Survey on Loan Practices of Financial Institutions by the Bank of Korea

Household Loan Screening Expected to Tighten in Q4

In the fourth quarter of this year, commercial banks are expected to take a stricter stance on household loans.

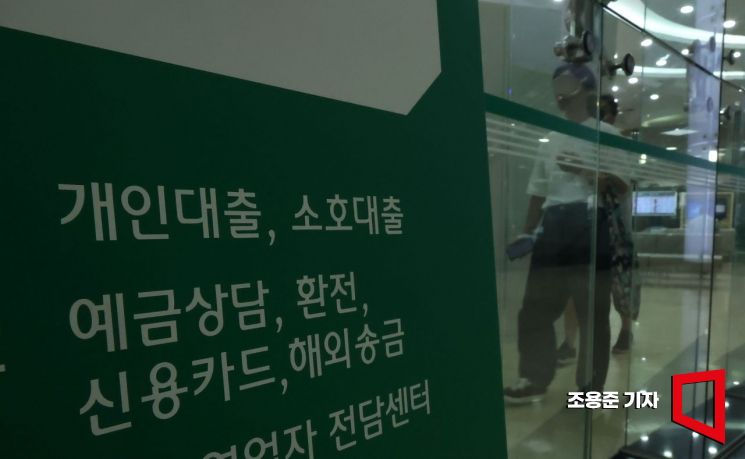

To slow down the pace of household loan growth, commercial banks are consecutively raising mortgage loan interest rates. On the 3rd, a loan information board was posted at a commercial bank branch in Euljiro, Jung-gu, Seoul. Photo by Jo Yongjun jun21@

To slow down the pace of household loan growth, commercial banks are consecutively raising mortgage loan interest rates. On the 3rd, a loan information board was posted at a commercial bank branch in Euljiro, Jung-gu, Seoul. Photo by Jo Yongjun jun21@

According to the "Survey Results on Lending Behavior of Financial Institutions" announced by the Bank of Korea on the 23rd, loan officers at domestic financial institutions such as banks and credit card companies forecast that the lending attitude of domestic banks in the fourth quarter will become stricter for households and somewhat more relaxed for small and medium-sized enterprises (SMEs).

The composite index of lending attitudes of domestic banks in the fourth quarter recorded -12. The more negative the index, the more respondents indicated a tightening of lending attitudes.

For large corporations, the lending attitude index was -3, showing a tightening compared to the previous quarter (0), while for SMEs, it was 3, indicating a slight easing, the same as the previous quarter. The Bank of Korea explained that the tightening for large corporations was expected due to risk management amid domestic and external uncertainties. On the other hand, SMEs are expected to see easing due to strengthened policy support.

For households, the lending attitude for housing loans was -28, further tightening compared to the previous quarter (-22). General household loans also maintained a negative index of -17. Due to continuous household debt management measures such as the expanded application of the stress Debt Service Ratio (DSR) to unsecured loans implemented since September, the tightening trend is expected to continue.

In the fourth quarter, corporate credit risk is expected to remain high due to poor business conditions among SMEs. The composite credit risk index forecasted by domestic banks for the fourth quarter was 19. The credit risk for large corporations rose to 11 from 6 in the previous quarter, while for SMEs, it decreased to 25 from 31. The more positive the index, the more respondents expected an increase in credit risk.

Household credit risk was 11, down from 25 in the previous quarter. The Bank of Korea explained that caution will continue as improvements in household income conditions are delayed.

Loan demand in the fourth quarter is expected to increase mainly among SMEs and households. The loan demand index for SMEs rose to 14 from 6 in the previous quarter. The loan demand index for general households increased from 17 to 19, while for household housing loans, it decreased from 28 to 8. Loan demand for SMEs is expected to increase due to working capital and liquidity needs, and for households, it is expected to rise mainly for unsecured loans such as living expenses.

Non-bank Financial Institutions Maintain Tightening Lending Attitude

The lending attitude of non-bank financial institutions is expected to maintain a tightening trend in most sectors except for credit card companies. Due to the high delinquency rates of non-bank financial institutions such as mutual savings banks, lending attitudes are expected to continue tightening to manage asset soundness.

Credit risk in non-bank financial institutions is expected to remain high in most sectors. This is mainly due to concerns over asset soundness centered on vulnerable borrowers such as low-credit and low-income groups and real estate-related loans.

The Financial Institution Lending Behavior Survey is conducted on 204 financial institutions, including banks and credit card companies. It investigates trends over the past three months and forecasts for the next three months regarding lending attitudes, credit risk, and loan demand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)