All Major Delivery Apps Saw User Decline Last Month

Baemin Experiences Consecutive User Drops Since Subscription Monetization

Last month, a win-win plan to reduce delivery app fees differentially was established, but it was found that the number of users of major delivery apps all slightly decreased. This is evaluated as the effect of user growth due to free delivery competition, which was one of the causes that triggered the fee controversy, has worn off. In this situation, the win-win plan also includes a provision to stop the 'most-favored-nation' demand that requires partner stores to set prices lower than or equal to competing apps, so it is expected that service competition, rather than discount competition, will become full-fledged in the future.

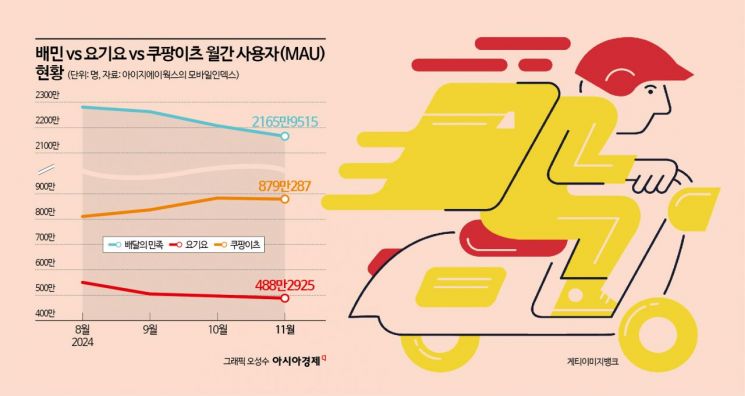

According to Mobile Index by data company IGAWorks on the 5th, the number of users (MAU) of Baemin, Coupang Eats, and Yogiyo last month recorded 21.66 million, 8.79 million, and 4.88 million respectively. Compared to the previous month, all three?Baemin, Coupang Eats, and Yogiyo?saw a decrease in users. Baemin lost 1.9%, Coupang Eats 0.5%, and Yogiyo 1.7% of users.

What stands out is that Coupang Eats, which had accelerated growth after launching free delivery service in March, showed signs of stagnation. Compared to March, Coupang Eats' users increased by 2.53 million, clearly benefiting from free delivery. However, the monthly growth trend compared to the previous month abruptly stopped last month. Baemin also saw an increase in users starting from May when it began the pilot service of its free delivery subscription, Baemin Club, but has recorded a decline for three consecutive months since its monetization in September. This is why there is an assessment that the user growth effect from free delivery may have reached its limit.

The concern deepened for Baemin, the market leader. Although the situation of being far ahead has not changed, the indicators have not been good since the monetization of the 'Baemin Club,' which was a decisive move. Although it barely succeeded in reaching an agreement, the backlash from partner stores against Baemin's fee increase, which initially caused negative public opinion, still lingers. Last month, Baemin's partner stores numbered 302,000, which is about 20,000 fewer than in July when the fee increase was announced. On the other hand, Coupang Eats increased by about 9,000, surpassing 200,000.

Industry insiders believe that free delivery, which shook the delivery market this year, no longer works as a user attraction strategy, and with the decision to stop operating conditions for subscription membership benefits, the so-called 'most-favored-nation' demands will disappear, forcing fundamental service differentiation competition in the future. A representative example is Baemin expanding its service range to all distribution channels, including corporate supermarkets, convenience stores, and large marts, allowing purchases of bulky or heavy items such as microwaves and rice cookers through the Baemin app. An industry official said, "Delivery apps now need to compete through service diversification rather than cutthroat competition through discount promotions," adding, "Especially in quick commerce, cooperation between delivery apps and distribution is expected to gradually expand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)