Major Bio Companies' Market Cap Increases by 7.7 Trillion Won in One Month

Related Stock Index Ranks 3rd in Exchange Theme Index Returns

Samsung Biologics Returns as the Top Stock

Biotech stocks are pushing out semiconductor stocks and emerging as the leading stocks in the domestic stock market. Expectations of improved fourth-quarter earnings and the arrival of an interest rate cut period, which will ease funding constraints, have combined to attract buying momentum. Samsung Biologics recently returned to its status as a blue-chip stock, with its stock price surpassing 1 million won on the back of expectations for benefits from the interest rate cut.

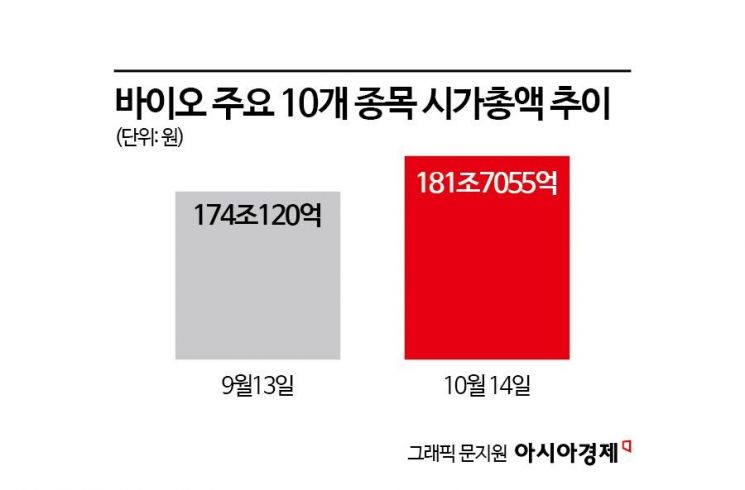

According to the Korea Exchange on the 16th, the total market capitalization of the top 10 major domestic biotech companies was 181.7055 trillion won as of the closing price on the 14th, an increase of 7.7 trillion won compared to one month ago (174.012 trillion won). The 10 companies are Samsung Biologics, Celltrion, Alteogen, Yuhan Corporation, SK Biopharmaceuticals, HLB, SK Bioscience, Hanmi Pharmaceutical, Samchundang Pharm, and Celltrion Pharm. The KRX Bio TOP10 index, composed of these stocks, rose 6.83% over the month, ranking third in returns among the exchange's theme indices during the same period.

Foreign investors buying biotech stocks have fueled the rise in stock prices. According to the exchange, foreign investors have net sold 8.3049 trillion won in the domestic stock market from last month through the 14th of this month. Despite maintaining a net selling trend in domestic stocks for two consecutive months, they have been buying biotech stocks. During this period, foreign investors net purchased 465.3 billion won worth of Alteogen and 297.6 billion won of Samsung Biologics. As a result, Alteogen's foreign ownership increased from 14.24% at the beginning of last month to 16.55% as of the 14th. Samsung Biologics also saw its foreign ownership rise from 12.98% to 13.38% during the same period.

The reason biotech stocks are showing strength is interpreted as improved investment sentiment toward biotech stocks due to entering an interest rate cut phase for the first time in four and a half years. Biotech companies require large-scale, long-term investments. Since massive funding is needed for research and development, they are inherently sensitive to interest rates. As interest rates fall, interest burdens decrease and can lead to improved earnings, so biotech stocks are generally classified as beneficiaries of interest rate cuts.

Junho Byun, a researcher at IBK Investment & Securities, said, "The biotech sector has recently shown clear strength in the market and is playing a leading role. Expectations for benefits from recent interest rate cuts, improvements in business conditions, benefits from the U.S. Biosecure Act, and stock price momentum are continuing, raising expectations for additional short-term gains."

Policy benefits are also anticipated. The Biosecure Act passed the U.S. House of Representatives in August. The U.S. enacted the Biosecure Act to check Chinese biotech companies and protect its domestic biotech industry. If the act passes the Senate this year, it will prohibit transactions with biotech companies from countries like China, which are in a trade-hostile relationship with the U.S. As demand for contract manufacturing (CMO) and contract development and manufacturing (CDMO) from Chinese companies declines, domestic companies are expected to benefit in the global CDMO market.

Samsung Biologics is cited as a representative beneficiary stock. On September 19, Samsung Biologics' closing price surpassed 1 million won, regaining its blue-chip status for the first time in 3 years and 1 month. Meritz Securities recently raised its target price for Samsung Biologics from 1.05 million won to 1.2 million won, stating that it would be the biggest beneficiary if the U.S. Biosecure Act passes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)