S&P500 Index Up 28% from Early Year Low

Additional Multiple Expansion Is Burdensome but

Temporary Pullback More Likely Than Trend Decline

Despite some concerns that US stock prices are overvalued amid the continued rise in the US stock market, securities firms advised increasing the proportion of US stocks when volatility expands in early next year. In particular, they analyzed that the index adjustment that may occur around the inauguration day of President-elect Donald Trump presents a dollar-cost averaging buying opportunity.

The securities industry said that early next year could be a buying opportunity as stock prices may fluctuate due to policy uncertainties of the new US administration. Getty Images

The securities industry said that early next year could be a buying opportunity as stock prices may fluctuate due to policy uncertainties of the new US administration. Getty Images

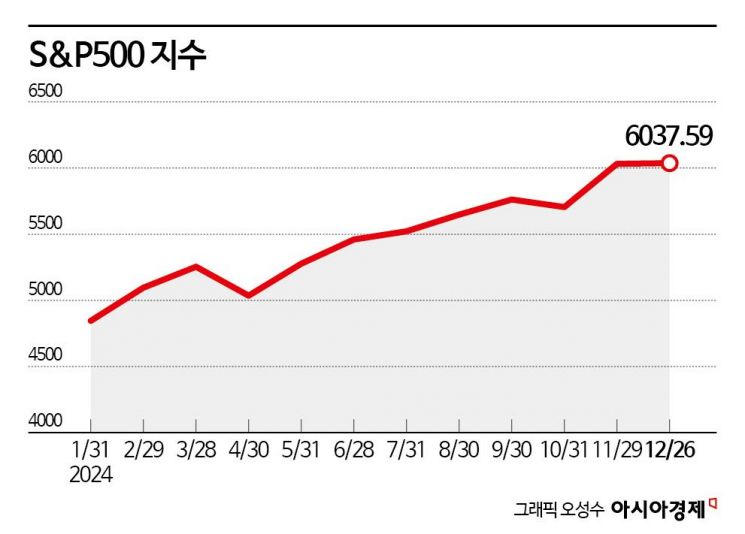

According to the financial investment industry on the 28th, the S&P 500 index, which represents the US stock market, rose 27.53% from the low at the beginning of this year as of the closing price on the 27th (local time). Unlike the domestic stock market, the US market has risen throughout this year. Although there was a sharp drop in August due to profitability concerns in the artificial intelligence (AI) industry and worries about the unwinding of the yen carry trade, the decline was recovered in just two weeks. In September, the market overcame fears of a recession triggered by the inversion of the yield curve between the 10-year and 2-year US Treasury bonds and continued its rally after the Federal Reserve's (Fed) 'big cut' (a 0.5 percentage point cut in the benchmark interest rate). On the 18th of this month, the market fell nearly 3% in one day due to a Fed shock that the rate cut would be smaller than initially expected, but it quickly staged a Santa rally and recovered to the 6000 level. This year, the US stock market outperformed the domestic market in terms of returns and resilience after crises.

Some argue that the US stock market's price level, which has risen relentlessly, is excessive. Baek Chan-gyu, a researcher at NH Investment & Securities, said, "The 12-month forward price-to-earnings ratio (PER) of the S&P 500 index is approaching about 23 times, increasing the burden on investors. During the COVID-19 pandemic in 2021, liquidity supply and low interest rates led to a breakthrough of the 4000 level based on a PER of 22 times, rising to 4800, but the current financial environment is somewhat different from that time." He added, "Expectations for future rate cuts and new government policies have already been priced into the market. Considering the current pace of inflation decline and the Fed's stance, it is a time to contemplate whether to assign additional multiples to the US market valuation."

Despite these concerns, securities firms said that early next year, when stock prices may fluctuate due to policy uncertainties of the new US administration, will be a buying opportunity. Choi Bo-won, a researcher at Korea Investment & Securities, said, "Historically, the US stock market's representative indices continue to rise until December, right after the presidential election, but in January, temporary profit-taking sales occur. This time, the policy uncertainty of the second Trump administration may limit the index's rise," but added, "However, rather than a trend decline, there is a high possibility of rebounds after temporary pullbacks multiple times. A strategy of dollar-cost averaging during corrections seems effective, and considering policies and earnings, sectors with high investment attractiveness are communication and industrials."

In particular, there is an analysis that volatility around January 20, the inauguration day of President Trump, should be utilized. Kim Il-hyuk, a researcher at KB Securities, said, "Recently, expectations for a rate cut have somewhat retreated due to inflation concerns, but Fed Chair Powell stated that he would not weaken the labor market to bring inflation down to the target, and with the average unemployment duration surging and the unemployment rate rising trend continuing, the Fed's cautious stance is expected to persist." He added, "The period around President Trump's inauguration could be an opportunity to increase stock allocation. Although the retreat of rate cut expectations is temporarily burdensome for stocks, a favorable environment for stocks will be created as nominal growth expectations rise."

Moon Nam-jung, a researcher at Daishin Securities, also said, "The decoupling between the US and non-US markets will become more distinct next year," adding, "The US economy is supported by economic strength amid an accommodative monetary policy phase. Ultimately, new industries such as AI and the metaverse after the pandemic are expected to enhance national productivity and corporate growth rates. The US stock market will continue its upward trend reflecting earnings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)