Bank of Korea Freezes Base Rate at 3.00%

Concerns Over High Exchange Rate Limit Consecutive Rate Cuts

Calls in the U.S. to Slow Down Rate Cuts Also Influence Decision

Possibility of Rate Cut Next Month to Address Economic Slowdown

The Monetary Policy Committee (MPC) of the Bank of Korea announced on the morning of the 16th at the Bank of Korea headquarters in Jung-gu, Seoul, during the first monetary policy direction meeting of the year, that the base interest rate will be maintained at the current level of 3.00%. Lee Chang-yong, Governor of the Bank of Korea (center), is presiding over the meeting. Photo by Bank of Korea

The Monetary Policy Committee (MPC) of the Bank of Korea announced on the morning of the 16th at the Bank of Korea headquarters in Jung-gu, Seoul, during the first monetary policy direction meeting of the year, that the base interest rate will be maintained at the current level of 3.00%. Lee Chang-yong, Governor of the Bank of Korea (center), is presiding over the meeting. Photo by Bank of Korea

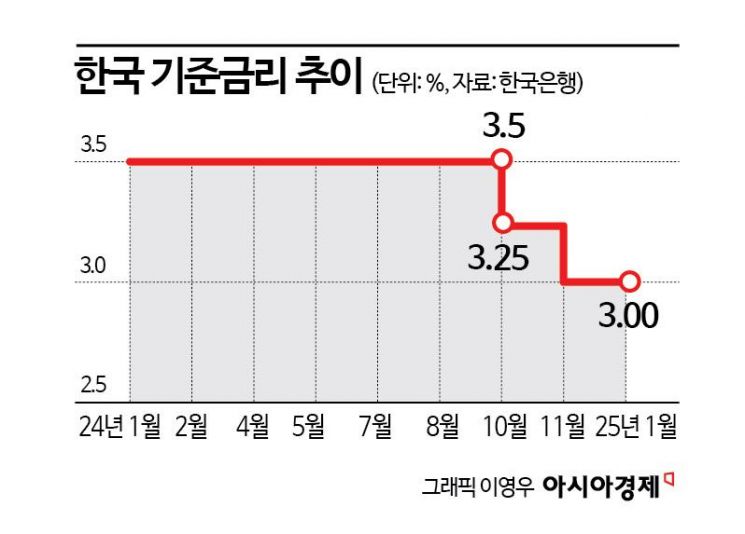

The Bank of Korea has kept the base interest rate steady at an annual rate of 3.00%. Although concerns over economic slowdown had previously warranted two consecutive rate cuts, the rate was maintained this month. This decision reflects worries that further rate cuts could push the already high won-dollar exchange rate even higher. The emerging calls in the United States to slow down the pace of interest rate cuts also influenced the decision. However, the prevailing outlook is that the Bank of Korea may resume cutting the base rate next month to revive the sluggish domestic economy.

Bank of Korea Holds Base Rate at 3.00% Amid High Exchange Rate Concerns

The Monetary Policy Board (MPB) of the Bank of Korea announced on the morning of the 16th at the Bank’s headquarters in Jung-gu, Seoul, during the first monetary policy meeting of the year, that it would keep the base interest rate at the current level of 3.00%. The MPB had lowered the base rate by 0.25 percentage points at the previous meeting held on November 28 last year. Including the consideration of a cut in October, the rate had been reduced twice consecutively before returning to a hold this time.

The high exchange rate is cited as the main reason for the Bank of Korea’s decision to hold the base rate. The won-dollar exchange rate surged sharply from the 1,390 won level at the time of the last monetary policy meeting in late November last year to around 1,450 won currently, within a short period. Among major world currencies, excluding Russia which is at war, the won has experienced the largest depreciation.

The global dollar strength and domestic political turmoil caused by the martial law situation are the primary causes of the sharp rise in the exchange rate, but concerns that a rate cut by the Bank of Korea could further fuel the exchange rate increase gained consensus among the MPB members. Excessive appreciation of the won-dollar exchange rate not only pushes up consumer prices but also causes economic damage in various areas such as sluggish domestic demand and reduced production.

Having cut the base rate twice consecutively earlier, the Bank of Korea decided to hold the rate for now to assess the domestic economic situation and plans to discuss further cuts at the next MPB meeting. This reflects an intention to observe more closely the effects of rate cuts on the economy.

Professor Andonghyun of Seoul National University’s Department of Economics explained, "Although domestic demand is severely sluggish, it was probably difficult to cut rates given the recent high level of the exchange rate. Since the U.S. 10-year Treasury yield is approaching 5% and the strong dollar continues, further rate cuts could cause the exchange rate to rise again."

Researcher Heo Jisoo of Woori Financial Management Research Institute analyzed, "The Bank of Korea froze the base rate this month considering the current situation of sustained high exchange rates and to evaluate the effects of the two consecutive rate cuts on the domestic economy."

The slowdown in the pace of interest rate cuts by the U.S. Federal Reserve (Fed) is also cited as a factor that led the Bank of Korea to pause rate cuts. The U.S. economy continues to perform well, and with the inauguration of Donald Trump’s second administration, inflation concerns have increased, making it likely that there will be no rate cuts for the time being. Researcher Jo Youngmoo of LG Economic Research Institute evaluated, "The burden of the elevated exchange rate and the cautious atmosphere regarding the Fed’s rate cuts seem to have led the Bank of Korea to hold the base rate this month."

The Monetary Policy Committee (MPC) of the Bank of Korea announced on the morning of the 16th at the Bank of Korea headquarters in Jung-gu, Seoul, during the first monetary policy meeting of the year, that the base interest rate will be maintained at the current level of 3.00%. Lee Chang-yong, Governor of the Bank of Korea (center), is striking the gavel. Photo by Bank of Korea

The Monetary Policy Committee (MPC) of the Bank of Korea announced on the morning of the 16th at the Bank of Korea headquarters in Jung-gu, Seoul, during the first monetary policy meeting of the year, that the base interest rate will be maintained at the current level of 3.00%. Lee Chang-yong, Governor of the Bank of Korea (center), is striking the gavel. Photo by Bank of Korea

Possibility of Rate Cut Next Month to Revive Sluggish Domestic Economy

However, many forecasts suggest that the Bank of Korea will resume cutting the base rate next month to revive the sluggish domestic economy. The economic growth rate for Korea projected by major domestic and international research institutions this year is significantly below the potential growth rate of 2.0%. The average forecast from eight major global investment banks (IBs), including Goldman Sachs and JP Morgan, is only 1.7%. The Bank of Korea’s own forecast is 1.9%, and it may lower this figure further in next month’s economic outlook. These forecasting institutions commonly warn that Korea’s low growth could become entrenched due to export slowdown and weak domestic demand.

Researcher Im Jaegyun of KB Securities said, "The Bank of Korea held the base rate this month due to exchange rate concerns," but added, "Considering worries about economic slowdown, there is a possibility that the MPB will cut rates again in February."

The already sluggish domestic demand has further deteriorated due to the martial law situation and impeachment aftermath. In December last year, the Consumer Confidence Index (CCSI) was 88.44, down 12.3 points from the previous month, marking the largest decline in 4 years and 9 months since the COVID-19 pandemic in March 2020. According to Statistics Korea, the retail sales index from January to November last year fell 2.1% compared to the same period the previous year, the largest drop in 21 years since the 2003 credit card crisis. The employment market also experienced a chill. In December last year, the number of employed persons decreased by 52,000, marking a decline for the first time in 3 years and 10 months.

Concerns that U.S. protectionist policies such as tariff increases, expected after the inauguration of President-elect Trump in four days, will further negatively impact the domestic economy also underpin expectations for a rate cut by the Bank of Korea next month.

Researcher Kang Seungwon of NH Investment & Securities emphasized, "The Bank of Korea held rates in January due to exchange rate concerns but will likely cut rates in February considering the economic situation. Important upcoming events such as President-elect Trump’s inauguration and the Fed’s Federal Open Market Committee (FOMC) meeting will be closely monitored to assess their impact on the domestic economy before deciding the base rate next month."

Professor Son Jongchil of Hankuk University of Foreign Studies’ Department of Economics said, "Although the Bank of Korea held rates this time due to the exchange rate, it will consider the difficult domestic economic conditions such as sluggish domestic demand, consumption, and investment next month."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)