Low-Interest Funding Through KDB Credit Extension

Increase in CDO Issuance Amid Bond Yield Decline

Major Securities Firms Expanding Market Participation

Bond Yield Drop Highlights Investment Products

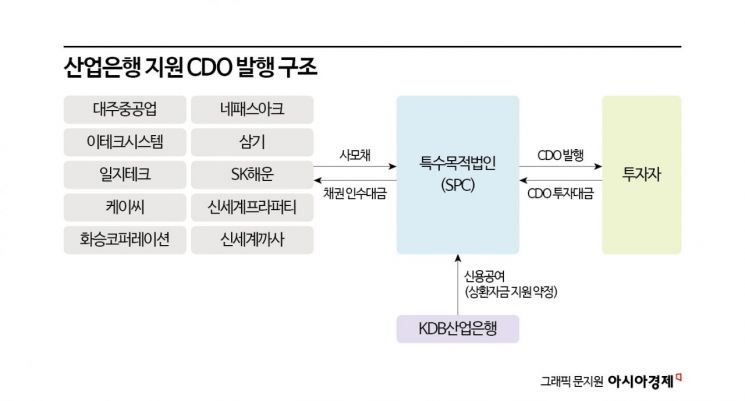

Ten companies, including SK Shipping and Shinsegae Property, raised 250 billion KRW by issuing Collateralized Debt Obligations (CDOs) supported by KDB Industrial Bank. CDOs are increasingly being issued recently as a means for multiple companies that find it difficult to issue corporate bonds on their own to jointly raise funds.

According to the investment banking (IB) industry on the 8th, Industrial Bank issued CDOs worth a total of 250 billion KRW through a Special Purpose Company (SPC). The 10 companies transferred privately placed corporate bonds they issued to the SPC, which then issued securitized bonds using the principal and interest of all bonds as the underlying assets (serving as collateral). When the companies repay the principal and interest of the private bonds to the SPC, the SPC uses those funds to repay the principal and interest of the CDO.

CDO (Collateral Debt Obligation) is a general term for securitized bonds issued using multiple corporate bonds or loans as collateral. Depending on whether the collateral is corporate bonds or loans, they are classified as CBO (Collateral Bond Obligation) and CLO (Collateral Loan Obligation). It is one of the financing methods for companies that find it difficult to issue corporate bonds based on their own credit rating or have difficulty obtaining bank loans.

By utilizing CDOs, companies can secure liquidity at relatively lower interest rates compared to raising funds based on their own credit rating. This is because multiple loans and corporate bonds are pooled and issued as a single income security, which from an investor’s perspective lowers default rates and increases repayment stability. Additionally, high-quality financial institutions such as financial public enterprises (like the Korea Credit Guarantee Fund), banks, and securities firms provide credit guarantees.

Through this CDO issuance, the 10 companies secured between 15 billion KRW and 40 billion KRW each. SK Shipping raised the largest amount with 40 billion KRW. Shinsegae Property, Hwaseung Corporation, and Nepes Arc each issued bonds worth 30 billion KRW, while Daejoo Heavy Industries, E-Tech System, KC, and Shinsegae Casa each issued bonds worth 20 billion KRW. Samki and Ilji Tech secured liquidity of 25 billion KRW and 15 billion KRW, respectively.

Previously, more than 200 mid-sized and small companies, including SK Shipping, M Capital, Seojin Automotive, and Daedong, participated in Primary Collateralized Bond Obligations (P-CBOs) led by the Korea Credit Guarantee Fund, raising a total of 540 billion KRW. The Korea Credit Guarantee Fund issues P-CBOs several times a year to support financing for mid-sized and small companies that have difficulty securing liquidity.

CDO issuance by securities firms is also increasing. In July, KB Securities issued an 80 billion KRW CLO to help Seragem, Kigwang Industry, Taeyang Machinery, Turbo One, and Saturn Bath secure liquidity. These companies provided real estate such as land and buildings as collateral for loans during the CLO issuance process. KB Financial Group affiliates, including KB Kookmin Bank and KB Real Estate Trust, supported the CLO issuance by providing loans and trust services.

Korea Investment & Securities recently established a CLO-related collaboration with Anchorage Capital in the U.S. Korea Investment & Securities’ New York branch, ‘KIS US,’ committed to investing in Anchorage Capital’s credit fund, which invests in structured products such as CLOs. Previously, they also launched CLO products in partnership with Carlyle Group, the world’s largest private equity firm.

An IB industry official said, "With the possibility of interest rate cuts in the U.S. emerging, investors’ interest in credit products such as bonds is increasing," adding, "However, the volume of bonds available in the market is limited, so the issuance of structured bond products like CDOs is increasing." The official also said, "Institutional investors prefer CDO investments, which have higher repayment stability compared to high-yield bonds that have high interest rates but low credit ratings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)