Instant Coffee No.1 Dongseo Food Faces Growing Crisis

Arabica and Other Bean Prices Soar Amid Drought

Political Instability and Rising Exchange Rates Increase Pressure

Low-Cost Coffee Struggles to Raise Prices for Fear of Losing Customers

"If this continues, we will not be able to avoid a deficit next year."

With the international coffee bean prices soaring and a high exchange rate compounding the issue, Dongseo Food, the number one instant coffee company in Korea, is facing an emergency. Despite recently implementing a price increase, the company relies entirely on imports for key raw materials such as coffee and sugar, which has heightened internal concerns. A Dongseo Food representative stated, "If sales volume remains similar to this year, a significant deficit is expected," adding, "Since prices were recently raised, next year we must defend performance as much as possible by reducing costs and other measures."

Arabica Hits Record High in 47 Years... Double Burden with Exchange Rate

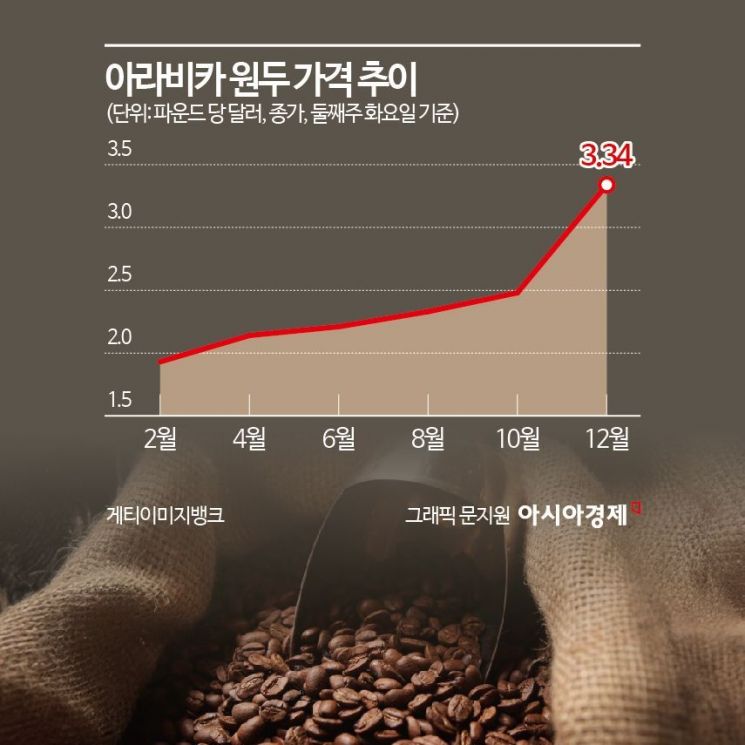

According to the industry on the 31st, with international coffee bean prices recently reaching an all-time high, the burden of raw material costs for coffee brands is expected to increase further in the new year.

Arabica, mainly used by Starbucks, the number one coffee shop, and Dongseo Food, the number one instant coffee company, hit its highest price in 47 years on the 10th. At that time, the Arabica coffee futures price in the New York market surged to $3.44 per pound, surpassing the previous record of $3.38 (1977). The closing price that day was $3.34, also a historic high.

The surge in Arabica prices is largely due to "climate inflation" caused by abnormal weather. Prolonged droughts in Brazil, the largest producing region responsible for half of the world's supply, have disrupted coffee supply. Although some drought relief began in October, the lack of moisture in the soil still makes coffee tree cultivation difficult.

Adding to the woes, prolonged political instability due to the impeachment situation has driven up the won-dollar exchange rate, increasing difficulties for the domestic coffee industry. On the 27th, the won-dollar exchange rate surpassed 1,486 won during trading, marking the highest level in 15 years and 9 months. Korea is known as a "coffee republic" due to its high per capita coffee consumption, but since it relies entirely on imports, the impact of the high exchange rate is inevitably greater.

An industry insider said, "This year, companies managed somehow with accumulated inventory, but next year, there will be no room to defend price increases, so each company is deeply concerned."

Low Customer Loyalty for Low-Priced Coffee: "Even a 100 Won Increase is Daunting"

Dongseo Food and Starbucks have already raised prices due to the burden of raw material costs. Dongseo Food increased the ex-factory prices of instant coffee, coffee mixes, and coffee beverages by an average of 8.9% starting from the 15th of last month. As a result, the price of Maxim Mocha Gold Mix 180-pack (2.16 kg) rose from 23,700 won before the increase to 25,950 won after, a 9.5% hike. This translates to about 13 won increase per unit, from 131.6 won to 144.1 won. Starbucks also raised prices in August by 300 won and 600 won for Grande (473 ml) and Venti (591 ml) coffee beverages, respectively.

The problem is that due to ongoing climate inflation effects, coffee bean prices are likely to rise again next year. An industry insider explained, "While the exchange rate may stabilize once political uncertainties subside, the coffee bean situation is not something that can be resolved in the short term."

Nevertheless, the domestic coffee industry plans to minimize the impact by strategically managing supply, such as purchasing coffee beans whenever prices drop slightly, rather than raising prices. A Twosome Place representative said, "Currently, there are no plans to raise prices," adding, "We are monitoring market supply and demand and striving to defend against price increases as much as possible."

Especially for mid- to low-priced brands, competition is fierce and customer loyalty is low, creating a more cautious atmosphere. Unlike Dongseo Food and Starbucks, these brands are easily replaceable, so even a 100 won increase in coffee prices could be a fatal blow.

An Ediya Coffee representative said, "Due to various factors such as international affairs, exchange rates, and climate change, prices of coffee beans and other raw materials continue to rise," adding, "We aim to minimize cost increases through operational efficiency without raising prices." A Mega Coffee representative also stated, "There are currently no plans to raise prices," explaining, "The headquarters is absorbing the pressure of rising raw material costs such as coffee beans and cocoa as much as possible and trying to offset this through economies of scale."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)