86% of Issuance Concentrated in the Second Half

Struggling to Defend K-ICS Amid Rate Cuts and Accounting Changes

"Large-Scale Issuance Expected to Continue This Year"

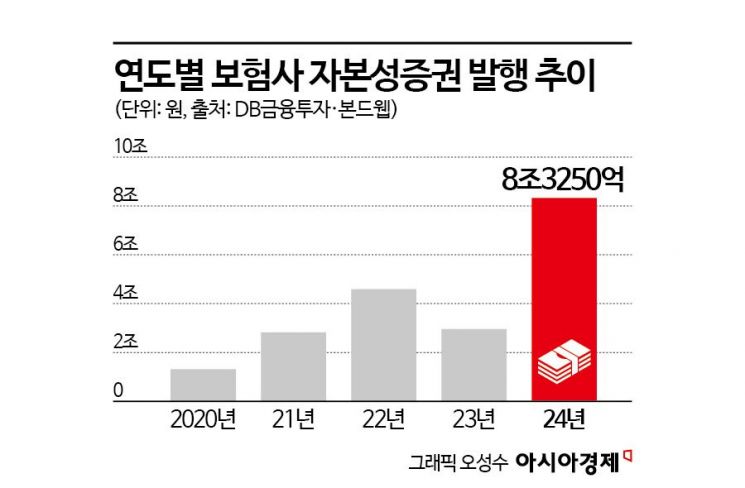

Last year, insurance companies issued more than 8 trillion won worth of capital securities, marking an all-time high. It is expected that the trend of capital expansion by insurers will continue this year due to the base interest rate cuts and changes in insurance accounting regulations.

According to DB Financial Investment on the 13th, insurance companies issued capital securities worth 8.325 trillion won last year. This is the first time capital securities issuance has exceeded 8 trillion won. Compared to the previous year, it increased by 182.6%. The upward trend was clear even compared to 2022, when insurers issued large-scale capital securities worth 4.5899 trillion won ahead of the implementation of the International Financial Reporting Standard (IFRS 17) by one year. Despite posting record-high earnings last year, insurers borrowed money by paying interest.

Generally, insurers can choose between two types of capital securities: hybrid capital securities and subordinated bonds. Among the capital securities issued last year, subordinated bonds accounted for about 6 trillion won, the largest portion, with the remainder being hybrid capital securities. Hybrid capital securities are essentially perpetual bonds with no maturity, but due to their long maturity and higher interest rates, subordinated bonds were preferred.

The insurer that issued the most capital securities last year was Hanwha Life, recording 1.9 trillion won. It was followed by Hyundai Marine & Fire Insurance (1.8 trillion won), Kyobo Life (1.3 trillion won), and Meritz Fire & Marine Insurance (800 billion won). About 86% of the capital securities issued by these insurers were concentrated in the second half of the year. This was due to efforts to defend the solvency ratio (K-ICS) amid base interest rate cuts and IFRS 17 regulatory improvements. K-ICS is a ratio that indicates whether an insurer can pay insurance claims on time, calculated by dividing available capital by required capital. Capital securities are accounted for as equity capital, so increasing issuance raises the K-ICS.

Looking at the K-ICS of major insurers before the application of the transitional measures in the third quarter of last year, Hanwha Life’s ratio rose by 1.3 percentage points to 164.1% compared to the previous quarter. Hyundai Marine & Fire Insurance increased by 0.4 percentage points to 170.1%, and Kyobo Life rose by 8.9 percentage points to 170.1%. Insurers that actively raised capital securities generally saw improvements in their K-ICS. However, there is a possibility that the K-ICS may decline during the year-end financial closing. This is because financial authorities require recalculating financial figures by applying the no-surrender and low-surrender insurance lapse rate guidelines announced in November last year. Applying these guidelines reduces the insurance contract margin (CSM), an insurer’s profitability indicator, which leads to a drop in K-ICS. If the K-ICS falls below 100%, the insurer becomes subject to timely corrective actions such as management improvement recommendations. The financial authorities recommend maintaining the K-ICS above 150%.

This year, it is expected that insurers will continue issuing capital securities due to uncertainties in domestic and international financial markets and changes in insurance accounting. The downward trend in the base interest rate also poses a burden for insurers defending their K-ICS. The Korea Insurance Research Institute previously estimated that a 1 percentage point drop in the base interest rate would reduce the K-ICS of life insurers and non-life insurers by 25 percentage points and 30 percentage points, respectively. Lee Byung-geon, head of the research center at DB Financial Investment, said, "Due to the phased implementation of regulations related to discount rates and instability in the bond market, the need for insurers to expand capital will continue this year. There is also a high possibility that refinancing demand for maturing bonds and conservative issuance demand from top insurers in the industry will join the trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)