Food Industry Business Index Drops to 86.2 in Q4 Last Year... Down 19.8 Points from Previous Quarter

"Sluggish Domestic Demand Is the Biggest Cause," Say 61.2%

Due to an unprecedented domestic demand slump, the food industry's sentiment significantly worsened in the fourth quarter of last year. The persistent high inflation and economic recession have exacerbated the domestic demand slump, and political uncertainties such as the martial law situation and impeachment crisis have further contributed, leading to a forecast of continued deterioration in the first quarter of this year compared to the previous quarter.

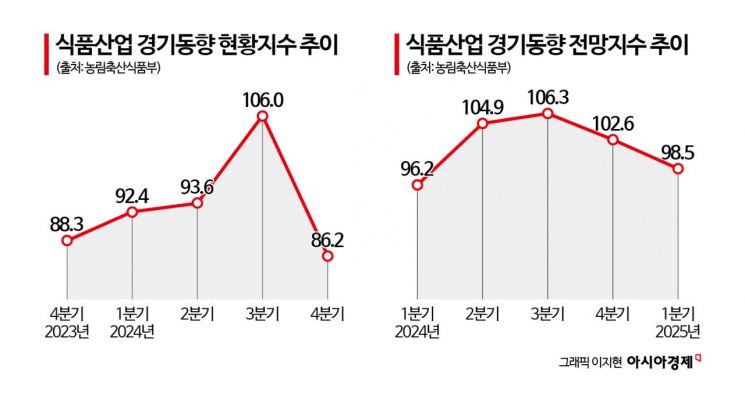

According to the '2024 Food Industry Business Trend Survey' conducted on the 13th by the Korea Agro-Fisheries & Food Trade Corporation (aT) targeting 1,561 food and beverage manufacturers nationwide, the food industry business index for the fourth quarter of last year was 86.2, a drop of 19.8 points from the third quarter (106.0). The food industry business index last year showed an upward trend from 92.4 in the first quarter to 93.6 in the second quarter and 106.0 in the third quarter, before sharply declining in the fourth quarter. An index above 100 indicates that more companies perceive the business conditions as improved compared to the previous quarter, while below 100 means more companies see conditions as worsened.

The biggest reason for the overall deterioration in the food industry's business conditions was identified as 'decreased consumer consumption' due to sluggish domestic demand and changes in consumption patterns, accounting for 61.2%. This was followed by 'economic instability caused by worsening international conditions' such as high interest rates and rising exchange rates at 22.9%, and 'deterioration due to environmental factors' such as poor raw material harvests caused by climate change, which accounted for 8.2%.

They gave negative evaluations across almost all sectors including production, sales, operating profit, finances, and employment. By sector, the indices for production scale (90.2), production facility operation rate (90.1), sales (87.1), export sales (94.7), operating profit (89.6), and financial conditions (89.7) all fell below 100. Particularly, the domestic sales index was 86.0, the lowest among all categories, confirming that the domestic market slump due to deteriorating consumer sentiment is at a serious level. However, the raw material purchase price index rose to 129.5 from 120.6 in the previous quarter, and the facility investment index also slightly increased to 109.6 from 108.3.

By industry, all businesses felt the impact of the domestic demand slump on worsening business conditions. Especially, the business condition indices were below 80 in fermented liquor (61.1), dairy and ice cream (70.8), oil manufacturing (77.6), and meat processing (79.3).

The outlook for the first quarter of this year is not optimistic either. The food industry business outlook index for the first quarter is 98.5, down 4.1 points from 102.6 in the fourth quarter of last year. After rising from 95.2 in the first quarter to 104.9 in the second quarter and 106.3 in the third quarter last year, it dropped to 102.6 in the fourth quarter and has continued to decline for two consecutive quarters. By sector, the indices for production scale (97.6), production facility operation rate (98.3), sales (97.9), domestic sales (97.5), operating profit (95.5), and financial conditions (98.4) all fell below 100. In contrast, the indices for raw material purchase price (110.8) and product shipment price (103.9) exceeded 100.

With raw material prices rising due to poor harvests caused by climate change and increased global economic uncertainty, production and sales prices are increasing. Political turmoil caused by the internal conflict at the end of last year has further contributed to the contraction of consumer sentiment. According to the Ministry of Agriculture, Food and Rural Affairs, consumer prices for agricultural and livestock products rose 6.6% last year compared to the previous year, marking the highest increase in three years since 2021 (9.9%).

Food and beverage consumption from January to November, compiled by Statistics Korea, decreased by 2.5% last year following a 1.8% decline in 2023, widening the drop. Food and beverage consumption had increased for 16 consecutive years from 2006 to 2021 since related statistics began being compiled, but has declined for three consecutive years recently. Kwon Hee-jin, a researcher at KB Securities, said, "Recent political uncertainties have sharply depressed consumer sentiment, and the sharply rising exchange rate is an additional factor pressuring consumption conditions," adding, "For consumer sentiment to improve, political stability must be restored first, and the weakening trend in economic activity sentiment must be halted."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)