Focused on Customer-Centric Innovation... Rising to Top 3 Globally

Steady Growth Despite Global Market Slowdown

Strengthening Robotics, SDV, AAM... Securing Future Growth Engines

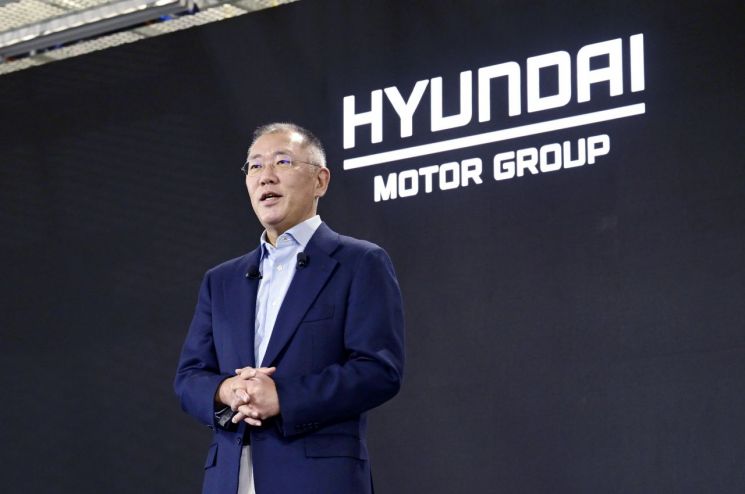

Hyundai Motor Group Chairman Chung Eui-sun attended the 2024 Hyundai Motor Group New Year's meeting last January and delivered a New Year's message titled "Consistent and Continuous Change for Sustainable Growth." (Photo by Hyundai Motor Group)

Hyundai Motor Group Chairman Chung Eui-sun attended the 2024 Hyundai Motor Group New Year's meeting last January and delivered a New Year's message titled "Consistent and Continuous Change for Sustainable Growth." (Photo by Hyundai Motor Group)

Hyundai Motor Group Chairman Chung Euisun will mark his 4th anniversary as chairman on the 14th. Despite the global automotive industry's slowdown due to COVID-19 and the electric vehicle chasm (temporary demand stagnation), Hyundai has steadily grown and risen to the world's 'top tier.' Building on the achievements of previous management, he has taken the company to the next level and is now looking beyond automobiles.

Since joining Hyundai Precision & Industries (now Hyundai Mobis) in 1994, Chairman Chung has gained experience and insights into the automotive market by working closely with employees on the ground. As a result, just two years after his inauguration in 2022, Hyundai Motor Group ranked 3rd in global sales for the first time. For the first time in the company's history, it simultaneously received an A credit rating from the world's three major credit rating agencies: Standard & Poor's (S&P), Moody's, and Fitch. Among automakers, only Hyundai Motor and Kia, along with Germany's Mercedes-Benz and Japan's Toyota and Honda, have achieved the 'triple crown' of A ratings from all three agencies. This is considered an unprecedented success for a latecomer in the industry.

Focus on Customer-Centric Innovation

Chairman Chung's management core has consistently been the 'customer.' The word 'customer' was the most frequently mentioned term (38 times) in his inaugural speech and four New Year's addresses since, surpassing 'future' (32 times) and 'growth' (30 times).

When the international credit rating agency S&P upgraded Hyundai Motor and Kia's credit ratings to A in August, it also highlighted this point. S&P stated, "Hyundai Motor and Kia rose to become the world's 3rd largest automaker in 2022 and strengthened their presence in key global markets, ranking 4th in North America last year. They reorganized their product lineup to focus on sport utility vehicles (SUVs) and premium lines tailored to consumer preferences." This analysis shows that their strategy of focusing on products desired by customers has strengthened their global market position.

This change in status is also reflected in brand value. In the new car advanced technology satisfaction survey released by U.S. market research firm J.D. Power in August, Hyundai Motor Group ranked first. Genesis topped the overall brand ranking for the fourth consecutive year, while Hyundai Motor and Kia dominated the general brand rankings at first and second place.

Over the past decade, Hyundai Motor and Kia have won a total of 66 awards at various ceremonies, including 'North American Car of the Year,' 'European Car of the Year,' and 'World Car of the Year,' far surpassing second-place Volkswagen. Thanks to this, Hyundai Motor recorded a brand value of $23 billion and Kia $8.1 billion in Interbrand's 2024 brand value evaluation. The combined total of $31.1 billion represents an increase of more than 54% over four years from $20.1 billion in 2020.

Hyundai Motor Group Chairman Chung Euisun is taking a selfie with local employees of the India region after the town hall meeting held at the new Delhi office of Hyundai Motor India Regional Headquarters last April. (Photo by Hyundai Motor)

Hyundai Motor Group Chairman Chung Euisun is taking a selfie with local employees of the India region after the town hall meeting held at the new Delhi office of Hyundai Motor India Regional Headquarters last April. (Photo by Hyundai Motor)

Strong Sales and Operating Profit Margins

Hyundai Motor Group is solidifying its position among the world's 'top 3' by strengthening both scale and substance. Since first ranking 3rd in annual global sales in 2022, it has maintained a three-strong structure with Toyota and Volkswagen through the first half of this year. Even in the fiercely competitive U.S. market, it ranked 4th last year and maintained its position by selling approximately 810,000 vehicles, including 160,000 eco-friendly cars, in the first half of this year.

Hyundai Motor Group plans to continue expanding global sales based on a diversified regional portfolio, a strong hybrid (HEV) lineup capable of overcoming temporary electric vehicle demand declines, and products that exceed customer expectations.

Profitability is also top-tier. Hyundai Motor and Kia recorded a combined operating profit margin of 10.7% in the first half of this year, the highest among the world's top five automakers. Combined sales and operating profit reached KRW 139.4599 trillion and KRW 14.9059 trillion, respectively, marking a record high for a half-year period. In the first quarter, Hyundai Motor and Kia's combined operating profit (KRW 6.9831 trillion) even surpassed Volkswagen Group's operating profit of €4.588 billion (approximately KRW 6.7935 trillion).

Structural improvements are also progressing smoothly. It is evaluated that the company has successfully shifted from the typical low-margin, high-volume model of latecomers to a sales structure centered on high-profit vehicles. Despite a decline in global vehicle sales in the first half compared to the previous year, Hyundai Motor and Kia achieved record-breaking results in this context.

In Hyundai Motor's sales for the first half of this year, RVs and Genesis accounted for more than 60% of total sales. Kia's RV sales in the key U.S. market also accounted for 78% during the same period.

Leading Eco-Friendly Vehicles Despite Electric Vehicle Chasm

Hyundai Motor Group Chairman Chung Euisun attended the ceremony celebrating the completion of the Indonesian EV ecosystem held at HLI Green Power in the Karawang New Industrial Complex, Indonesia, last July, where he and attendees including Indonesian President Joko Widodo assembled battery cells into battery modules. (Photo by Hyundai Motor Group)

Hyundai Motor Group Chairman Chung Euisun attended the ceremony celebrating the completion of the Indonesian EV ecosystem held at HLI Green Power in the Karawang New Industrial Complex, Indonesia, last July, where he and attendees including Indonesian President Joko Widodo assembled battery cells into battery modules. (Photo by Hyundai Motor Group)

Hyundai Motor and Kia's sales of eco-friendly vehicles, including electric vehicles, hybrids, and hydrogen fuel cell vehicles, totaled 61,883 units in the U.S. in the first half of this year. Despite the electric vehicle chasm, sales increased by 60.9% year-on-year in the highly competitive U.S. market. Their electric vehicle market share jumped to double digits, ranking second after Tesla.

They also swept various external awards. The Kia EV6 won 'European Car of the Year' in 2022 and 'North American Car of the Year' in 2023. Hyundai Motor's Ioniq 5 won 'World Car of the Year' in 2022, followed by the Ioniq 6 in 2023 and the Kia EV9 in 2024, achieving three consecutive years of dominance.

Early adoption of the dedicated electric vehicle platform E-GMP is considered decisive. E-GMP was the starting point of Chairman Chung's proactive electric vehicle leadership strategy. The powertrain system equipped on E-GMP won the 'Top 10 Engines and Powertrains' award by the U.S. automotive media 'WardsAuto' for three consecutive years.

Hybrid vehicles shone particularly during the electric vehicle chasm. Hyundai Motor and Kia's global hybrid vehicle sales in the first half increased by 15.6% year-on-year to approximately 490,000 units, setting a record for the first half. It is expected that combined hybrid vehicle sales for both companies will surpass 1 million units for the first time by the end of the year.

As of the first quarter of this year, Hyundai Motor and Kia are the only major global automakers ranked simultaneously in the top five worldwide for both electric and hybrid vehicle sales. This success is interpreted as the result of their eco-friendly vehicle strategy aiming to capture 'two rabbits' based on portfolio diversification.

In the hydrogen fuel cell vehicle sector, one of the core pillars of future eco-friendly vehicles, Hyundai Motor Group holds the world's number one market share as of the first half of this year. They plan to launch a successor model to the existing Nexo next year and invest KRW 5.7 trillion over the next decade to further solidify their position as a 'top tier' in the global hydrogen industry.

Strengthening Robots, SDV, PBV, and More: "Accelerating into Future Mobility"

Hyundai Motor Group Chairman Chung Eui-sun is taking a commemorative photo with attendees at the hydrogen bus delivery ceremony for firefighter recovery support held last June. (From the left in the middle row) Hyundai Motor Group Chairman Chung Eui-sun (sixth), Hyundai Motor President Jang Jae-hoon (tenth), then Fire Agency Commissioner Nam Hwa-young (ninth), Jeju Provincial Deputy Governor Kim Ae-sook (fifth), Jeju Fire Safety Headquarters Chief Go Min-ja (eleventh), Korea Chamber of Commerce and Industry Executive Vice Chairman Park Il-jun (fourth)

Hyundai Motor Group Chairman Chung Eui-sun is taking a commemorative photo with attendees at the hydrogen bus delivery ceremony for firefighter recovery support held last June. (From the left in the middle row) Hyundai Motor Group Chairman Chung Eui-sun (sixth), Hyundai Motor President Jang Jae-hoon (tenth), then Fire Agency Commissioner Nam Hwa-young (ninth), Jeju Provincial Deputy Governor Kim Ae-sook (fifth), Jeju Fire Safety Headquarters Chief Go Min-ja (eleventh), Korea Chamber of Commerce and Industry Executive Vice Chairman Park Il-jun (fourth)

Chairman Chung is pursuing various new businesses under the banner of 'progress for humanity,' beyond the traditional automotive industry, including robotics, Advanced Air Mobility (AAM), and mobility services.

In robotics, based on international collaboration among Robotics Lab, Boston Dynamics, and the Robot Artificial Intelligence (AI) Research Institute, they are expanding the application areas of robots while focusing on developing 'intelligent robots' organically integrated with AI.

In the AAM field, they unveiled the first physical model of the next-generation aircraft 'S-A2.' To lead the future AAM ecosystem, they are expanding strategic partnerships with overseas companies and government agencies such as Europe's largest defense contractor BAE Systems and NASA, strengthening research capabilities with the goal of entering the AAM market expected to bloom in 2028.

They are also continuously contemplating and advancing the future of their core automotive business. Preparing for the full-scale launch of software-defined vehicles (SDV), they are developing next-generation infotainment systems and open ecosystems that provide user-centric environments. Based on the 'Android Automotive' operating system, they are developing various central display ratios to be applied to mass-produced vehicles in the first half of 2026. In the second half of that year, they plan to unveil an 'SDV face car' with high-performance electric and electronic architecture and demonstrate new mobility services and businesses.

In the purpose-built vehicle (PBV) sector, they launched 'ST1,' the first PBV concept applied domestically. Kia will release its first mid-size PBV, the PV5, next year, followed by additional large and small PBV lineups. They plan to expand into logistics companies, mobility firms, and individual users, with sales in Japan planned by 2026.

They are also taking thorough measures to prepare for rapidly changing global geopolitical risks. Chairman Chung's emphasis on 'early preparation' to employees, even amid record-breaking performance, is for this reason.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)