Public Purchase Price Increased by 890,000 Won... Volume Also Expanded by 20%

"Actual Circulating Volume Below 20%... Subscription Uncertainty Resolved"

Korea Zinc has increased the maximum tender offer volume by 20% along with raising the tender offer price. In addition to the price merit, the company intends to absorb virtually all the shares circulating in the market to minimize shareholder damage caused by sharp stock price fluctuations before and after the tender offer.

On the morning of the 11th, Korea Zinc held a board meeting and resolved to raise the maximum tender offer volume from 18% (3,209,009 shares) to 20% (3,623,075 shares). Korea Zinc will purchase 17.5%, and Bain Capital will purchase 2.5%. The tender offer price was also raised from 830,000 KRW per share to 890,000 KRW per share. Compared to the figures proposed by MBK Partners and Young Poong, the volume is 5.39% higher, and the price is 60,000 KRW higher.

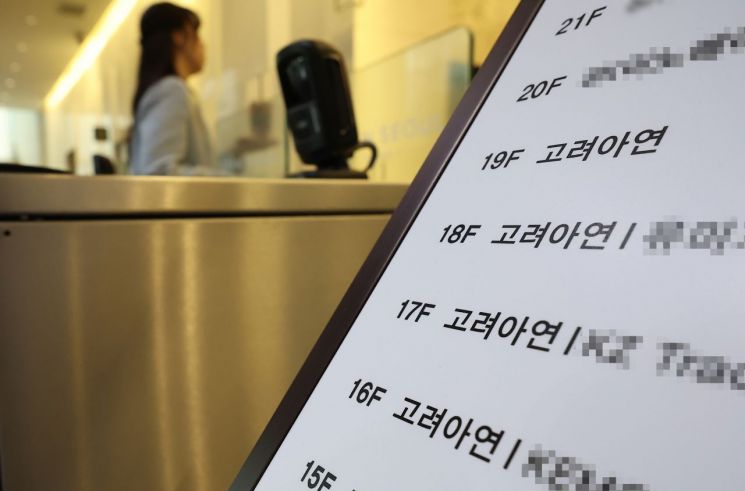

The headquarters of Korea Zinc in Jongno-gu, Seoul, on the morning of the 11th when Korea Zinc held its board meeting.

The headquarters of Korea Zinc in Jongno-gu, Seoul, on the morning of the 11th when Korea Zinc held its board meeting. [Photo by Yonhap News]

The actual circulating volume eligible for the tender offer is estimated to be less than 20%, including domestic and foreign institutional investors and general individual investors. This figure excludes passive funds (5.9%) and treasury shares held by Korea Zinc (2.4%).

Since passive funds track specific indices, the company’s position is that it is structurally impossible for them to participate in the tender offer at this time unless Korea Zinc is completely excluded from the relevant index.

By increasing the maximum tender offer volume to 20%, Korea Zinc expects to purchase virtually all the shares that can respond to the tender offer. Because it will buy almost all the actual circulating shares, shareholders and investors will not face the risk of losses due to high price volatility such as stock price declines after the tender offer.

A Korea Zinc official emphasized, "With the maximum tender offer volume increased to 20%, the uncertainty regarding subscription has been resolved."

Meanwhile, the subscription period for Korea Zinc’s treasury stock tender offer is until the 23rd. The lead managers for the tender offer are KB Securities and Mirae Asset Securities. At KB Securities, newly added as a lead manager, both online and offline subscriptions are possible.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)