Positive Evaluation of Interest Rate Cut Effects

Limitations Expected in Corporate Financial Improvement

The Korea Economic Association analyzed that the Bank of Korea's decision on the 11th to lower the base interest rate by 0.25 percentage points will reduce the annual interest burden on households and businesses by approximately 6 trillion won. As a result, economic agents who had been struggling due to prolonged high interest rates are expected to experience some relief in their burdens.

This rate cut is the first measure in about two years since the base rate rose from 3.25% to 3.50%. The Bank of Korea raised rates nine times starting in August 2021 and has since maintained a cautious stance by keeping rates unchanged for 13 consecutive times.

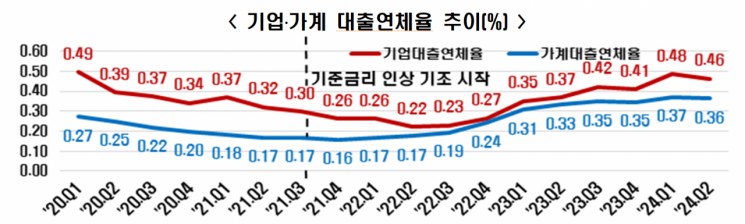

However, with the economic recession and high interest rate environment, the financial conditions of companies and households have deteriorated, leading to an increase in loan delinquency rates. During the low-interest period of 2020-2021, delinquency rates fell, but since interest rates exceeded the 1% level, delinquency rates on corporate and household loans have been rising again.

According to the Korea Economic Association's analysis, this rate cut is expected to lower household loan interest rates by a cumulative 0.14 percentage points and corporate loan interest rates by a cumulative 0.19 percentage points. Interest burdens on households and businesses are anticipated to decrease by 2.5 trillion won and 3.5 trillion won, respectively. The average interest burden per household is also expected to decrease by about 210,000 won, suggesting some easing of household debt burdens.

However, there is also analysis that, since companies still bear a significant interest burden, it will be difficult for their financial conditions to improve substantially even with this cut. The annual interest burden on companies was previously in the range of 30 to 40 trillion won but surged to 93.8 trillion won last year due to the economic downturn and prolonged high interest rates. This figure is 2.4 times higher compared to 2019.

The Korea Economic Association evaluated this rate cut as a measure reflecting domestic and international economic conditions and an important signal indicating the future direction of interest rate policy.

Lee Sang-ho, Head of the Economic and Industrial Division at the Korea Economic Association, stated, "The Bank of Korea's decision to cut rates this time appears to be a careful consideration of growing domestic and international uncertainties such as the global economic slowdown and sluggish domestic demand," adding, "It carries significance beyond a simple one-time cut."

He continued, "To alleviate corporate financial burdens, it is necessary to accompany this with strengthened tax support," and "Liquidity management is needed to prevent the rate cut from leading to rising real estate prices and increased household debt."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)