LGD's 8.6-Gen OLED Line Halted

A Game Changer Dramatically Increasing Production Scale

LGD Prioritizes 'Tight Management' Over New Investments

2.3 Trillion KRW from Guangzhou Plant Sale Used for Financial Improvement

Competitors Like Samsung Display, China's BOE and Visionox Proceed with Investment Decisions

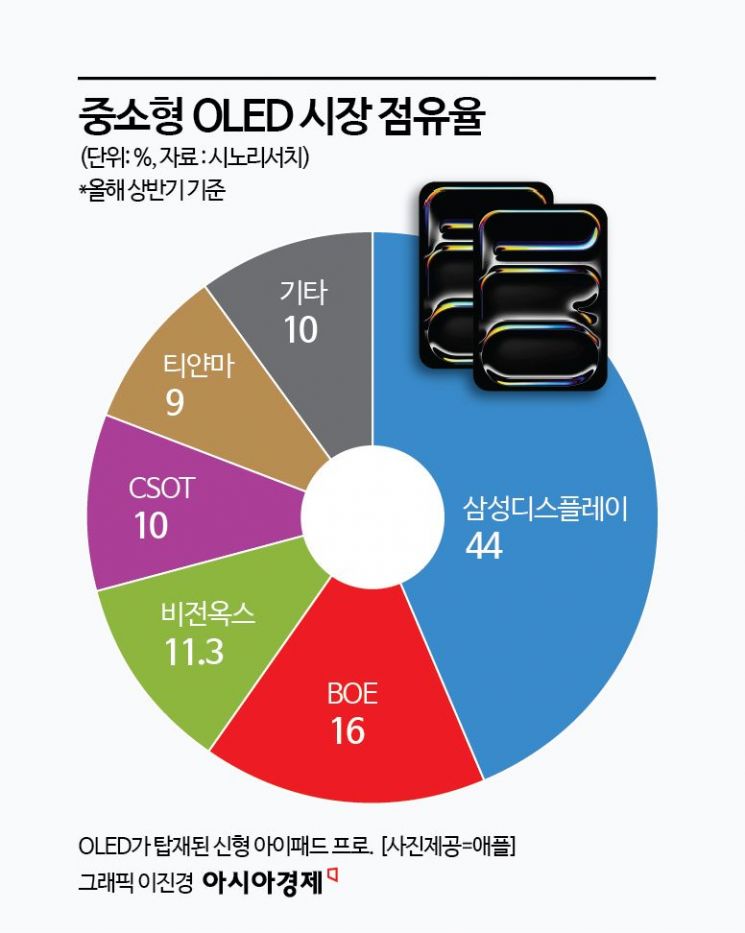

LG Display is facing a dilemma over establishing a new 8.6-generation organic light-emitting diode (OLED) line that can significantly reduce panel production costs. While Samsung Display and Chinese competitors have all decided to invest, LG Display appears reluctant to make new investments due to its top priority of escaping losses. Since it is difficult to recover once pushed out of mass production competition in the display industry, there are concerns that the decision time is running short.

Minimum investment of 3 trillion won... Debt ratio nearing 300%

According to industry sources on the 18th, LG Display has not decided on a new line construction plan for 8.6-generation IT OLED investment. This is because the company judges that its current financial capacity is limited. It is known that at least 3 trillion won must be invested to equip key equipment and facilities such as deposition machines to operate the 8.6-generation line. However, the company has recorded losses for six consecutive quarters since the second quarter of 2022, except for the fourth quarter of last year, and again posted losses in the first and second quarters of this year. Losses are also expected in the third quarter. As of the end of the first half of this year, the debt ratio is approaching 282.1%.

Especially since the appointment of President Jeong Cheol-dong, LG Display has focused more on reducing losses through tight management and cost-cutting rather than new investments. President Jeong has set "achieving annual profitability" as the biggest goal and is tightening the belt accordingly.

In fact, LG Display borrowed 1 trillion won from LG Electronics in March last year and conducted a paid-in capital increase of 1.36 trillion won at the end of last year to improve its financial structure. The approximately 2.03 trillion won cost generated from selling the Guangzhou LCD factory to China’s China Star Optoelectronics Technology (CSOT) is also expected to be used to improve the financial structure.

However, the industry believes that investment must be accelerated to maintain competitiveness in the small- and medium-sized OLED market in the future. Although the 8.6-generation OLED will initially supply IT panels, it is expected to gradually expand to small- and medium-sized OLEDs overall. Apple, a key customer, plans to equip OLEDs in its MacBook starting in 2025, beginning with tablets next year.

8.6-generation is a game changer

The 8.6-generation production technology is regarded as a "game changer" in terms of mass production. In the display industry, the generation refers to the size of the glass substrate. The higher the generation number, the larger the size. A larger glass substrate improves panel yield efficiency by increasing the number of panels produced from one substrate, thereby lowering panel prices. The 8.6-generation measures 2290 mm in width and 2620 mm in length, more than twice the area of the existing 6-generation (1500 mm × 1850 mm). For a 14.3-inch tablet, a 6-generation facility can produce 4.5 million units annually per line, but an 8.6-generation facility can produce up to 10 million units.

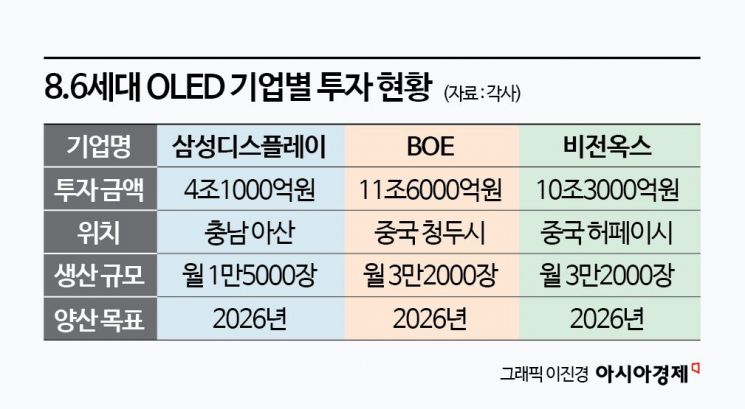

Competitors have already decided to invest. Samsung Display is investing 4.1 trillion won to build a factory with a monthly capacity of 15,000 sheets at its Asan plant. Chinese display companies have also joined the 8.6-generation investment. Chinese companies BOE and Visionox have confirmed investments in 8.6-generation OLED, and other companies such as Tianma and CSOT are also considering investments. Although Chinese companies’ OLED technology is reportedly 2 to 3 years behind domestic companies, their price competitiveness is ahead. Currently, Samsung Display aims to produce 15,000 sheets per month of 8.6-generation OLED, but BOE and Visionox are preparing to have capacities of 32,000 sheets per month each. The longer LG Display delays investment, the wider the gap between Korean and Chinese companies is expected to become.

Market research firm DSCC also forecasted, "China will record an average annual growth rate of 8% from 2023 to 2028, four times faster than Korea’s 2%, and will catch up," adding, "China’s share of global display production capacity will increase from 68% in 2023 to 74% in 2028, while Korea and Taiwan will see a decrease in absolute production capacity."

"Being caught up can happen in an instant"

LG Display’s CFO in charge of investments avoided answering phone inquiries. Some in the industry say that since companies find it difficult to bear direct investments for future growth alone amid worsening business conditions and poor performance, active government investment support is necessary. Currently, the government applies tax credits for domestic display companies’ research and development (R&D) and facility investments. However, the tax credit for national strategic technologies under the Restriction of Special Taxation Act (RSTA) will expire in December this year. An industry insider said, "Even if companies mobilize all emergency measures to secure future growth engines, there are limits," expressing concern that "if competing countries expand investments backed by massive government subsidies, catching up, as happened with LCD, could happen in an instant."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)