Countdown to Domestic Stock Asset Scale Reversal, Gap at 8 Trillion Won

Higher Returns Than Domestic... Actively Expanding Overseas Stock Proportion

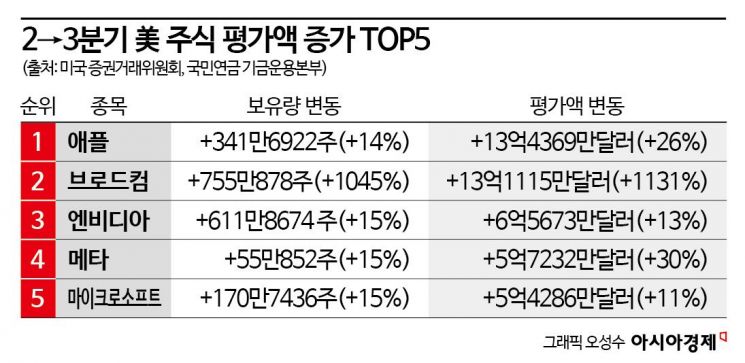

Focused Bulk Purchase of Broadcom in Q3... Significantly Increased 'M7' Holdings

The National Pension Service's (NPS) direct investment assets in U.S. stocks have surpassed $100 billion for the first time ever. The NPS fund management is broadly divided into two types: direct investment managed by its own personnel and indirect investment entrusted to external asset management firms.

According to the U.S. Securities and Exchange Commission (SEC)'s '13F (disclosure of holdings by institutional investors with over $100 million)' as of the end of the third quarter, the NPS's direct investment assets in U.S. stocks amounted to $103.6 billion (approximately 142 trillion KRW). This marks the sixth consecutive quarter of record highs by amount. Compared to the previous quarter, it increased by 19% ($16.6 billion), and compared to the previous year, it rose by 66% ($41.2 billion). As of the third quarter, the NPS is invested in a total of 511 stocks.

U.S. Direct Investment Scale, 'Gukjang' Assets Soon to be Surpassed

The scale of the NPS's direct investment assets in U.S. stocks first exceeded $10 billion in the second quarter of 2016. It surpassed $50 billion in the second quarter of 2021, then slightly declined due to the global downturn the following year, but from the second quarter of last year through the third quarter of this year, it has repeatedly set record highs for six consecutive quarters. This represents a doubling in about three years since the first $50 billion milestone.

If the current trend continues, the moment when direct investment assets alone surpass domestic stock assets is imminent within the fourth quarter. Domestic stocks, combining both direct and indirect investments, currently hold about 150 trillion KRW as of the latest disclosure in August. The gap between the two asset classes is only about 8 trillion KRW. At the end of last year, it was approximately 49 trillion KRW. Thanks to the record rally and boom in the U.S. stock market and the NPS's investment expansion policy, U.S. stock direct investment assets increased by 44% during the first to third quarters of this year. Meanwhile, during the same period, the domestic stock market saw net sales of 528.4 billion KRW. The KOSPI showed sluggish performance, even recording a negative annual growth rate. Including indirect investments, the crossover happened long ago. The combined overseas stock assets (including the U.S.) of the NPS amount to 389 trillion KRW.

In a recent National Assembly audit, when questioned about whether the NPS is passive in domestic stock investments, Kim Tae-hyun, the NPS CEO, responded, "There is a possibility of misunderstanding that we are ignoring it," adding, "We set investment proportions by asset class in a direction to improve pension returns." The NPS's top priority is to enhance returns to maintain the retirement funds of all citizens. It is diversifying investments by gradually increasing the overseas portion, which has higher returns than domestic stocks, where most investments are based on the KOSPI 200. Since the fund's establishment in 1988 until last year, the cumulative return on overseas stocks is 11.04%, while domestic stocks returned 6.53%.

Q3 Pension Pick is 'Broadcom'

The most prominent stock in the NPS's U.S. stock investments in the third quarter was Broadcom. The NPS increased its holdings in this stock by 1,045%. The number of shares held rose from 722,279 in the second quarter to 8,273,157 in the third quarter, an increase of 7,550,878 shares. The value of Broadcom shares increased by $1.31115 billion (approximately 1.8 trillion KRW) compared to the previous quarter. During the same period, Broadcom's ranking in the NPS's U.S. stock portfolio jumped 159 places, from 169th to 10th.

Broadcom is regarded by investment banks such as Citibank as the "second Nvidia." It has rapidly emerged as an AI-related stock this year. Its main products are communication semiconductors used in network equipment, and it has secured key semiconductor lines across wireless, networking, broadband, and storage businesses. These strengths have propelled it to rank 10th in global market capitalization, surpassing Tesla, which is ranked 11th.

The NPS also continued to buy stocks in its core portfolio, the "Magnificent 7 (M7: Apple, Microsoft, Google Alphabet, Amazon, Nvidia, Meta, Tesla)." Holdings of each of these seven stocks increased between 14% and 16%. The number of stocks invested in decreased from 546 in the second quarter to 511 in the third quarter. Only 10 new stocks were added in the third quarter, and unlike the first and second quarters, none of the investments exceeded $100 million. Rather than investing in new stocks, the NPS focused on strengthening its existing "blue-chip" holdings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)