Hanamicron, Etech System, and others

Several BBB-rated mid-sized companies eligible for guarantee support

Many companies struggling with self-funding included

Procurement interest rates at 3-5%... Lower procurement costs

Amid ongoing financial market instability triggered by the Lotte Group, hundreds of large, medium, and small enterprises including KCC Construction and HLD&I Hanla have secured approximately 480 billion KRW in funding with government support. Companies facing difficulties in securing funds independently due to credit rating downgrades were largely included as beneficiaries of financial support through guarantees from the Korea Credit Guarantee Fund (KODIT).

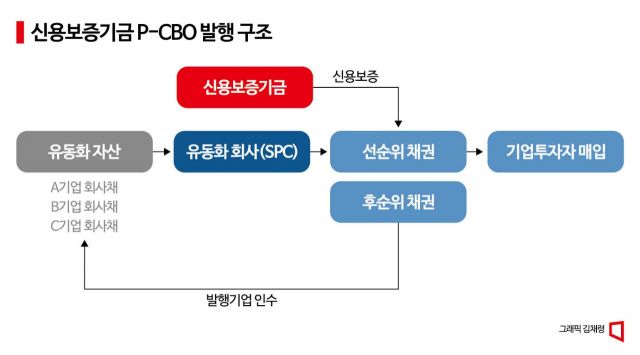

According to the investment banking (IB) industry on the 25th, KODIT will issue Primary Collateralized Bond Obligations (P-CBO) worth 483.2 billion KRW on the 28th. About 260 companies’ privately placed bonds or loans will be acquired through a Special Purpose Company (SPC). Subsequently, KODIT will provide guarantees to the SPC, which will issue senior and subordinated CBOs based on repayment priority.

When the companies that issued private bonds or received loans repay their funds at maturity, the money will be used to repay principal and interest to CBO investors. Senior CBO investors will be repaid first, and subordinated CBO investors will receive the remaining funds only after all senior investors have been fully repaid.

Among large corporations, only KCC Construction succeeded in issuing privately placed bonds worth 20 billion KRW with KODIT guarantees. Medium-sized enterprises such as HLD&I Hanla, Hanamicron, Amotech, and Shinwon were included as beneficiaries. KCC Construction (credit rating A-) and HLD&I Hanla (BBB+) belong to the construction sector, which is struggling to secure funds independently due to project financing (PF) defaults caused by the downturn in the real estate market.

BBB-rated companies such as AJ Networks (BBB+), PolyMirae (BBB+), and E-Tech System (BBB-) issued privately placed bonds with KODIT support. Daedong (BBB+), which recently agreed to supply agricultural machinery to Ukraine, secured the largest government-supported funding among medium-sized enterprises with 50 billion KRW. Following them in terms of amount are HLD&I Hanla (38 billion KRW) and Hanamicron (27.5 billion KRW). Medium-sized companies including Hanamicron, E-Tech System, PolyMirae, and Daebo Distribution received overlapping support.

The private bond issuance interest rates for medium-sized enterprises were formed in the low 3% range. Small and medium enterprises raised funds at rates ranging from the 4% level to the high 5% level. This is somewhat lower compared to the interest rates on KODIT-guaranteed private bonds issued until October. The decline in market interest rates is considered to have influenced this. Major securities firms such as KB Securities, Samsung Securities, and Kiwoom Securities, along with IBK Securities, Kyobo Securities, Hyundai Motor Securities, Hi Investment & Securities, IBK Investment & Securities, and Yuanta Securities, were responsible for credit evaluation and interest rate determination as well as underwriting the private bond issuance for companies receiving government support.

An IB industry official said, "The construction PF restructuring has not progressed quickly, and concerns about Lotte Group’s liquidity have added to the financial market instability. As more companies find it difficult to secure funds for debt repayment or operations independently, the number of companies applying for guarantees from KODIT is increasing." The official added, "Although KODIT cannot infinitely increase guarantee amounts due to concerns over rising default rates, it is significantly helping companies alleviate some liquidity issues."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)