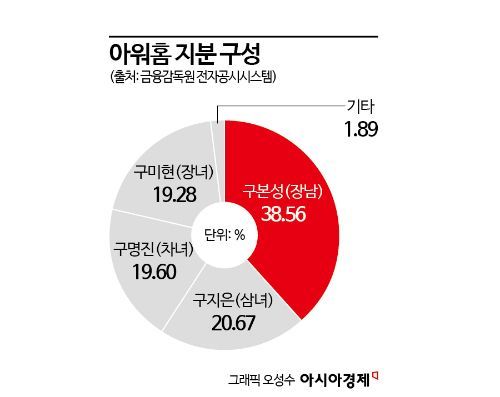

According to investment banking (IB) industry sources and retail circles on the 22nd, Hanwha has valued Ourhome at about 1.5 trillion KRW and is attempting to acquire its shares. Ourhome, an unlisted company, currently has over 98% of its shares held by the late Chairman Koo Ja-hak's three daughters and one son. The eldest son, former Vice Chairman Koo Bon-sung, holds 38.56%, the eldest daughter and current chairperson Koo Mi-hyun holds 19.28%, the second daughter Koo Myung-jin holds 19.6%, and the youngest daughter, former Vice Chairman Koo Ji-eun, holds 20.67%.

860 Billion KRW War Chest Prepared... Challenges in Securing Shares from the Koo Siblings

Hanwha is reportedly negotiating to acquire 57.84% of the shares held by the pro-sale former Vice Chairman Koo Bon-sung and Chairperson Koo Mi-hyun. The offer price is about 860 billion KRW at 65,000 KRW per share, with the goal of signing a Share Purchase Agreement (SPA) between shareholders from the 7th to the 10th of next month. Hanwha Hotels & Resorts, led by Vice President Kim, plans to invest 200 to 300 billion KRW, Hanwha Vision will contribute 250 to 300 billion KRW, and private equity fund (PEF) operator IMM Credit & Solution will be secured as a financial investor (FI) to invest 200 to 300 billion KRW. Since Hanwha Hotels & Resorts had only 129.4 billion KRW in cash and cash equivalents as of Q3 last year, it appears they are raising funds through group companies and external sources.

Earlier, the alliance of former Vice Chairman Koo Bon-sung and Chairperson Koo Mi-hyun reportedly expressed their intention to sell the management rights of Ourhome after gaining the upper hand in a sibling management dispute in May last year and contacting PEF operators. The key issue is the stance of the second daughter Koo Myung-jin and youngest daughter former Vice Chairman Koo Ji-eun, who opposed the alliance of the eldest son and eldest daughter. According to Article 9, Clause 3 of Ourhome's articles of incorporation, when an existing shareholder transfers shares, they must first offer the shares to other shareholders on the shareholder register. Under this clause, the former Vice Chairman Koo Ji-eun's side could exercise a right of first refusal to purchase the shares of the eldest son and eldest daughter at the price Hanwha offers.

There is a clear difference in position among the siblings on this matter, leaving room for dispute. Previously, Hanwha and the sides of former Vice Chairman Koo Bon-sung and Chairperson Koo Mi-hyun sent a certified letter in September last year to former Vice Chairman Koo Ji-eun asking whether she would exercise her right of first refusal and her intention to jointly sell the shares, allowing a one-month period for response. However, since former Vice Chairman Koo Ji-eun did not express her intention, Hanwha considers that the right of first refusal has expired.

On the other hand, former Vice Chairman Koo Ji-eun's side argues that the right of first refusal remains valid as the notification was unilateral. Based on this, former Vice Chairman Koo Ji-eun may file a provisional injunction with the court to prohibit the disposal of shares to defend against Hanwha's acquisition. There is also talk of exercising the right of first refusal together with PEF operators to purchase the shares of the eldest son and eldest daughter before Hanwha.

There is also a possibility that Hanwha may counter by acquiring Ourhome's management shares and then conducting a paid-in capital increase. In this case, even if they fail to secure the shares of Koo Myung-jin and former Vice Chairman Koo Ji-eun, they could dilute those shares through the capital increase.

Aggressive Investment in Future Growth Areas Including Food Tech and Theme Parks

Kim Dong-seon, Vice President and Head of Future Vision at Hanwha Galleria and Hanwha Hotels & Resorts

Kim Dong-seon, Vice President and Head of Future Vision at Hanwha Galleria and Hanwha Hotels & Resorts

Vice President Kim Dong-seon has been in charge of Hanwha's distribution, dining, hotel, leisure, and robotics businesses, focusing on new ventures. Notably, in February last year, Hanwha Hotels & Resorts renamed its dining subsidiary The Tastable to 'Hanwha Food Tech' and announced plans to target the global food tech market, valued at 450 trillion KRW.

In October last year, Hanwha Food Tech established a catering business division, sparking speculation that it would resume corporate catering operations. Although the domestic corporate catering market shrank during the COVID-19 pandemic, it rebounded due to the rise in dining costs caused by high inflation. Ourhome also recorded its highest-ever figures in 2023 with consolidated sales of 1.9835 trillion KRW and operating profit of 94.3 billion KRW.

From Hanwha's perspective, acquiring Ourhome, which performs well in catering, food distribution, concession (food and beverage outsourcing), and home meal replacement (HRM) businesses, could create synergies. Expanding corporate catering demand linked with group companies and transferring Ourhome's concession expertise to the food and beverage (F&B) service sector, a major revenue source for hotel and resort businesses, are representative strategies.

Industry insiders view Hanwha's re-entry into the corporate catering market just over four years after its 2020 exit as groundwork for Vice President Kim to strengthen his position within the group amid succession processes. Previously, Hanwha Hotels & Resorts sold Foodist, which handled food distribution and corporate catering, to domestic PEF operator VIG Partners for 100 billion KRW in 2020. A food industry source said, "They are buying back the corporate catering business, which was sold for a bargain 100 billion KRW, for as much as 1.5 trillion KRW. Internally, there are voices that Vice President Kim Dong-seon is making an excessive investment to increase his scale."

In fact, Hanwha Group's eldest son, Vice Chairman Kim Dong-gwan, oversees key affiliates spanning defense, energy, and space industries, including Hanwha Aerospace, Hanwha Systems, Hanwha Ocean, and Hanwha Energy. The second son, Kim Dong-won, Chief Global Officer of Hanwha Life, manages the financial sector. Vice President Kim Dong-seon is in charge of Hanwha Hotels & Resorts and Hanwha Galleria, whose combined sales account for less than 2% of the group's total revenue.

.

Yoo Jeong-bok, Mayor of Incheon Metropolitan City (left), and Kim Dong-seon, Executive Vice President of Future Vision at Hanwha Hotels & Resorts, are posing for a commemorative photo after signing a Memorandum of Understanding (MOU) to promote the development of a large-scale theme park on the site of the Incheon Asian Games stadium. Photo by Hanwha Hotels & Resorts

Yoo Jeong-bok, Mayor of Incheon Metropolitan City (left), and Kim Dong-seon, Executive Vice President of Future Vision at Hanwha Hotels & Resorts, are posing for a commemorative photo after signing a Memorandum of Understanding (MOU) to promote the development of a large-scale theme park on the site of the Incheon Asian Games stadium. Photo by Hanwha Hotels & Resorts

Meanwhile, Hanwha Hotels & Resorts recently signed a Memorandum of Understanding (MOU) with Incheon Metropolitan City to develop a large-scale theme park on the site of the Dream Park Equestrian Stadium, which hosted the 2014 Incheon Asian Games. The plan is to build various leisure and cultural facilities through a Build-Transfer-Operate (BTO) private investment project. Subsidiaries such as Aqua Planet (aquarium), Hanwha Next (equestrian stadium), and Hanwha Food Tech are expected to contribute to this project.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)