Bio Focus of National Pension Fund for the First Time This Year

'Winter Loan' Winds Blow on Semiconductors, Leading to Sharp Reduction in Weight

Holding Companies, Beneficiaries of 'Value Up', Also Significantly Reduced

In the third quarter, when the stock market was volatile due to events like the 'Black Monday,' the National Pension Service (NPS) newly included pharmaceutical and bio stocks among its large-scale holdings (with a stake of 5% or more). Conversely, semiconductor materials, parts, and equipment (so-bu-jang) companies and holding companies were removed from its portfolio.

According to the Financial Supervisory Service's electronic disclosure system on the 10th, the NPS disclosed a total of 130 changes in large-scale holdings from the 1st to the 8th of this month. Among these, nine stocks were newly added, with pharmaceutical and bio sectors accounting for the largest number at four. Meanwhile, 21 stocks fell below the 5% stake threshold and were excluded from the large-scale holdings list, with semiconductor so-bu-jang companies making up the largest portion at nine, followed by holding companies at four.

When the stake in a large-scale holding increases or decreases, the disclosure must be made according to the holding purpose: 'simple investment' disclosures are due by the 10th of the month following the quarter of change, and 'general investment' disclosures by the 10th of the month following the month of change. January, April, July, and October are months when these two disclosure obligations overlap, resulting in over 100 disclosures. As of the 7th, the NPS holds a total of 273 large-scale holdings.

A Long-Awaited 'Bio Love Call'

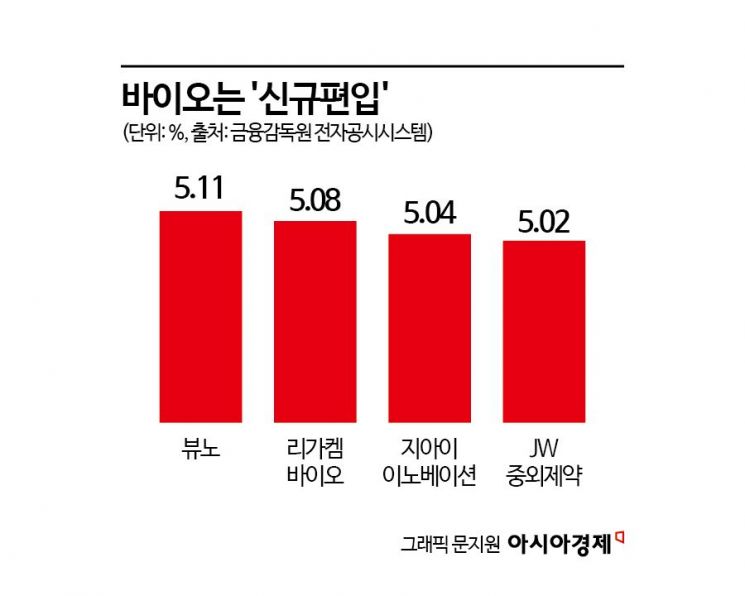

The nine stocks newly included as large-scale holdings in the third quarter are STX Engine with an 8.25% stake, Hanwha Industrial Solutions (6.34%), Shift Up (6.15%), Vuno (5.11%), Ligand Chem Bio (5.08%), GI Innovation (5.04%), EcoPro Mety (5.03%), JW Pharmaceutical (5.02%), and Aekyung Chemical (5.01%). Among these, JW Pharmaceutical, Ligand Chem Bio, Vuno, and GI Innovation belong to the pharmaceutical and bio sector. Vuno provides artificial intelligence (AI) diagnostic solutions, Ligand Chem Bio is recognized for its advanced technology in anticancer treatments and was acquired by Orion earlier this year. GI Innovation is also related to anticancer drugs, and JW Pharmaceutical is considered one of Korea's 'Top 10 pharmaceutical companies' with a 79-year history.

This is the first time in the year that bio stocks have stood out in the NPS portfolio during the third quarter. After years of stagnation, the bio sector has recently gained attention in the market. Kim Jong-min, a researcher at Samsung Securities, stated, "I maintain the view that bio is the top priority during market rebounds," adding, "The reason we see this as the start of the bio cycle this year is the 'Biosecurity Act,' which will change the industry's landscape when enacted in the U.S." The Biosecurity Act, expected to be implemented as early as next year, primarily prohibits subsidies to bio companies that the U.S. government deems concerning. This is an extension of 'sanctions against China.' As a result, Korean bio companies are expected to benefit.

Besides bio, STX Engine, which received a love call from the NPS, is benefiting from the boom in the defense industry, its upstream sector. Hanwha Industrial Solutions is a company spun off from Hanwha Aerospace. Since the NPS held shares in Hanwha Aerospace, it naturally acquired shares in this company through the spin-off. Shift Up is a game company that went public in the third quarter, and EcoPro Mety is considered one of the leading secondary battery stocks that rebounded in the third quarter. Aekyung Chemical also produces batteries and is thus heavily influenced by the secondary battery sector's sentiment.

'Winter Loan' Semiconductor and 'Value-Up' Related Stocks 'Cut'

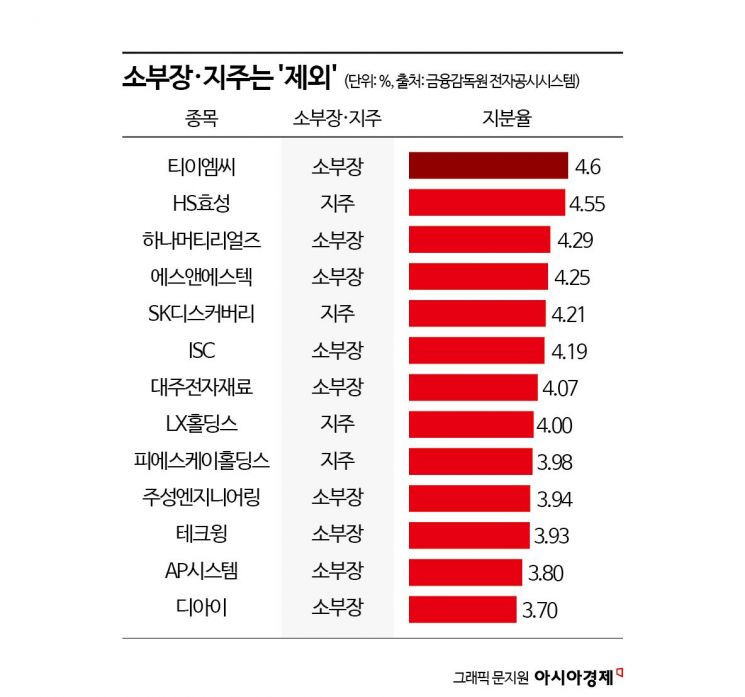

On the other hand, nine semiconductor so-bu-jang stocks fell below the 5% stake threshold and were removed from the large-scale holdings list. These include TMC (4.6%), Hana Materials (4.29%), SNS Tech (4.25%), ISC (4.19%), Daewoo Electronic Materials (4.07%), Jusung Engineering (3.94%), Techwing (3.93%), AP System (3.8%), and DI (3.7%). It is notable that the NPS reduced its holdings in semiconductor-related stocks during the third quarter when global investment bank Morgan Stanley raised concerns about a 'semiconductor winter.' Among these, Jusung Engineering and Hana Materials are also included in the 100 stocks of the 'Korea Value-Up Index' newly established by the Korea Exchange in September.

Additionally, holding companies, which have been considered major beneficiaries of the 'Value-Up Program' this year, were largely removed from the NPS's large-scale holdings. The NPS adjusted its stakes below 5% in four stocks: HS Hyosung (4.55%) of the HS Hyosung Group, SK Discovery (4.21%), LX Holdings (4.00%), and PSK Holdings (3.98%). Since stakes below 5% do not require disclosure, the NPS will not disclose even if it further reduces its holdings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)