2025 Real Estate and Economic Outlook Seminar

Supply Shortage Puts Upward Pressure Starting in Second Half

Localized Price Changes and Household Debt Regulation as Variables

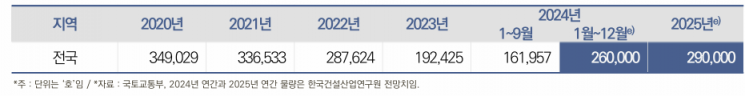

290,000 Housing Units for Sale, 440,000 Units Permitted Expected

Next year, nationwide real estate sale prices are expected to decline by 1.0%, with the metropolitan area rising by 1.0% and provincial areas falling by 2.0%. Price increase pressures due to supply shortages are anticipated to emerge from the second half of next year.

On the 6th, the Korea Construction Industry Research Institute held the '2025 Construction and Real Estate Market Outlook Seminar' at the Construction Hall in Gangnam-gu, Seoul. The institute analyzed that next year, nationwide sale prices will fall by 1.0% annually, while jeonse (long-term lease) prices will rise by 1.0%.

Kim Seonghwan, a senior researcher at the institute, stated, "Apart from the average market price rise and fall trends, localized increases and decreases are expected to continue," adding, "Considering factors such as housing construction progress and the number of housing starts three years ago, price increase pressures due to supply shortages are expected to appear around the second half of 2025."

"Sustaining current transaction levels is difficult"…Next year's pre-sale volume to increase by 30,000 units compared to this year

Until September this year, housing replacement transactions centered on actual demanders became active, leading to a significant increase in transaction volume compared to the previous year. With rising transactions compared to the previous period, the index showed a slight upward trend, with price increases particularly noticeable in the metropolitan area. However, since September, transaction volumes have slowed due to government policies managing total household debt.

Senior researcher Kim analyzed, "Although consumer sentiment has somewhat recovered and prices have fallen compared to the previous peak, the absolute price level remains high, mortgage loan interest rate reductions are limited, and government policies on total household debt management are expected to continue, along with a slow overall economic recovery. Considering these factors, sustaining the current level of transactions will be difficult."

The preference for newly built apartments remains strong, but due to rising construction costs, it is difficult to set low pre-sale prices. Demand concentration is expected to continue, especially in projects subject to the pre-sale price ceiling system.

The institute forecasts that next year's housing permits and pre-sale volumes will recover to 2022 levels. The pre-sale volume next year is expected to be 290,000 units, 30,000 units more than this year's estimate of 260,000 units. Permits are expected to reach 440,000 units, an increase of 75,000 units compared to this year's estimate of 365,000 units.

Senior researcher Kim stated, "After 2025, market interest in newly built housing is expected to increase as the shortage of new apartments becomes recognized. Particularly, financing conditions for suppliers such as project financing (PF) are expected to improve compared to this year, influencing the increase in permit volumes," adding, "If unexpected policies related to consumer financing, such as group loans, are introduced, the growth trend may slow, so careful policy design is necessary."

Next year's jeonse price increase to slow down…Jeonse loan regulations remain a variable

Jeonse prices are expected to rise at a slower pace than this year as the concentration on apartments eases. Although many demanders avoided non-apartment types such as row houses and multi-family houses due to jeonse fraud issues, the supply of purchase leases by public entities like LH is expected to reduce the decline. However, rising interest rates on jeonse loans and ongoing discussions about including jeonse loans in the debt service ratio (DSR) calculation pose constraints, acting as downward pressure factors on jeonse prices.

Senior researcher Kim analyzed, "The jeonse market is expected to see additional demand inflow into the rental market due to reduced sale demand, and the 2025 move-in volume will slightly decrease compared to this year, which is a factor for price increases," adding, "Although the shift to monthly rent is progressing, the conversion rate and the lowering of market product interest rates due to base rate cuts will somewhat slow the pace of conversion, especially for apartments."

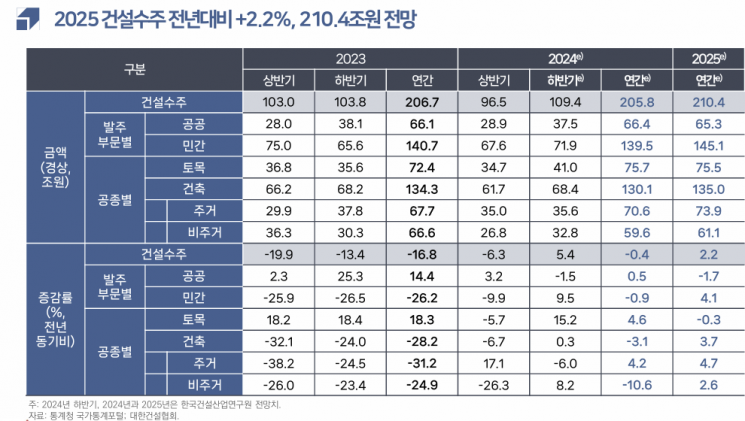

Construction orders to increase by 2.2%, construction investment to decrease by 2.1% forecast

The institute forecasts that next year's construction orders will increase by 2.2% compared to the previous year. After two consecutive years of decline last year and this year, orders are expected to reach about 210.4 trillion KRW, supported by interest rate drops and policies to activate housing supply. Construction orders this year are expected to decrease by 0.4% to 205.8 trillion KRW compared to last year, which recorded 206.7 trillion KRW, down 16.8% from the previous year. By client type, public orders are expected to decrease by 1.7% to 65.3 trillion KRW, while private orders are expected to increase by 4.1% to 145.1 trillion KRW. By construction type, housing orders are expected to increase by 4.7% to 73.9 trillion KRW, non-housing by 2.6% to 61.1 trillion KRW, and civil engineering by 0.3% to 75.5 trillion KRW.

The institute analyzed that next year's domestic construction investment will shrink by 2.1% from the previous year to 295.3 trillion KRW. The sharp decline in construction orders in 2023 is expected to continue affecting investment reductions not only in the second half of this year but also next year. Factors such as government SOC investment cuts, low investment capacity of companies and households, high-interest rate situations due to government loan regulations, the fallout from real estate project financing (PF) defaults, and still high construction costs are cited as obstacles to construction market recovery.

Researcher Lee Ji-hye explained, "Construction companies need to monitor the rapidly changing market environment and establish risk management systems such as portfolio diversification, supply chain diversification, and securing financial liquidity," adding, "It is also necessary to promote technology investments to reduce costs, increase productivity, and enhance industrial competitiveness, as well as strengthen safety and quality management through the introduction of smart construction technologies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)