KOSPI Falls Below 2500 and KOSDAQ Below 720

First Time Since August's 'Black Monday'

Domestic Market Cools Despite US Stock Market Record Highs

Concerns Over Trump Election Victory

Continued Foreign Investor Outflow

The stock market downturn is deepening. While the U.S. stock market has reached all-time highs and shown strength following Donald Trump's election victory, the domestic market has reflected concerns over Trump's win, causing the KOSPI to fall below the 2500 level for the first time in about three months.

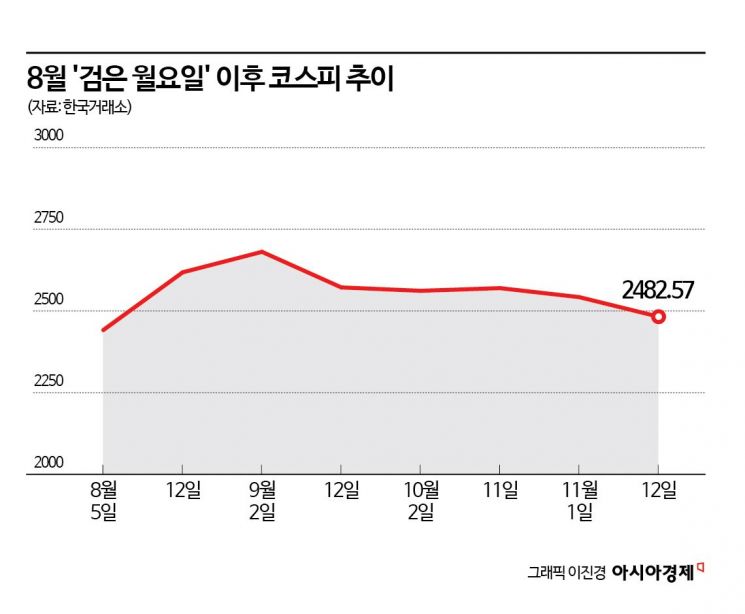

According to the Korea Exchange on the 13th, the KOSPI closed at 2482.57, down 1.94% from the previous day, falling below the 2500 mark. This is the first time since 'Black Monday' on August 5 last year, when global markets crashed simultaneously, that the KOSPI has closed below 2500. The KOSDAQ also fell 2.51%, breaking below the 720 level for the first time since 'Black Monday.' The KOSPI has been in decline for three consecutive days, and the KOSDAQ has fallen for two consecutive days.

Ji-won Kim, a researcher at KB Securities, said, "Since Trump's election was confirmed, the KOSPI has dropped 3.16% and the KOSDAQ 4.41%, showing weakness. This contrasts with the U.S. three major indices, which rose about 4% and reached all-time highs during the same period." He added, "Goldman Sachs analyzed that Trump's tariff policies could be more detrimental to Korea and Taiwan, raising concerns. Meanwhile, the won-dollar exchange rate surpassed 1400 won, and foreigners showed net selling in both spot and futures markets for three consecutive trading days at this elevated level."

On the previous day in the Seoul foreign exchange market, the weekly closing rate of the won-dollar exchange rate rose 8.8 won from the previous session to close at 1403.5 won, breaking above 1400 won again and marking the highest closing rate in two years.

Since September, the KOSPI had been stagnating within a trading range, but recently it has broken downward out of this range following the U.S. presidential election. Ji-young Han, a researcher at Kiwoom Securities, said, "Although the U.S. stock market is showing a neutral or better price movement due to continued expectations following Trump's election despite accumulated level and speed burdens, the domestic market is experiencing the opposite situation." She explained, "This is because the dominant sentiment is anxiety that Trump's election will not be a major positive factor for the domestic market." Concerns are growing that protectionism, such as universal tariffs, is likely to strengthen due to Trump's election, which would inevitably have a negative impact on the export-dependent domestic market.

The stock market downturn has led to a surge in stocks hitting new lows. On the 12th, 194 stocks on the KOSPI and 425 on the KOSDAQ recorded 52-week lows, totaling 619 stocks. This means 22.7% of the total 2,727 listed stocks hit new lows. On the previous day, about 400 stocks hit new lows, but the number of stocks hitting new lows surged again in just one day. The leading stock Samsung Electronics hit new lows for two consecutive days, closing at 53,000 won after falling 3.64%. Following a 52-week low of 55,000 won the previous day, it dropped further to 53,000 won.

Foreigners' selling pressure continues to pull down stock prices. Since the beginning of this month, foreigners have net sold 699.5 billion won in the domestic stock market. Since August, foreigners have continued selling, offloading a total of 15.8837 trillion won during this period. Weak earnings are also cited as a factor behind the domestic market's weakness. According to financial information provider FnGuide, the consensus operating profit forecast for the KOSPI this year (average of securities firms' estimates) has been revised downward by 3.26% compared to a month ago, to 247.5737 trillion won. Kyung-min Lee, a researcher at Daishin Securities, analyzed, "The reasons for the KOSPI's weakness include earnings and supply-demand. Although the third-quarter earnings season has passed its peak, the fourth-quarter and annual earnings forecasts are being revised downward, and foreign demand improvement is weak."

To respond to the current market, there is an opinion that attention should be paid to stocks that foreigners are buying. Dae-jun Kim, a researcher, said, "Ultimately, focusing on the flow of money is an appropriate response in the current situation." He added, "Foreigners accumulated shares last week in shipbuilding, defense, and utilities sectors. These sectors also have favorable earnings forecasts." He continued, "Of course, these sectors have already risen considerably after Trump's election, but it seems unlikely that foreigners' views on these sectors will change in the short term. Therefore, it seems appropriate to increase investment weight in these sectors while responding to the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)