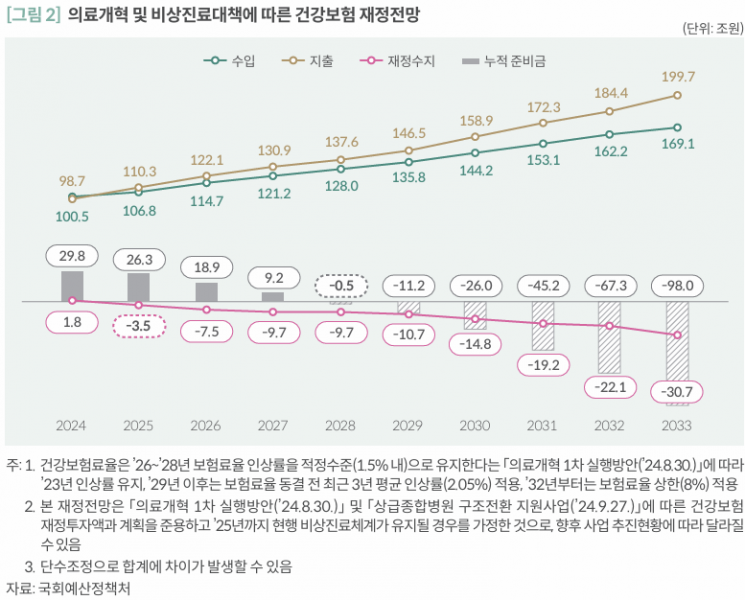

National Assembly Budget Office Forecasts 1-Year Shortening of Deficit Turnaround and 2-Year Reduction in Cumulative Reserve Depletion

"Additional National Fiscal Input and Expenditure Efficiency Needed to Ensure Mid- to Long-Term Stability"

Due to the medical reform and emergency medical system being promoted by the government, it is projected that the point at which the National Health Insurance (NHI) finances turn to deficit will be brought forward, and the depletion of accumulated reserves will accelerate.

According to the report titled "National Health Insurance Financial Outlook Reflecting Medical Reform and Emergency Medical Measures" by the National Assembly Budget Office on the 25th, the government's "First Implementation Plan for Medical Reform" and emergency medical measures are expected to cause the NHI finances to shift to a deficit starting next year, with accumulated reserves being depleted by 2028.

Originally, before the medical reform, it was anticipated that the NHI finances would turn to deficit in 2026 and the accumulated reserves would be exhausted by 2030. This is due to a continuous deficit caused by reduced revenue growth from the reduction of property-based insurance premiums for regional subscribers and reaching the upper limit of the health insurance premium rate (8%), as well as increased expenditures from population aging and strengthened coverage.

However, in February this year, the government announced the "Four Major Tasks of Medical Reform" and plans to increase medical school quotas. The Ministry of Health and Welfare decided to invest more than 20 trillion won in NHI finances over five years (2024?2028) for "fair compensation systems (normalization of medical fees)" and follow-up tasks among these. Additionally, to operate the emergency medical system, the government has been supporting the NHI finances with 208.5 billion won monthly until the emergency medical "severe" stage is lifted, and has also provided advance payments to training hospitals.

Considering these circumstances, the timing of the deficit transition (2025) and the depletion of accumulated reserves (2028) are brought forward by one year and two years respectively compared to maintaining the current system without injecting NHI finances into these policies. The cumulative deficit over the next 10 years is projected to increase by 32.2 trillion won compared to a scenario without financial input into these policies.

In response, the Budget Office explained that considering the objectives and financial requirements of government-led health care policies, national fiscal input should be reviewed. They also emphasized the need for financial projections that take into account changes in the environment due to medical reform and medical service gaps, as well as securing mid- to long-term financial stability through expenditure efficiency.

Im Seul-gi, an analyst at the National Assembly Budget Office, stated, "Even if the NHI finances are maintained as they are due to population aging, the accumulated reserves are expected to be depleted by 2030, so it is difficult to see sufficient investment capacity." He pointed out, "Improving the health care system, such as strengthening essential and regional medical services and responding to the crisis of medical service gaps, falls under public policies promoted by the state, so active role-sharing and principles of national fiscal responsibility are necessary."

Analyst Im also added, "In the case of medical reform, the increase in NHI expenditures due to fee hikes is expected to continue even after the government's announced five-year period, so a mid- to long-term financial stability review that clearly reflects additional financial requirements is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)