Successful Tender Offer for Korea Zinc

Youngpoong·MBK 42.74%, Chairman Choi 40.27%

MBK Likely to Buy on Market to Secure Majority

Korea Zinc Strives to Acquire Additional Shares Using Allies

With the legal risks surrounding Korea Zinc's treasury stock repurchase eliminated, the tender offer will proceed as planned. As the share battle triggered by MBK Partners and Young Poong's tender offer comes to a close, the management rights dispute is now expected to shift toward securing voting rights ahead of the shareholders' meeting.

The Seoul Central District Court Civil Division 50 (Chief Judge Kim Sang-hoon) dismissed Young Poong's injunction request to halt the tender offer procedure on the 21st. Although Young Poong and MBK argued that Korea Zinc's treasury stock tender offer violated the Capital Markets Act and the Commercial Act, the court rejected this, stating that "the right to be preserved and the necessity of preservation were not sufficiently demonstrated."

Treasury Stock Tender Offer Goes to the End... Both Sides' Shareholdings

Based on the court's ruling, Korea Zinc plans to complete the treasury stock tender offer as scheduled on the 23rd. It intends to purchase up to 20% of shares together with Bain Capital, of which 17.5% will be treasury stock that will be entirely canceled afterward, thus having no impact on the vote battle at the upcoming shareholders' meeting.

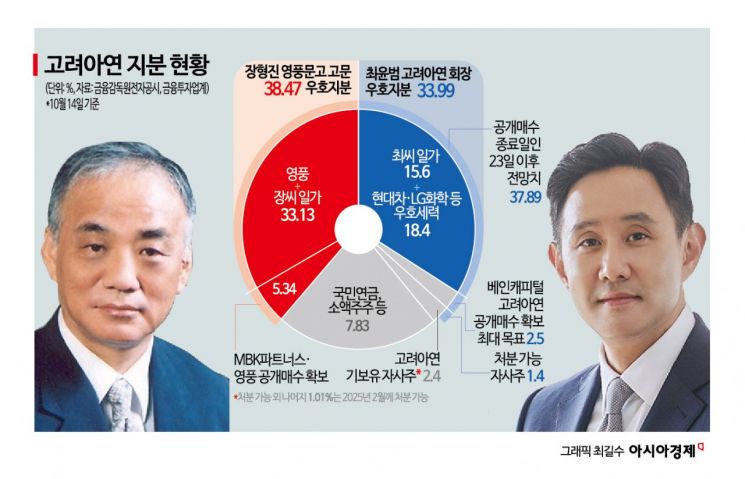

If Bain Capital secures up to 2.5% of shares, Chairman Choi Yoon-beom's friendly shares will increase to 36.49%. The Young Poong-MBK alliance, which has additionally secured 5.34% of shares through the tender offer, currently holds 38.47%. If Korea Zinc purchases and cancels 10% of the circulating shares by the 23rd, the shares held by Chairman Choi's side and the Young Poong-MBK side will rise to 40.27% and 42.74%, respectively.

MBK plans to soon attempt to convene an extraordinary shareholders' meeting, and it is highly likely that both sides will face the meeting without securing a majority. In this case, the key to the management rights dispute could be held by the National Pension Service, which holds 7.83% of Korea Zinc shares.

However, with the court dismissing two injunctions in favor of Korea Zinc, it is expected that the National Pension Service will lean toward Korea Zinc on grounds of legitimacy. Over the past five years, the National Pension Service has supported 92.5% of the proposals submitted at shareholders' meetings, showing trust in the current management's decisions. It also has a precedent of voting against the appointment of Young Poong advisor Jang Hyung-jin as a director at the 2022 shareholders' meeting.

Will Young Poong-MBK Buy on the Market? Korea Zinc Tender Offer Volume Is Key

There is speculation that Young Poong and MBK will attempt to acquire additional shares on the market before the shareholders' meeting. Following the dismissal of the injunction, Korea Zinc's stock price rose significantly, and to avoid allegations of market manipulation, the purchase timing is expected to be after the tender offer ends on the 24th. The critical factors will be how much volume flows into Korea Zinc's tender offer and how the stock price moves afterward.

The headquarters of Korea Zinc in Jongno-gu, Seoul, on the morning of the 11th when Korea Zinc held its board meeting.

The headquarters of Korea Zinc in Jongno-gu, Seoul, on the morning of the 11th when Korea Zinc held its board meeting. [Photo by Yonhap News]

Currently, excluding the shares absorbed by Young Poong and MBK through the tender offer, about 15% of Korea Zinc's shares are known to be circulating. If most of the circulating shares are absorbed by Korea Zinc's tender offer, it may be difficult for MBK to increase its stake through market purchases.

On the other hand, if the stock price hovers around the tender offer price of 890,000 KRW, there is a possibility that investors will sell on the market due to tax burdens, which could result in fewer shares responding to Korea Zinc's tender offer than expected. If MBK secures more than half of the voting rights, it could eliminate the variable of the National Pension Service.

Korea Zinc also urgently needs to secure additional shares to gain a decisive advantage. The easiest way is to transfer existing treasury stock (2.4%) to friendly forces to revive voting rights.

Attention is also focused on how Trafigura's chairman, who is scheduled to visit Korea next month to meet with Chairman Choi, will cooperate with Korea Zinc. Trafigura, the world's largest commodity trading intermediary, holds 1.49% of Korea Zinc shares and is an ally of Chairman Choi. With sales reaching approximately 335 trillion KRW last year, Trafigura has enormous financial power. The market expects Trafigura to directly support Chairman Choi, possibly by purchasing shares.

Prolonged Management Rights Dispute

Although MBK plans to convene an extraordinary shareholders' meeting soon to attempt to seize control of the board, it is expected that the board composed of Korea Zinc's side will reject this. If MBK applies to the court for permission to convene the extraordinary meeting, the timing of the shareholders' meeting is likely to be further delayed. Earlier this year, when Young Poong refused to hold the Seorin Sangsa shareholders' meeting, Korea Zinc applied to the court for permission to convene the meeting, which took about three months until the meeting was held.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)