Valuation Expected to Improve with Interest Rate Cut

Large Shipping Companies' Orders Followed by Small and Medium-Sized Firms Waiting

"Q3 Earnings Concerns Already Reflected"

Shipbuilding stocks, which had been sluggish amid market volatility, have recently shown a rebound. The securities industry analyzed that in the interest rate cut phase, the shipbuilding sector is in a phase where corporate value is being re-evaluated thanks to additional orders for eco-friendly ships and improved profitability. Concerns about earnings decline due to a shortage of operating days in the third quarter, raised by some, are judged to have already been reflected in price adjustments.

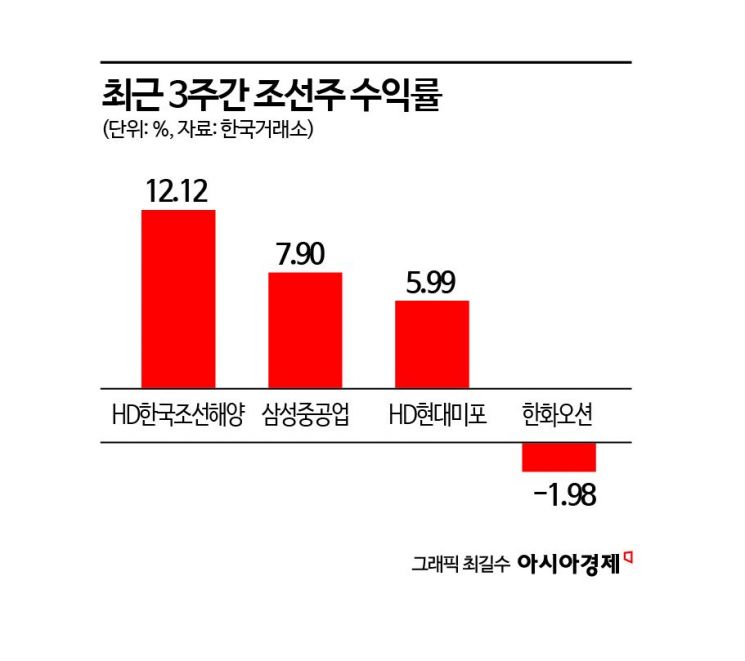

According to the Korea Exchange on the 26th, HD Hyundai Heavy Industries rose 12.12% over the past three weeks, closing at 196,900 KRW the day before. Other companies such as Samsung Heavy Industries (7.90%) and HD Hyundai Mipo (5.99%) also showed simultaneous strength during the same period. It is interpreted that investment sentiment is recovering due to expectations of additional orders and better-than-expected earnings compared to concerns in the remaining second half of the year.

The market expects that shipbuilding stocks could replicate the upward trend seen in the first half of this year. This is based on the judgment that valuations are expanding again. Baek Gi-yeon, a researcher at Meritz Securities, explained, "The shipbuilding industry is in a phase where the multiple is expanding due to an increase in return on equity (ROE)," adding, "The base effect of steel plate prices acts as a catalyst for profitability, making the cost environment favorable." Furthermore, he said, "Interest rate cuts are a factor for valuation expansion and simultaneously create an effect of advancing investments by client companies," and predicted, "The expanded multiples of shipyard companies could be reflected in future equipment costs."

It is also positive that eco-friendly ship orders from domestic shipbuilders are expected to remain steady for the time being. Han Seung-han, a researcher at SK Securities, said, "Global container ship order demand is inevitably increasing gradually in line with eco-friendly regulations," adding, "With shipbuilders’ delivery slots fully booked, demand momentum will continue to drive ship prices upward." He continued, "With the future commercialization of ammonia engines, global shipowners’ ordering activity may resume," and added, "Small and medium-sized shipping companies are also likely to place additional orders to secure eco-friendly ships."

While some express concerns about earnings decline due to a shortage of operating days in the third quarter, analysis suggests that price adjustments have already been made. Choi Kwang-sik, a researcher at Daol Investment & Securities, said, "Concerns about third-quarter earnings seem to have already been priced in. Productivity and profitability improvements due to adaptation of new construction personnel mean the results may not be worse than expected." He added, "Until the third quarter, orders continued mainly from customers favoring China, but in the future, domestic shipbuilders are expected to regain market share through orders from customers who prefer Korean ships, such as Evergreen."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)