Overseas Stock Ratio 33.0→35.9% 'All-Time High'

Domestic Stock Ratio 15.4→14.9%... Amount Likely to Increase

Gold Investment Possibility Open Next Year... BTC Still Uncertain

The gap between the proportions of domestic and overseas stocks in the portfolio of the country's largest institutional investor, the National Pension Service (NPS), is expected to widen further next year. This is because the policy to expand the proportion of overseas investments to improve returns will be maintained.

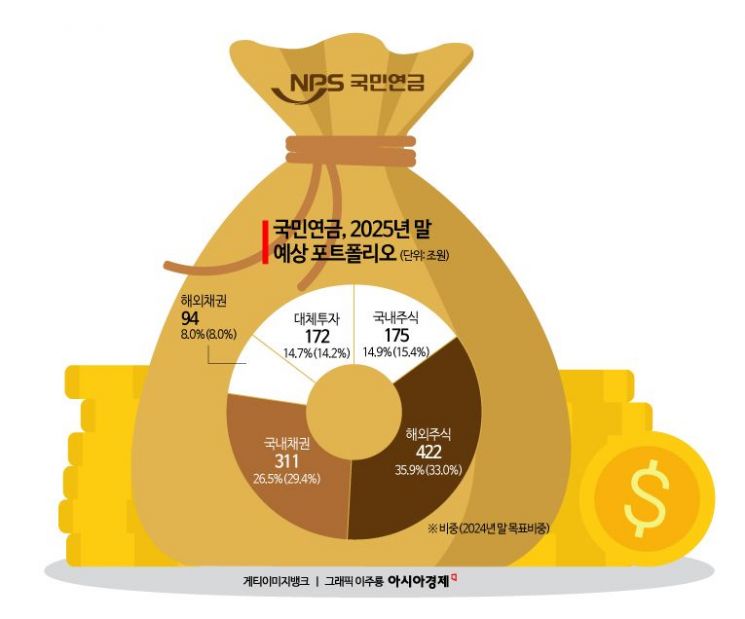

According to the financial investment industry on the 27th, the NPS has finalized the target asset allocation for the end of next year as 14.9% domestic stocks, 35.9% overseas stocks, 26.5% domestic bonds, 8.0% overseas bonds, and 14.7% alternative investments. Looking at stocks alone, the target allocation for the end of 2024 was 15.4% domestic stocks and 33.0% overseas stocks. The gap between the proportions of these two asset classes is expected to reach a record high, increasing from 17.6 percentage points this year to 21 percentage points next year.

Overseas Stocks and Alternative Investments Expand in Both Proportion and Amount

The top priority of the NPS fund is to improve returns for the retirement funds of the public. To this end, it is promoting diversification of its investment portfolio by expanding overseas and alternative investments in the long term. According to next year’s plan, among the five asset classes, only overseas stocks and alternative investments will increase in both amount and proportion. The size of overseas stock holdings, whose target proportion increases by 2.9 percentage points, is expected to reach 422 trillion won by the end of next year. Alternative investments, which are also expanding their proportion from 14.2% at the end of this year to 14.7% next year, will increase by about 15 trillion won. The target proportion for overseas bonds remains at 8% for both this year and next year. Due to the growth of the fund size, the investment amount is expected to increase by 6 trillion won.

On the other hand, the proportions of domestic stocks and bonds will decrease by 0.5 percentage points and 2.9 percentage points, respectively. Although the proportion of domestic stocks decreases, the absolute investment amount is expected to increase by about 6 trillion won from this year’s target to 175 trillion won due to fund growth. However, depending on market conditions, there is a possibility that both the target proportion and amount may fall short. In fact, in this year’s sluggish domestic stock market, the proportion of domestic stocks as of September was 12.7%, which is 2.7 percentage points lower than the target proportion (15.4%). This decline in proportion was due to a decrease in valuation. The tactical asset allocation (TAA) allowance range for domestic stocks is 3 percentage points, which is slightly above the lower limit of 12.4%. Domestic bonds are the only asset class expected to decrease in both proportion and amount. One year later, the amount will be reduced by about 12 trillion won compared to the current level.

Will Gold and BTC Investments Be Possible Next Year?

The NPS will face significant changes in fund management starting next year. The 'benchmark portfolio' will be applied to the alternative investment sector for the first time. The benchmark portfolio is a method of flexibly adjusting the proportion of investment assets according to market conditions. Currently, the NPS invests in private equity, real estate, and infrastructure within alternative investments at a ratio of 4:3:3, but going forward, it will no longer maintain this ratio and will be able to increase the proportion of specific asset classes depending on the situation. With the opening of the San Francisco office this year, the existing New York office and the new office together complete a 'two-top system' covering the East and West coasts for U.S. alternative investments.

It has also become easier to incorporate new investment assets. For example, assets such as gold futures or spot gold, and commodities, which are not currently invested in, can now be invested in at the discretion of the Fund Management Headquarters. Previously, such investments required approval from the Fund Management Committee. Attention is also focused on whether investment in Bitcoin, known as 'digital gold,' will be possible next year. Although it recorded the most overwhelming returns this year, investment is currently effectively blocked. The NPS limits its investment targets to securities and derivatives as defined by the Capital Markets and Financial Investment Business Act. Virtual assets do not fall under any of these categories. If the financial authorities approve domestic spot exchange-traded funds (ETFs), Bitcoin investment will become possible. ETFs are treated as securities. However, even if spot ETFs are approved, public opinion, which still views virtual assets as speculative, remains a major obstacle.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)